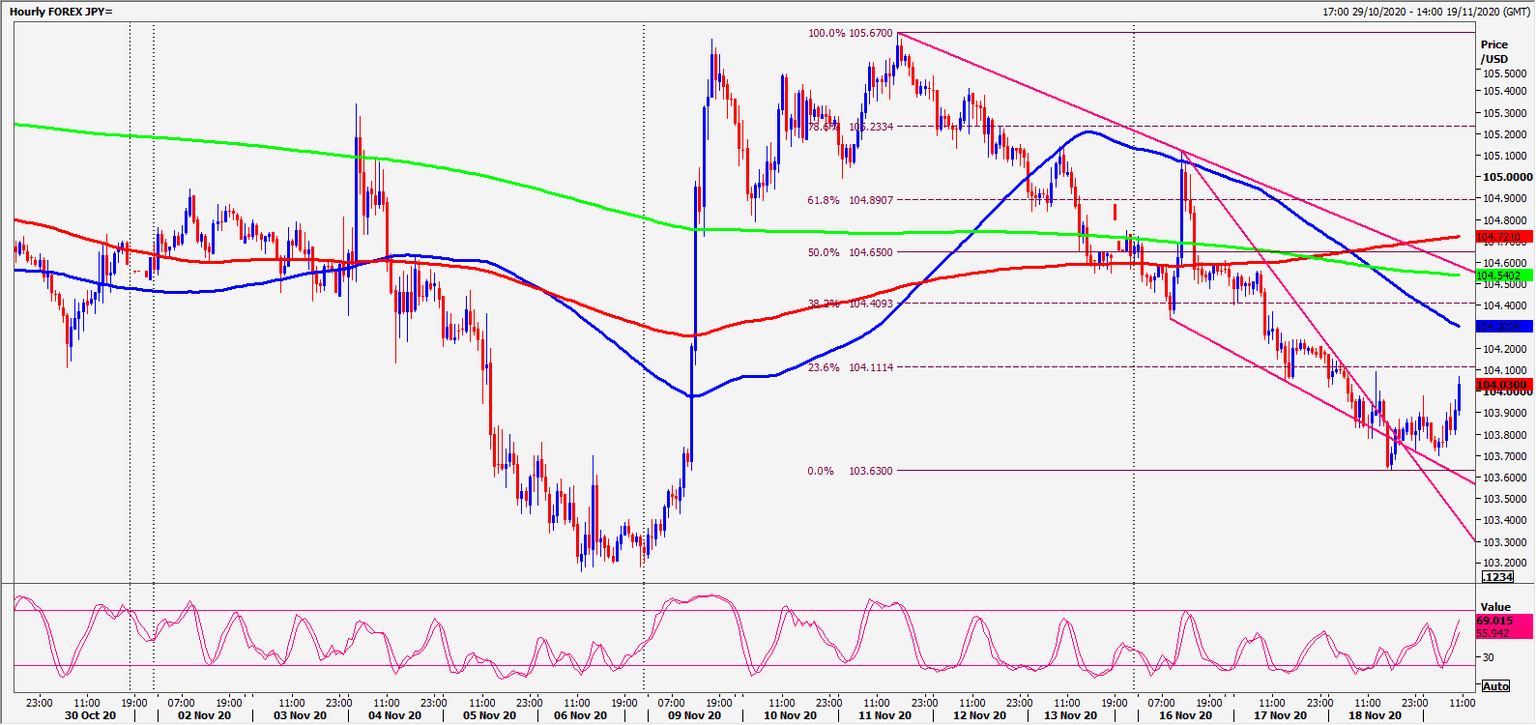

USD/JPY in a 5 day downward sloping channel hitting 103.63

USD/JPY – EUR/JPY

USDJPY in a 5 day downward sloping channel hitting 103.63.

EURJPY we wrote: holding below 123.55 targets 123.30. On further losses look for 123.00/122.90. Target hit.

Daily Analysis

USDJPY break below 103.90 was a sell signal targeting 103.75/70, perhaps as far as 103.50/45 today. Further losses retest support at the November low of 103.25/15. Longs need stops below 103.00.

First resistance at 105.05/15. Shorts need stops above 104.25. A break higher targets a selling opportunity at 104.50/60 with stops above 104.75.

EURJPY hits the next target of 123.00/122.90. If we continue lower look for 122.70/60 then 122.10/00.

First resistance at 123.20/30 then a selling opportunity at 123.55/65 with stops above 123.90.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk