USD/JPY Price Forecast: Bears have the upper hand amid BoJ rate hike bets, ahead of US PCE data

- USD/JPY stalls its sharp retracement slide from a two-week high touched on Thursday.

- The USD attracts buyers amid some repositioning ahead of the US PCE and lends support.

- The divergent BoJ-Fed policy expectations and trade uncertainty could benefit the JPY.

The USD/JPY pair attracts some intraday buyers near the 143.45-143.40 area on Friday and for now, seems to have stalled the previous day's sharp retracement slide from a two-week high. The US Dollar (USD) regains some positive traction following Thursday's downfall amid some repositioning trade ahead of the crucial US inflation report and turns out to be a key factor acting as a tailwind for the currency pair. Any meaningful upside, however, still seems elusive in the wake of the growing acceptance that the Bank of Japan (BoJ) will continue raising interest rates amid signs of broadening inflation in Japan.

The bets were reaffirmed by the upbeat macro data released from Japan earlier today. In fact, the Statistics Bureau of Japan reported the headline Consumer Price Index (CPI) in Tokyo – Japan's capital city – rose 3.4% from a year earlier in May, while a gauge that excludes volatile fresh food exceeded median market forecasts for a 3.5% gain and climbed to the 3.6% YoY rate, or a more than two-year high. A separate index that strips away the effects of both fresh food and fuel costs rose 3.3% in the year to May after a 3.1% rise recorded in April. The data pointed to sticky inflation and will pressure the BoJ to hike rates again.

Adding to this, Japan's Retail Sales rose more than expected, by 3.3% YoY in April, compared to 3.1% in the prior month. This comes on top of expectations that bumper wage hikes will boost private consumption and backs the case for further BoJ policy normalization. That said, the uncertainty over US tariffs might force the central bank to maintain the wait-and-see approach. This, however, still marks a big divergence in comparison to expectations that the Federal Reserve (Fed) will lower borrowing costs further by the end of this year. This, along with the US fiscal concerns, should cap the USD and the USD/JPY pair.

Meanwhile, a federal appeals court on Thursday temporarily reinstated US President Donald Trump's sweeping trade tariffs, a day after a separate trade court deemed them illegal and ordered an immediate block. This adds to a layer of uncertainty in the markets amid deep-rooted US-China trade tensions and dents investors' appetite for riskier assets. This, along with persistent geopolitical risks stemming from the Russia-Ukraine war and conflicts in the Middle East, should benefit the safe-haven JPY and keep a lid on the USD/JPY pair. Traders might also opt to wait for the US Personal Consumption Expenditure (PCE) Price Index.

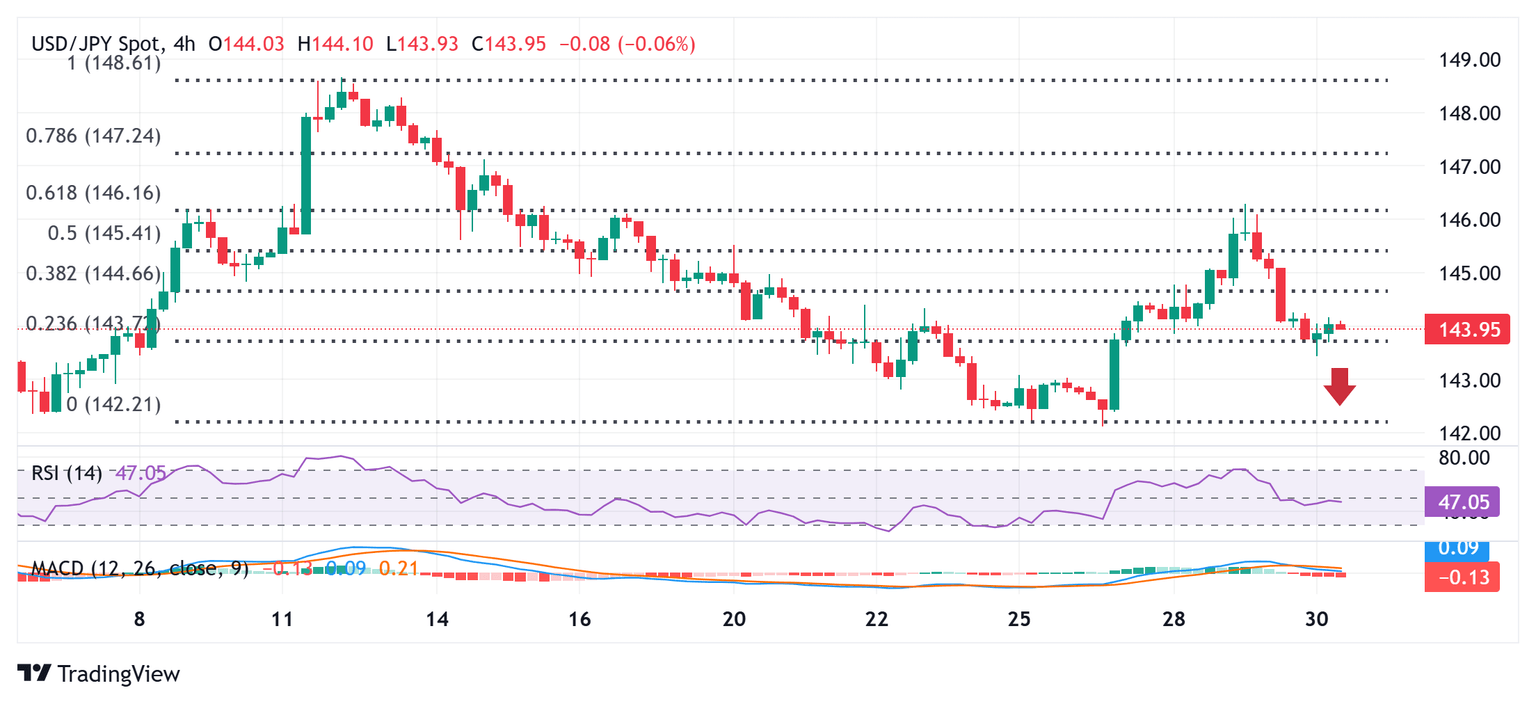

USD/JPY 4-hour chart

Technical Outlook

The overnight failure near the 61.8% Fibonacci retracement level of the recent downfall from the monthly peak and the subsequent fall favors the USD/JPY bears amid negative oscillators on daily/hourly charts. However, an intraday bounce makes it prudent to wait for some follow-through selling below the 143.45 area, or the daily trough, before positioning for further losses. Spot prices might then accelerate the fall towards the 143.00 mark en route to the 142.40 intermediate support before eventually dropping to the 142.10 area, or the monthly low touched on Tuesday.

On the flip side, any subsequent move up is more likely to confront stiff resistance near the 144.25-144.30 region, above which the USD/JPY pair could aim to reclaim the 145.00 psychological mark. A sustained strength beyond the latter should pave the way for a move towards the next relevant hurdle near the 145.65 horizontal zone en route to the 146.00 round figure and the overnight swing high, around the 146.25-146.30 region, or a two-week top.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.