USD/JPY Price Forecast: Bulls hold short-term control ahead of US inflation data

- USD/JPY stands firm near a two-week high as trade optimism undermines the safe-haven JPY.

- Some repositioning trade benefits the USD and lends additional support to the currency pair.

- The divergent BoJ-Fed policy expectations cap spot prices ahead of the crucial US CPI report.

The USD/JPY pair attracts buyers for the second straight day on Wednesday and trades near the 145.20 area, close to a two-week top during the early part of the European session. The Japanese Yen (JPY) weakened after data released earlier today showed that Japan's Corporate Goods Price Index (CGPI) rose 3.2% in May from a year earlier. This was the slowest increase since September last year and marked a notable deacceleration from a revised 4.1% gain in the previous month, which could ease pressure on the Bank of Japan (BoJ) to raise interest rates.

In fact, the latest Reuters poll revealed that a slight majority of economists expect that the BoJ will forego another interest rate hike this year due to uncertainty over US tariff policy. Apart from this, the optimism over a positive outcome from the high-stakes US-China negotiation turns out to be another factor undermining the JPY's safe-haven status. In fact, China’s Vice Commerce Minister Li Chenggang told reporters that delegations from both countries agreed to a framework on trade and implement the Geneva Consensus after two days of talks in London.

Adding to this, US Commerce Secretary Howard Lutnick indicated the deal should resolve issues surrounding rare earths and magnets. This, along with reduced bets for imminent interest rate cuts by the Federal Reserve (Fed) this year, assists the US Dollar (USD) to gain some positive traction and acts as a tailwind for the USD/JPY pair. However, traders are still pricing in the possibility that the US central bank will lower borrowing costs in September, which keeps the USD confined in a range near its lowest level since April 22 touched last week.

Meanwhile, a federal appeals court's ruling that US President Donald Trump's “Liberation Day” tariffs could remain in effect while it reviews a lower court decision to block them adds a layer of uncertainty in the markets. Furthermore, BoJ Governor Kazuo Ueda has shown readiness to keep raising interest rates if the underlying inflation approaches the 2% target. This is holding back the JPY bears from placing aggressive bets and capping the USD/JPY pair. Investors further opt to wait for the release of the latest US consumer inflation figures.

The crucial US Consumer Price Index (CPI) report is forecast to point to still sticky inflation. Adding to this, a still resilient US labor market and economic growth may reinforce the Fed’s wait-and-see stance toward further easing. Nevertheless, the data will play a key role in influencing market expectations about the Fed rate-cut path, which, in turn, will drive the USD demand and provide some meaningful impetus to the USD/JPY pair. The fundamental backdrop, meanwhile, warrants some caution before positioning for a further appreciating move.

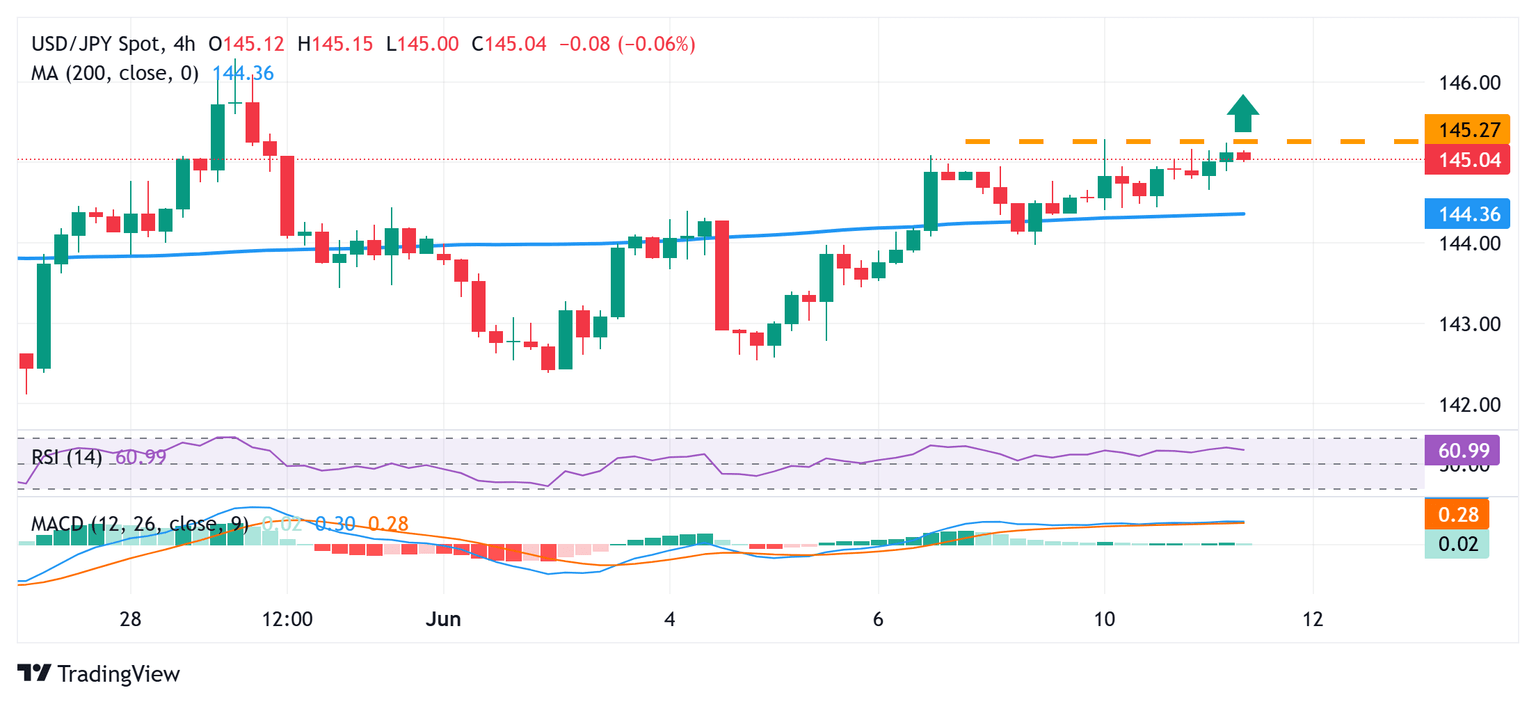

USD/JPY 4-hour chart

Technical Outlook

From a technical perspective, acceptance above the 200-period Simple Moving Average (SMA) on the 4-hour chart and the 145.00 psychological mark favor bullish traders amid positive oscillators on daily/hourly charts. Some follow-through buying beyond the 145.30 area or a two-week top touched on Tuesday, will reaffirm the constructive setup and lift the USD/JPY pair beyond the 145.60-145.65 intermediate hurdle, towards the 146.00 round figure. The momentum could extend further towards the next relevant hurdle near the 146.25-146.30 region, or May 29 swing high.

On the flip side, any meaningful slide below the 145.00 mark could attract some dip-buyers and remain limited near the 144.30 area, or the 200-period SMA on the 4-hour chart. This is followed by the 144.00 round figure, which if broken decisively will negate the positive outlook and shift the near-term bias in favor of bearish traders. The subsequent downfall could drag the USD/JPY pair to the 143.60-143.50 region en route to sub-143.00 levels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.