USD/JPY Forecast: Bulls have chances as long as the pair holds above 104.40

USD/JPY Current price: 104.95

- Japan will publish Q4 Gross Domestic Product is foreseen at 2.3% QoQ.

- US long-term Treasury yields surged to their highest in a year.

- USD/JPY closed below 105.00 but maintains its bullish stance.

The USD/JPY pair eased on Friday from a daily high of 105.17, ending the week in the red in the 104.90 price zone. Nevertheless, the pair was able to post intraday gains, underpinned by the rally in US stocks and US Treasury yields. The 30-year note yield surged past 2%, while that on the 10-year note settled at 1.21%.

Over the weekend, Japan approved its first coronavirus vaccine, co-developed and supplied by Pfizer, and will start the inoculation process this week. The country also suffered a magnitude 7.2 earthquake on Saturday, although not major consequences have been reported. Japan will publish early on Monday the preliminary estimate of its Q4 Gross Domestic Product, foreseen at 2.3% QoQ. The country will also release December Industrial Production and Capacity Utilization.

USD/JPY short-term technical outlook

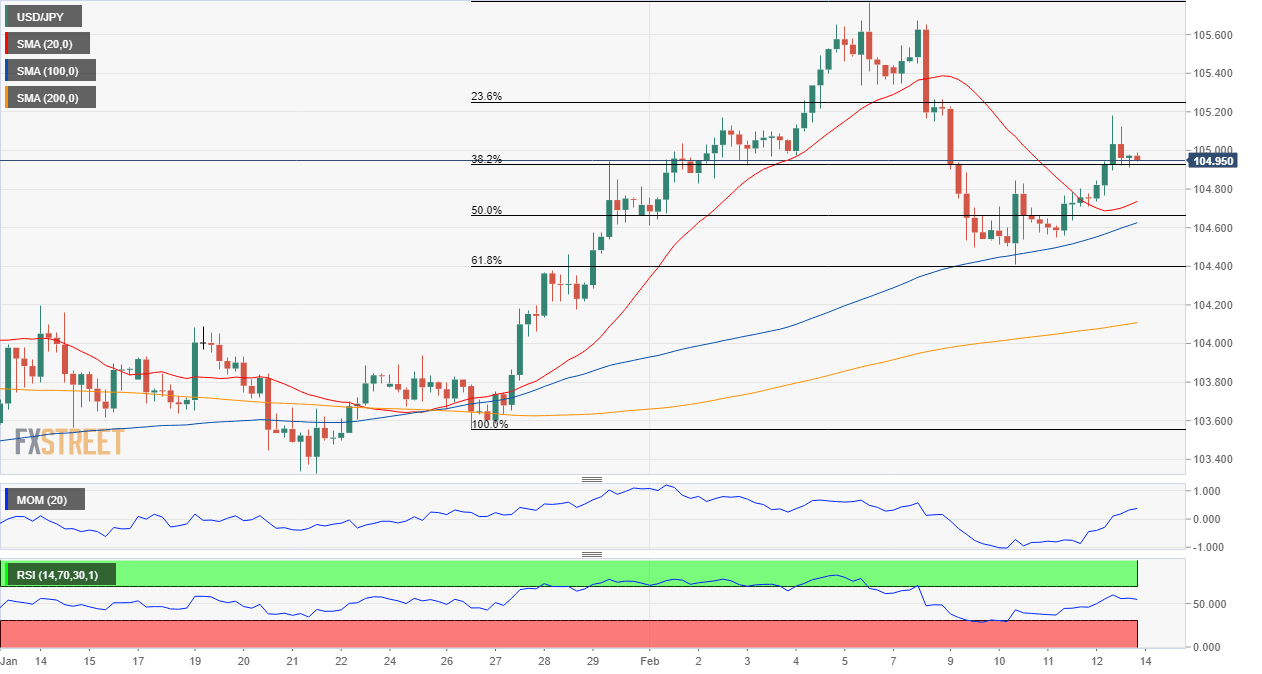

The daily chart for the USD/JPY pair shows that it recovered from around its 100 SMA while tee 20 SMA advanced to converge wit the larger one, both around 104.50. The pair has the 61.8% retracement of its latest daily run at 104.40, making the area a relevant support zone. Technical indicators have resumed their advances within positive levels, skewing the risk to the upside. The pair also has room to advance in the 4-hour chart as the pair remains above mildly bullish moving averages, while technical indicators turned higher within positive levels.

Support levels: 104.40 104.05 103.70

Resistance levels: 105.30 105.75 106.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.