USD/JPY Price Forecast: Retreats from multi-week top on strong Tokyo CPI, ahead of US PCE

- USD/JPY attracts some sellers in the vicinity of the monthly peak after stronger Tokyo CPI.

- Rising trade tensions weigh on investors’ sentiment and drive safe-haven flows towards JPY.

- A modest USD uptick fails to lend support as traders look to the US PCE for fresh impetus.

The USD/JPY pair retreats after touching a nearly four-week top earlier this Friday and extends its intraday descent through the first half of the European session. The Japanese Yen (JPY) gained some positive traction following the release of strong consumer inflation figures from Tokyo – Japan's capital city. In fact, government data showed that the headline Tokyo Consumer Price Index (CPI) rose 2.9% in March from 2.8% previous. Adding to this, Tokyo Core CPI, which excludes volatile fresh food prices, climbed to 2.4% during the reported month from 2.2% in February. Moreover, a core reading that excludes both volatile fresh food and energy prices grew from 1.9% in the prior month to 2.2% in March. This was now above the BoJ's annual 2% target and keeps the door open for more interest rate hikes by the Bank of Japan (BoJ).

Furthermore, the BoJ Summary of Opinions from the March 18-19 meeting revealed a consensus to continue raising rates if the economy and prices move in line with the forecast. The board, however, viewed that the policy must be kept steady for the time being as the downside risks to the economy have heightened due to the US tariff policy. This, along with the prevalent risk-off environment, turns out to be another factor driving safe-haven flows toward the JPY. The global risk sentiment took a hit in reaction to US President Donald Trump's new tariffs on imported cars and light trucks, announced on Wednesday. Adding to this, Trump's impending reciprocal tariff announcement next week continues to weigh on investors' sentiment, which is evident from a generally weaker tone around the equity markets and lends additional support to the JPY.

The US Dollar (USD), on the other hand, regains some positive traction following the previous day's pullback from a multi-week top, though it does little to lend any support to the USD/JPY pair. The USD uptick could be attributed to some repositioning trade ahead of the crucial US inflation data and seems limited amid bets that the Federal Reserve (Fed) will resume its rate-cutting cycle in June amid worries about tariff-driven US economic slowdown. This marks a big divergence in comparison to hawkish BoJ expectations, which should continue to benefit the lower-yielding JPY and suggests that the path of least resistance for the USD/JPY pair is to the downside. Traders, however, might refrain from placing aggressive bets and opt to wait for the release of the US Personal Consumption Expenditure (PCE) Price Index later during the North American session.

The crucial US inflation data would influence market expectations about the Fed's future interest rate cut path, which, in turn, will play a key role in driving the USD demand and provide some meaningful impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to register gains for the third successive week. The fundamental backdrop, however, warrants some caution positioning for an extension of the recent goodish recovery from the vicinity of mid-146.00s, or the lowest level since September 2024 touched earlier this month.

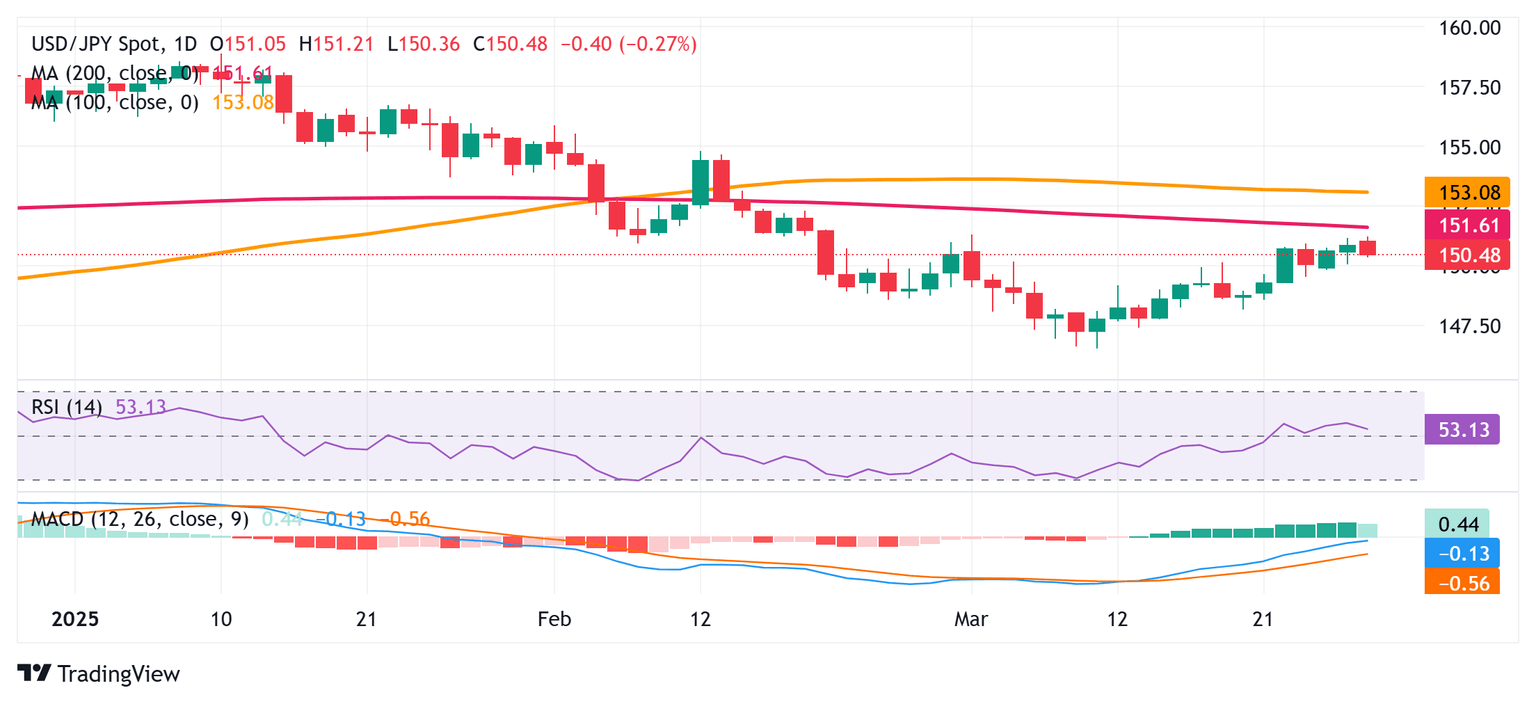

USD/JPY daily chart

Technical Outlook

From a technical perspective, the USD/PY pair's inability to build on modest gains beyond the 151.00 mark and the subsequent pullback from the vicinity of the monthly peak warrants some caution for bullish traders. However, oscillators on the daily chart have just started gaining positive traction and support prospects for the emergence of dip-buyers near the 150.00 psychological mark. Some follow-through selling below the 149.85-149.80 region, however, would negate any near-term positive bias and drag spot prices to the 149.25 support zone en route to the 149.00 round figure and the next relevant support near the 148.65 region.

On the flip side, the 151.00 mark now seems to act as an immediate hurdle ahead of the monthly peak, around the 151.30 region, This is followed by a technically significant 200-day Simple Moving Average (SMA), currently pegged near the 151.65 region. A sustained strength beyond the latter will be seen as a fresh trigger for bulls and allow the USD/JPY pair to reclaim the 152.00 mark. The upward trajectory could extend further to the 152.45-152.50 intermediate hurdle before spot prices aim to challenge the 100-day SMA, around the 153.00 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.