USD/JPY Price Forecast: Bulls await acceptance above 200-day SMA, 149.00 mark

- USD/JPY gains strong follow-through positive traction amid a combination of supporting factors.

- Domestic political uncertainty and the BoJ rate hike ambiguity continue to undermine the JPY.

- The divergent BoJ-Fed policy expectations cap spot prices ahead of the crucial US macro data.

The USD/JPY pair extends its strong move up for the second straight day on Wednesday and spikes to a fresh one-month peak during the first half of the European session. Against the backdrop of the Bank of Japan (BoJ) rate hike ambiguity, heightened domestic political uncertainty turns out to be another factor that continues to undermine the Japanese Yen (JPY). The US Dollar (USD), on the other hand, looks to build on the previous day's solid rebound from the vicinity of the August monthly swing low and lends additional support to the currency pair.

BoJ Deputy Governor Ryozo Himino said on Tuesday the central bank should keep raising interest rates but warned that global economic headwinds remains high. Furthermore, the Japanese ruling party's secretary general, Hiroshi Moriyama, a close aide to Prime Minister Shigeru Ishiba, said that he intends to resign from his post. Adding to this, Japanese media reported that former Prime Minister Aso Taro will publicly call for a new Liberal Democratic Party (LDP) presidential election on Wednesday. This encouraged speculators to continue building short JPY positions.

However, BoJ Governor Kazuo Ueda said on Wednesday that there is no change in stance on raising interest rates and stated that he will scrutinise without preconception whether the economy and prices move in line with our forecast. Moreover, expectations that strong wage growth is expected to fuel demand-driven inflation and keeps the door open for an imminent interest rate hike by the end of this year. This, in turn, limits deeper JPY losses and fails to assist the USD/JPY pair to capitalize on the intraday positive momentum beyond the 149.00 round-figure mark.

Meanwhile, the growing acceptance that the US Federal Reserve (Fed) will lower borrowing costs this month and deliver at least two 25 basis points (bps) by the year-end marks a significant divergence in comparison to a relatively hawkish BoJ outlook. This further contributes to capping the USD/JPY pair. Traders also seem reluctant to place aggressive directional bets and opt to wait for the release of the US Nonfarm Payrolls (NFP) report on Friday for more cues about the Fed's rate-cut path, which will play a key role in influencing the USD price dynamics.

In the meantime, market participants on Wednesday will take cues from the release of the US JOLTS Job Openings data. This week's US economic docket also features the ADP report on private-sector employment and ISM Services PMI on Thursday, which should contribute to producing short-term opportunities around the USD/JPY pair. Nevertheless, the aforementioned mixed fundamental backdrop warrants some caution for bullish traders and positioning for any further near-term appreciating move.

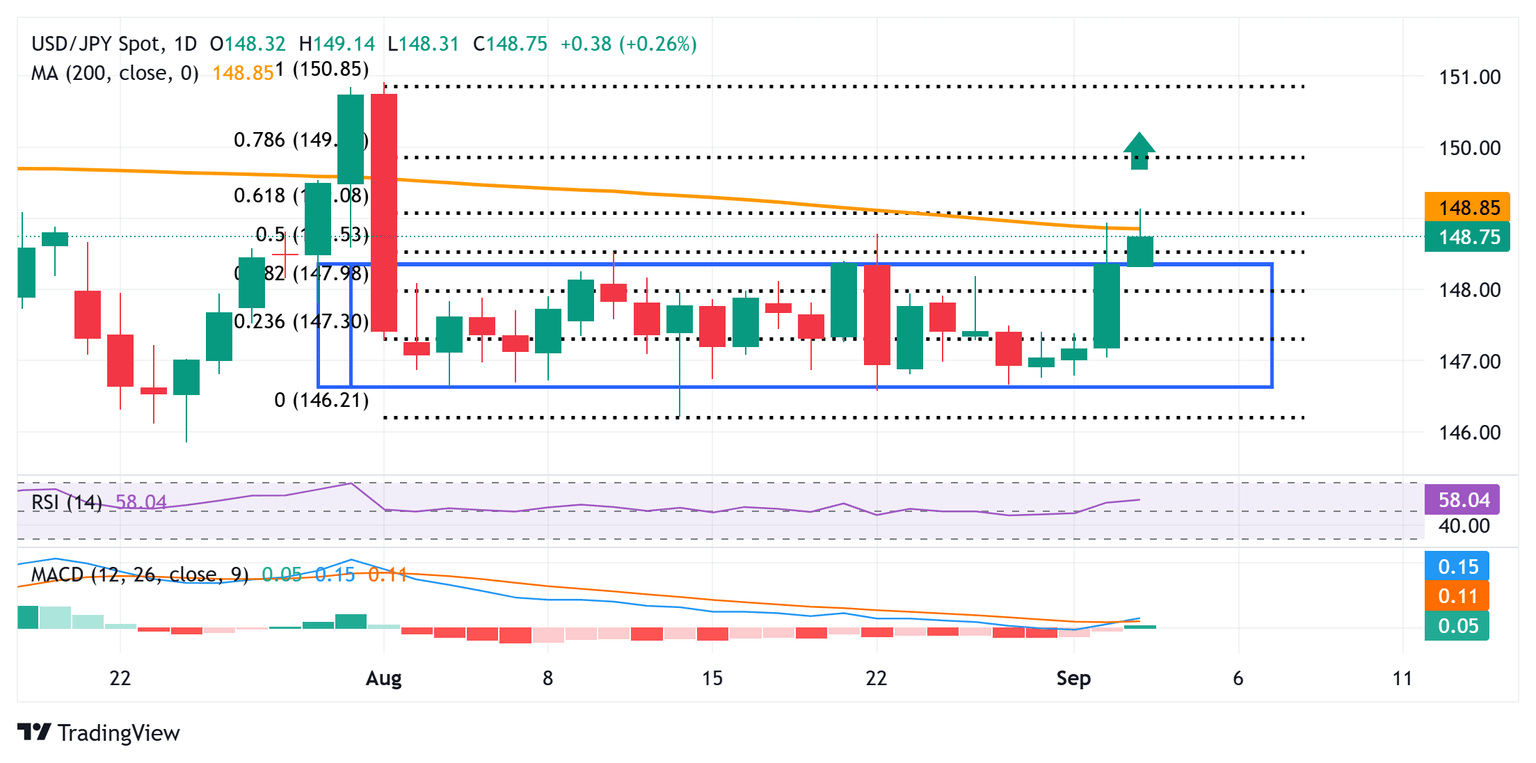

USD/JPY daily chart

Technical Outlook

From a technical perspective, the intraday move up falters near the 61.8% Fibonacci retracement level of the downfall witnessed in August. The said barrier is pegged near the 149.20 region, which, if cleared, will reaffirm the overnight breakout through a four-week-old trading range. Given that oscillators on the daily chart have just started gaining positive traction, a sustained move beyond should allow the USD/JPY pair to reclaim the 150.00 psychological mark. The momentum could extend further towards challenging the August monthly swing high, around the 151.00 neighborhood.

On the flip side, the trading range barrier breakpoint, around the 148.30-148.25 region, now seems to protect the immediate downside ahead of the 148.00 round figure. A convincing break below the latter could drag the USD/JPY pair to the 147.40 intermediate support en route to the 147.00 mark and the 146.70 horizontal zone. Failure to defend the said support levels might shift the bias back in favor of bearish traders and expose the August swing low, around the 146.20 region, before spot prices eventually drop to the 146.00 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.