USD/JPY Price Forecast: Rallies to multi-week high amid dovish BoJ-inspired broad-based JPY selling

- USD/JPY attracts strong buying for the third straight day amid a combination of supporting factors.

- The BoJ’s dovish pause weighs on the JPY and provides a goodish lift amid a modest USD strength.

- Traders now look to the US macro data for some impetus ahead of the US NFP report on Friday.

The USD/JPY pair jumps to a three-week top – levels beyond mid-144.00s – during the early European session on Thursday in reaction to the Bank of Japan's (BoJ) dovish pause. As was widely anticipated, the BoJ kept short-term interest rates steady at 0.5% by a unanimous vote amid the uncertainty surrounding US tariffs. In the accompanying quarterly outlook report, the BoJ struck a cautious tone by slashing its economic growth and inflation forecasts. The central bank expects the Japanese economy to grow 0.5% in the current fiscal year, down from its earlier projection of 1.1% expansion in January. On the inflation front, the BoJ maintained that price pressures are broadly on course toward the 2% target, but revised its core CPI forecast down from 2.4% to 2.2% for fiscal 2025, and from 2.0% to 1.7% for fiscal 2026.

The BoJ, however, raised its projection for the core-core CPI from 2.1% to 2.3% for fiscal 2025, followed by a downgrade from 2.1% to 1.8% in 2026 before stabilizing at 2.0% in 2027. In the post-meeting press conference, BoJ Governor Kazuo Ueda said that the uncertainty from trade policies heightened sharply and the timing to achieve the 2% inflation goal will be somewhat delayed. This, in turn, forced investors to scale back their bets for a rate hike in June or July and weighs heavily on the JPY. Meanwhile, the global risk sentiment remains well supported by the optimism over the potential de-escalation of trade tensions between the US and China. This further undermines the safe-haven JPY, which, along with a modest US Dollar (USD) strength, provides an additional boost to the USD/JPY pair.

The BoJ, however, reiterated that it remains committed to raising interest rates further if the economy and prices move in line with its forecasts. This marks a big divergence in comparison to bets for more aggressive policy easing by the Federal Reserve (Fed), which should cap any meaningful USD appreciation and help limit deeper losses for the lower-yielding JPY. Traders now seem convinced that the US central bank will resume its rate-cutting cycle in June and have been pricing in the possibility of a 100 basis points (bps) rate cut by the end of this year. The expectations were reaffirmed by dismal US macro data released on Wednesday, which showed a surprise contraction in the US GDP, signs of easing inflationary pressure, and a cooling labor market. This warrants caution before placing fresh bullish bets around the USD/JPY pair.

Traders now look forward to Thursday's US economic docket – featuring the release of the usual Weekly Initial Jobless Claims and the ISM Manufacturing PMI. The focus, however, will remain glued to the US Nonfarm Payrolls (NFP) report on Friday, which might provide fresh cues about the Fed's policy outlook. This, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the USD/JPY pair.

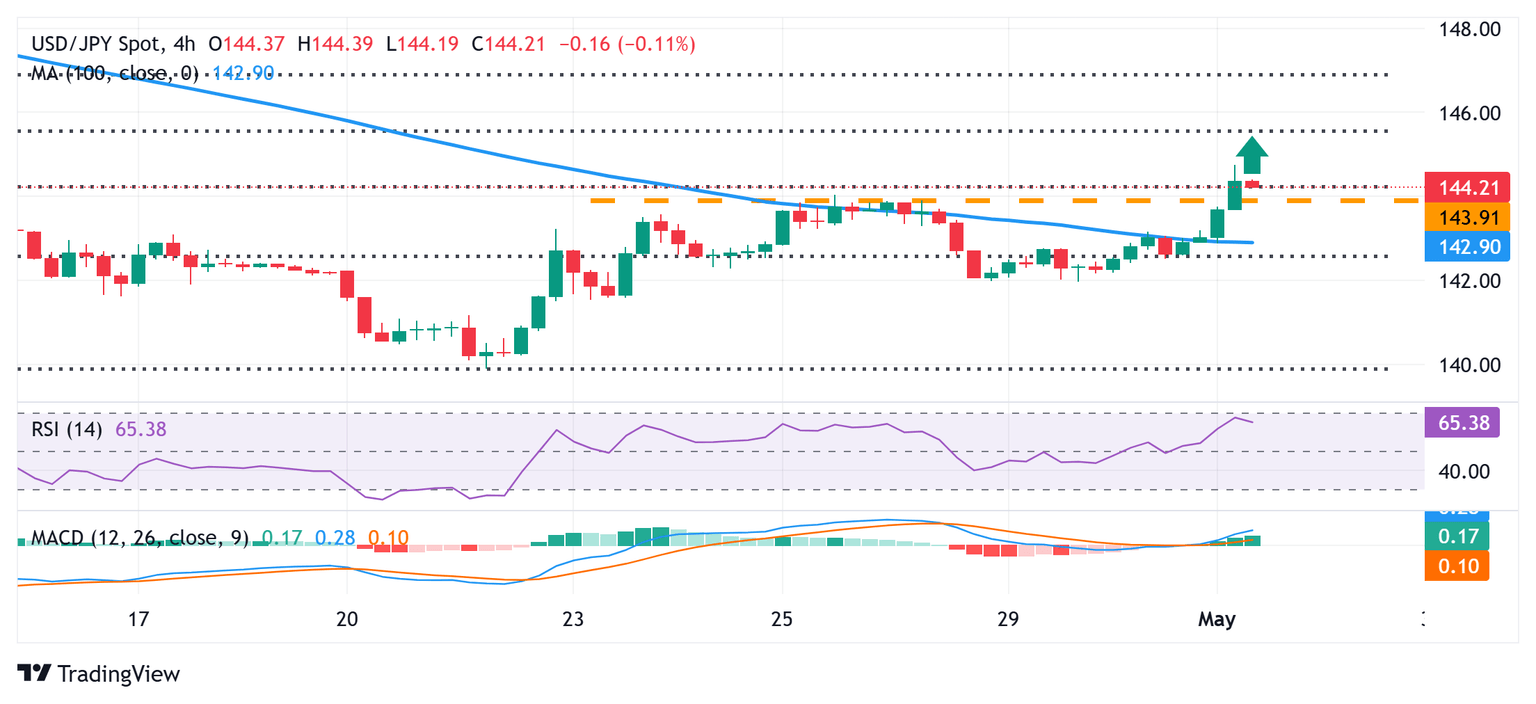

USD/JPY 4-hour chart

Technical Outlook

An intraday move beyond the 100-period Simple Moving Average (SMA) on the 4-hour chart and a subsequent move beyond the 144.00 mark and the 38.2% Fibonacci retracement level of the March-April downfall could be seen as a key trigger for bulls. Moreover, oscillators on the said chart have been gaining positive traction and support prospects for additional gains. That said, technical indicators on the daily chart – though they have been recovering from lower levels – are yet to confirm a positive bias and warrant some caution. Hence, any further move up might confront some resistance near the 145.00 psychological mark, above which the USD/JPY pair could aim to test the 50% Fibo. level, around the 145.50 region.

On the flip side, the 144.00 round figure now seems to protect the immediate downside and any further slide could now be seen as a buying opportunity. This should help limit the downside for the USD/JPY pair near the 143.00 mark, or the 100-period SMA on the 4-hour chart. A convincing break below the latter, however, might shift the near-term bias back in favor of bearish traders and make spot prices vulnerable to weaken further below the 142.40-142.35 intermediate support, towards the 142.00 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.