USD/JPY Price Forecast: Consolidates near multi-month peak before the next leg up

- USD/JPY consolidates the recent blowout rally to a multi-month top amid fundamental cues.

- A weaker risk tone benefits the safe-haven JPY, though reduced BoJ rate cut bets cap gains.

- Expectations that the Fed would delay rate cuts limit the USD pullback and support the pair.

The USD/JPY pair enters a bullish consolidation phase after touching its highest level since late April earlier this Wednesday and seesaws between tepid gains/minor losses through the first half of the European session. Global equity markets tracked the overnight negative session on Wall Street amid concerns about the potential economic fallout from US President Donald Trump's trade tariffs and diminishing odds for an immediate rate cut by the Federal Reserve (Fed). This, in turn, offers some support to the safe-haven Japanese Yen (JPY), which, along with a modest US Dollar (USD) downtick, acts as a headwind for the currency pair.

However, any meaningful USD pullback from its highest level since June 23 touched the previous day seems elusive in the wake of the growing acceptance that the Federal Reserve (Fed) will keep interest rates higher for longer. The bets were reaffirmed by the latest US consumer inflation figures released on Tuesday. In fact, the US Bureau of Labor Statistics reported that the headline Consumer Price Index (CPI) climbed the most in five months, by 0.3% in June, and accelerated to the 2.7% YoY rate from 2.4% in May. The core gauge, which excludes food and energy costs, rose 2.9% YoY from 2.8% prior, indicating the inflationary effects of Trump's tariffs.

In fact, Trump reiterated that 200% tariffs on pharmaceutical imports will come by the month-end. This comes on top of Trump's tariff notices to over 20 trading partners, including Japan, which faces a punishing 25% tariff on all exports to America amid stalled US-Japan trade talks. Moreover, slowing economic growth in Japan, declining real wages, signs of cooling inflation, and domestic political uncertainty could complicate the Bank of Japan's (BoJ) policy normalization path. Recent polls indicate that Japan’s ruling coalition – the Liberal Democratic Party (LDP) and Komeito – might lose its majority in the Upper House election on July 20.

The outcome could further heighten both fiscal and political risks in Japan, which, in turn, might force the BoJ to forgo raising interest rates this year. This keeps the JPY bulls on the defensive and suggests that the path of least resistance for the USD/JPY pair is to the upside. Hence, any corrective pullback could be seen as a buying opportunity and is more likely to remain cushioned. Traders now look forward to the release of the US Producer Price Index (PPI), due later during the North American session. Apart from this, speeches from influential FOMC members will drive the USD demand and produce short-term trading opportunities.

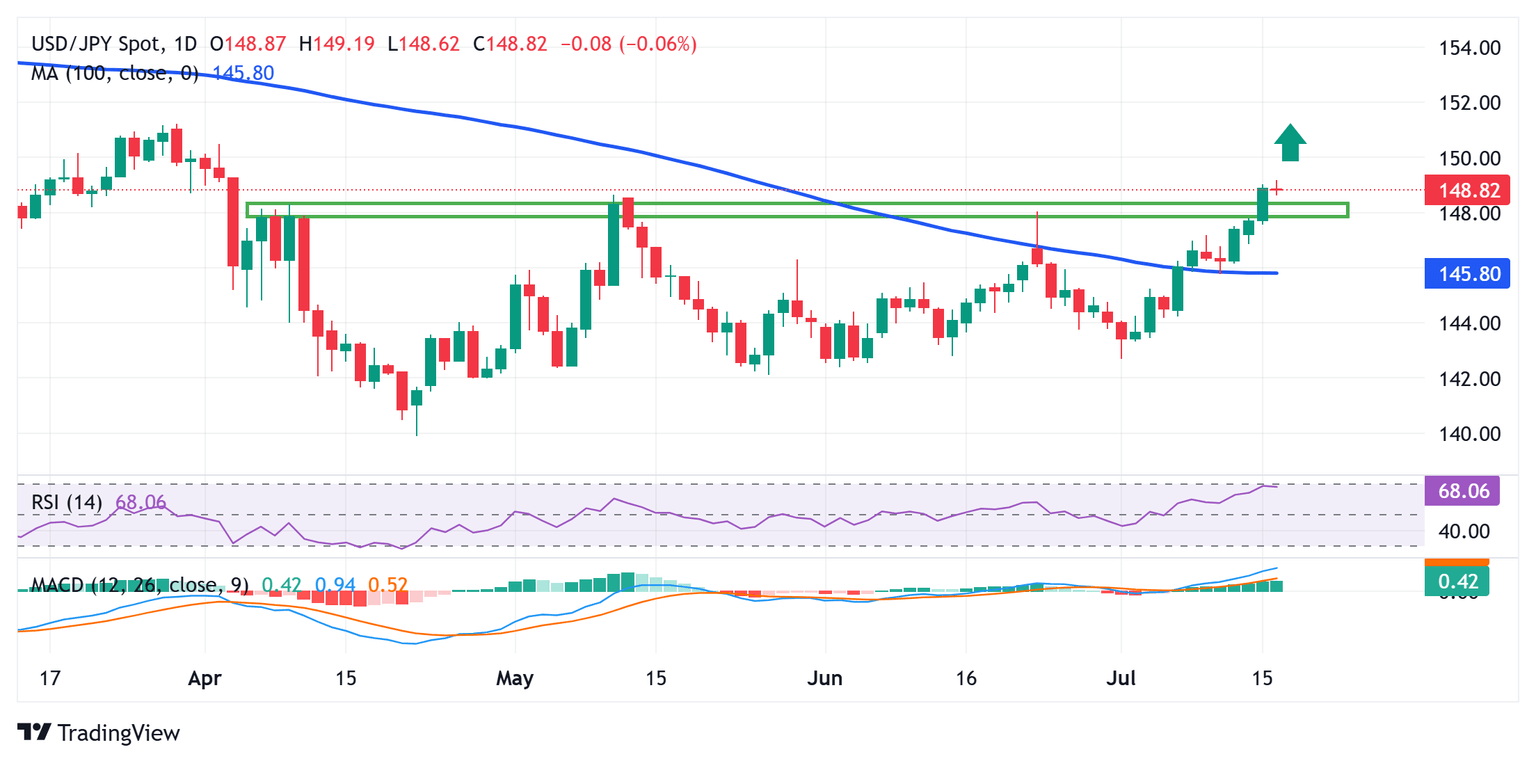

USD/JPY daily chart

Technical Outlook

The overnight breakout through the 148.00 mark (June peak) and a subsequent move beyond the May swing high, around the 148.65 area, was seen as a fresh trigger for the USD/JPY bulls. That said, the Relative Strength Index (RSI) on hourly charts is flashing overbought conditions and has moved closer to the 70 mark on the daily chart. This makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for any further appreciating move.

In the meantime, corrective pullback is likely to find some support near the 148.65 region, below which the USD/JPY pair could slide to the 148.00 round figure. Any further decline could be bought into and remain limited near the 147.60-147.55 horizontal zone. The latter should act as a key pivotal point, which, if broken, might prompt some technical selling and drag spot prices to the 147.00 mark en route to the 146.30-146.25 support.

On the flip side, a sustained strength and acceptance above the 149.00 round figure should pave the way for a move towards the next relevant hurdle near the 149.35-149.40 region. The momentum could extend further and eventually push the USD/JPY pair to the 150.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.