USD/JPY Price Forecast: Remains confined in weekly trading range ahead of US NFP

- USD/JPY scales higher for the second straight day and is supported by a combination of factors.

- The disappointing domestic macro data and a positive risk tone undermine the safe-haven JPY.

- A goodish pickup in the USD demand provides an additional boost ahead of the US NFP report.

The USD/JPY pair builds on the previous day's goodish rebound from the vicinity of mid-142.00s and gains positive traction for the second consecutive day on Friday. The momentum lifts spot prices to the top end of the weekly range and is sponsored by a combination of factors. The Japanese Yen (JPY) weakened in reaction to the disappointing domestic macro data, which, along with a goodish pickup in the US Dollar (USD) demand, provides a goodish lift to the currency pair.

Government data released earlier this Friday showed that Japan's Household Spending unexpectedly fell by 0.1% from a year earlier in April as compared to the 2.1% increase recorded in the previous month. On a monthly basis, spending declined more than anticipated, by 1.8% during the reported month. This comes on top of Thursday's data, which showed that real wages in Japan fell for a fourth successive month in April as rising prices continued to outpace pay hikes. This could further undermine private consumption, which contributes to over 50% of Japan’s GDP, and trigger an economic recession. Adding to this, concerns that global trade tensions may weaken wage momentum, and complicate the Bank of Japan's (BoJ) efforts to normalize policy, weigh on the JPY.

Meanwhile, the US Treasury Department, in its exchange-rate report to Congress, said on Thursday that the BoJ should continue to proceed with monetary tightening, The report argued that doing so would support a healthier exchange rate and facilitate needed structural adjustments in trade flows. Adding to this, Japan reportedly is softening its stance on the 25% US auto tariff and instead is proposing a flexible framework to reduce the rate based on how much countries contribute to the US auto industry. Japan’s chief tariff negotiator, Ryosei Akazawa, is in Washington for the fifth round of talks with US officials. Moreover, the optimism over the resumption of trade talks between the US and China – the world's two largest economies – turns out to be another factor undermining the safe-haven JPY.

The USD, on the other hand, attracts some buyers and moves away from its lowest level since April 22 touched on Thursday on the back of repositioning trades ahead of the crucial US monthly employment details. The popularly known US Nonfarm Payrolls (NFP) report is expected to show that the economy added 130,000 new jobs in May and the Unemployment Rate held steady at 4.2%. A host of other employment readings released this week pointed to a cooling in the US labor market, which should give the Federal Reserve (Fed) more impetus to cut interest rates. Traders are currently pricing in the possibility that the US central bank will deliver at least two 25 basis points (bps) rate cuts by the year-end, though several FOMC officials suggested the wait-and-see approach.

Hence, the critical jobs data will play a key role in influencing market expectations about the Fed's future rate-cut path and provide some meaningful impetus to the USD. Nevertheless, this still marks a big divergence in comparison to hawkish BoJ expectations, which should continue to benefit the lower-yielding JPY and cap any further appreciation for the USD/JPY pair.

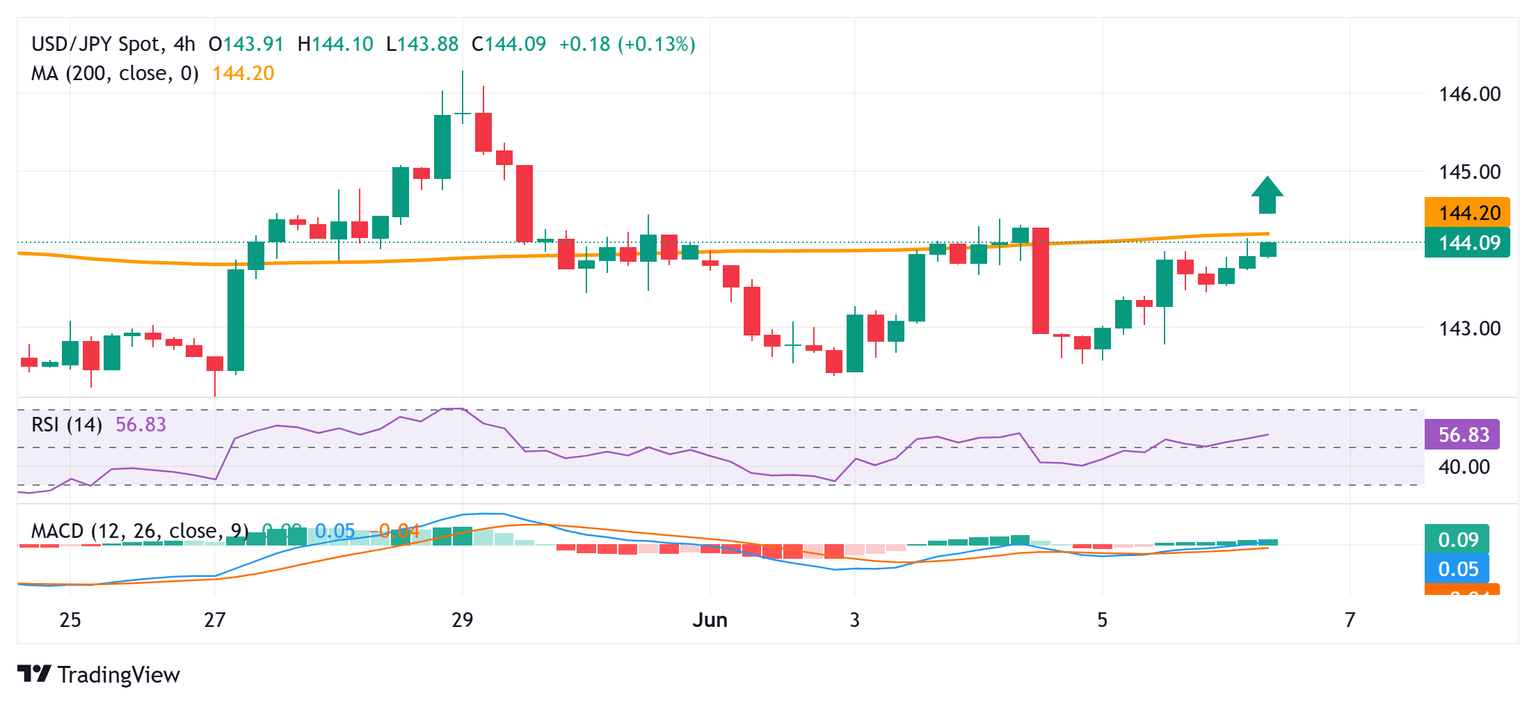

USD/JPY 4-hour chart

Technical Outlook

The USD/JPY pair has been oscillating in a familiar range since the beginning of this week, forming a rectangle on the daily chart. Against the backdrop of the downfall from the May monthly swing low, this might still be categorized as a bearish consolidation phase. Moreover, slightly negative oscillators on the daily chart suggest that the path of least resistance for spot prices is to the downside.

Hence, any subsequent move up is more likely to confront stiff resistance near the 200-period Simple Moving Average (SMA) on the 4-hour chart, currently pegged around the 144.25 area. This is closely followed by the weekly high, around the 144.40 region, which if cleared decisively might shift the bias in favor of bullish traders and allow the USD/JPY pair to aim towards reclaiming the 145.00 psychological mark.

On the flip side, any corrective slide could attract some dip-buying near the 143.50-143.45 area, which should help limit the downside near the 143.00 round figure. Some follow-through selling, leading to a subsequent slide below the 142.75-142.70 region, drag the USD/JPY pair to the 142.10 region, or last week's swing low. A convincing break below the latter could make spot prices vulnerable to the recent downward trajectory and slide further to the next relevant support near the 141.60 area en route to sub-141.00 levels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.