USD/JPY Forecast: Comfortable above 109.00, bulls getting ready

USD/JPY Current price: 109.33

- US Treasury yields remained within familiar levels despite growing optimism.

- Japanese markets will remain closed until next Thursday.

- USD/JPY could challenge the weekly high and extend its gains beyond 110.00.

The USD/JPY pair posed a modest intraday advance, ending Tuesday around the 109.30 level, amid resurgent demand for the American currency. The greenback gained partly on the dismal market mood that led the US session but also helped by continued signs of improvement in the world’s largest economy. The pair gained despite the sour tone of equities and lower US government bond yields, as that on the 10-year Treasury note fell to 1.55%, to later settle at 1.58%.

Japanese markets will remain closed amid the celebration of Children’s Day within the Golden Week. The country will return to work on Thursday, May 6, when the Bank of Japan will publish the Minutes of its latest meeting.

USD/JPY short-term technical outlook

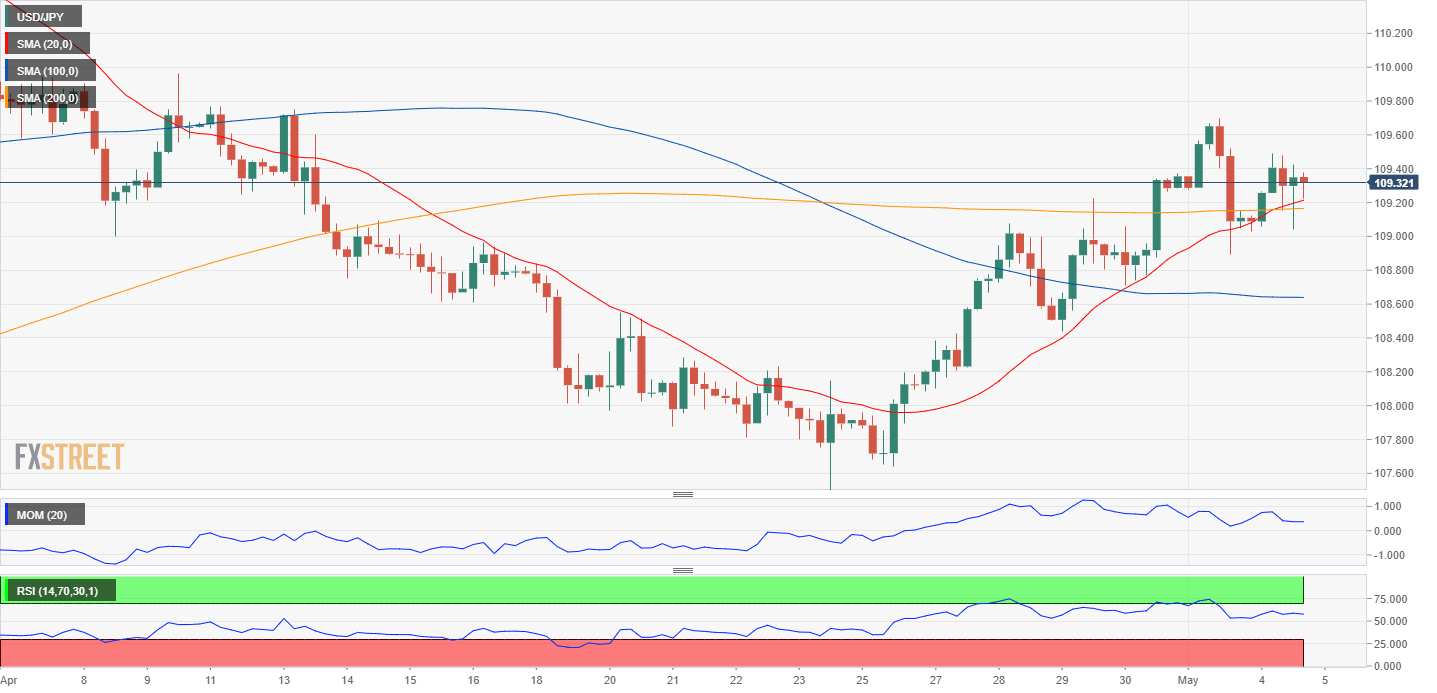

The USD/JPY pair is neutral in the near-term, with the risk skewed to the upside. The 4-hour chart shows that it finished the day above all of its moving averages, with the 20 SMA maintaining its bullish slope after crossing above the longer ones. Technical indicators have lost their bullish strength and turned marginally lower within positive levels. Chances are of a bullish extension on a break above 109.69, the weekly high.

Support levels: 108.90 108.60 108.25

Resistance levels: 109.70 110.10 110.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.