USD/JPY Price Forecast: Bears have the upper hand amid divergent BoJ-Fed expectations

- USD/JPY drifts lower on Friday as Japan’s upbeat Household Spending data lifts BoJ rate hike bets.

- US fiscal concerns keep the USD bulls on the defensive and exert additional pressure on the pair.

- The uncertainty over Trump’s trade policies might hold back traders from placing directional bets.

The USD/JPY pair attracts fresh sellers on Friday and moves further away from over a one-week high, around the 145.25 region, touched the previous day. Despite the Bank of Japan's (BoJ) rate hike hesitations, investors seem convinced that the central bank will stay on the path of monetary policy normalization amid signs of broadening inflation in Japan and acts as a tailwind for the Japanese Yen (JPY). The US Dollar (USD), on the other hand, ticks lower amid concerns about the worsening US fiscal condition and exerts additional pressure on the currency pair.

The incoming data indicated that inflation in Japan has persistently exceeded the BoJ's 2% annual target for over three years. Moreover, the Tankan Survey released earlier this week revealed that firms expect consumer prices to rise by 2.4% over the next three years and by 2.3% annually over the next five years. Adding to this, a government report on Friday showed that Household Spending in Japan surpassed even the most optimistic estimates and rose 4.7% in May from a year earlier. This, in turn, keeps the door open for further rate hikes by the BoJ and underpins the JPY.

US President Donald Trump’s tax-cut and spending bill cleared its final hurdle in Congress on Thursday. The legislation is estimated to add $3.4 trillion to the nation’s debt over the next decade and worsen America’s long-term debt problems. This, to a larger extent, overshadows better-than-expected US employment details, which keep the USD bulls on the defensive and contribute to the offered tone surrounding the USD/JPY pair. In fact, the US economy added 147,000 new jobs in June compared to the previous month's upwardly revised reading of 144,000 and the 110,000 expected.

Moreover, the Unemployment Rate edged lower to 4.1% from 4.2% in May and pointed to a still resilient US labor market. This should give the Federal Reserve (Fed) space to stick to its wait-and-see approach amid the uncertainty stemming from Trump's trade policies. Other details of the report showed that wage growth, as measured by the change in the Average Hourly Earnings, slowed to 0.2% in June from 0.4% previously and retreated to 3.7% from 3.8% in May This helps to ease inflation concerns and keeps the door open for at least two 25 basis points rate reductions by the Fed in 2025.

This marks a significant divergence in comparison to hawkish BoJ expectations and suggests that the path of least resistance for the USD/JPY pair is to the downside. Investors, however, remain worried that global trade tensions triggered by Trump's tariff policies could complicate the BoJ's efforts to normalise monetary policy. This might hold back the JPY bulls from placing aggressive bets amid relatively thin trading volumes on the back of the Independence Day holiday in the US. Nevertheless, spot prices manage to hold comfortably above a one-month trough touched earlier this week.

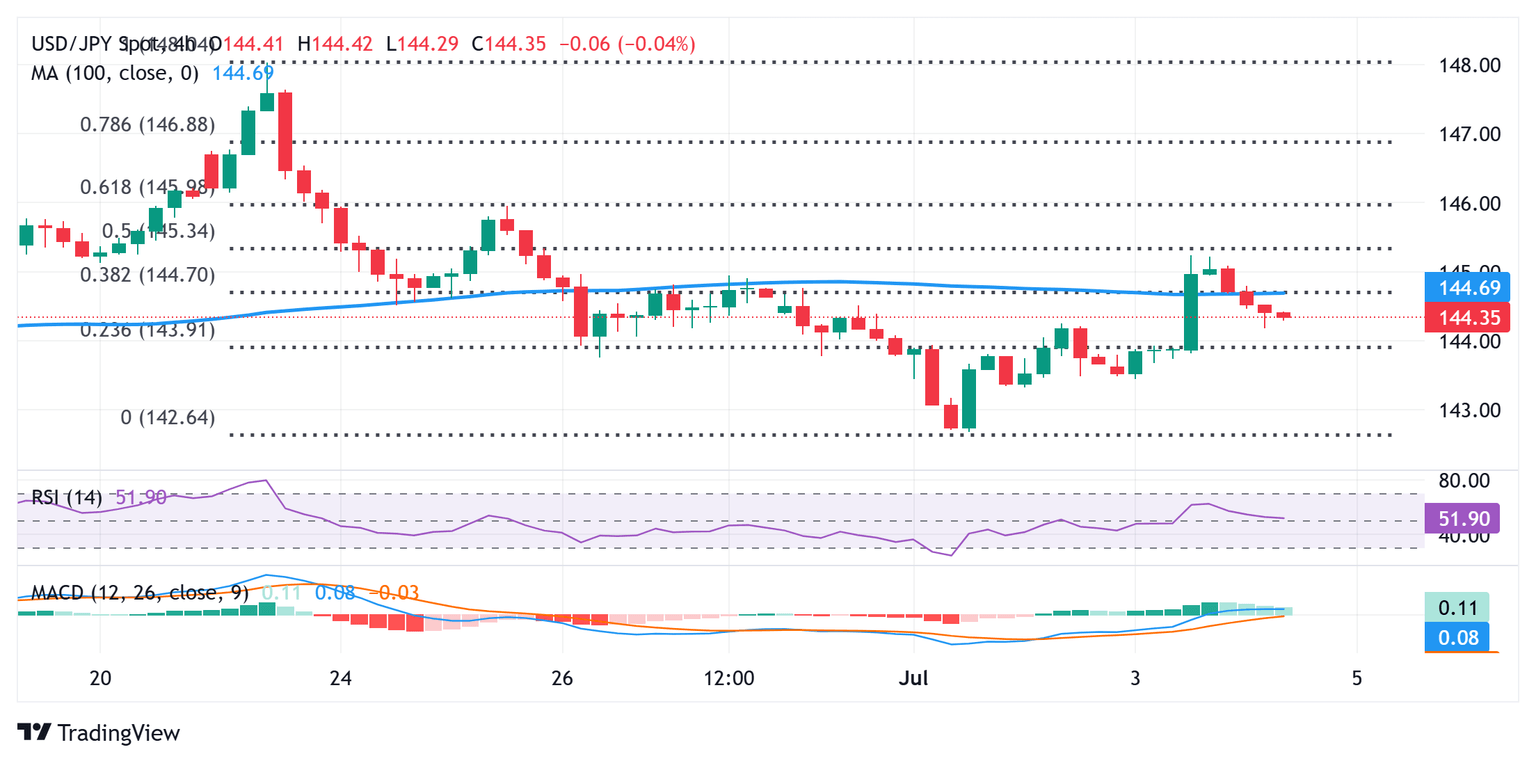

USD/JPY 4-hour chart

Technical Outlook

The overnight failure near the 145.25 supply zone, which nears the 50% retracement level of the June-July downfall, and the subsequent slide on Friday warrants some caution for the USD/JPY bulls. Any further slide, however, is likely to find some support near the 144.00 round figure, or the 23.6% Fibo. retracement level. A convincing break below the latter might shift the bias back in favor of bearish traders and drag spot prices to the 143.45 intermediate support en route to the 143.00 mark. The downward trajectory could extend further towards retesting the one-month low, around the 142.70-142.65 region set on Tuesday.

On the flip side, attempted intraday recovery might now face some resistance near the 144.65 confluence – comprising the 100-period Simple Moving Average (SMA) on the 4-hour chart and the 38.2% Fibo. retracement level. A sustained strength beyond should allow the USD/JPY pair to reclaim the 145.00 psychological mark en route to the 145.25-145.30 region. Some follow-through buying should pave the way towards testing the 61.8% Fibo. retracement level and conquer the 146.00 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.