USD/JPY Daily: a double-top at 109.72

Major Pairs Summary

30 December 2019/8:07 a.m. EST

Positioning

Long EUR/USD and AUD/USD

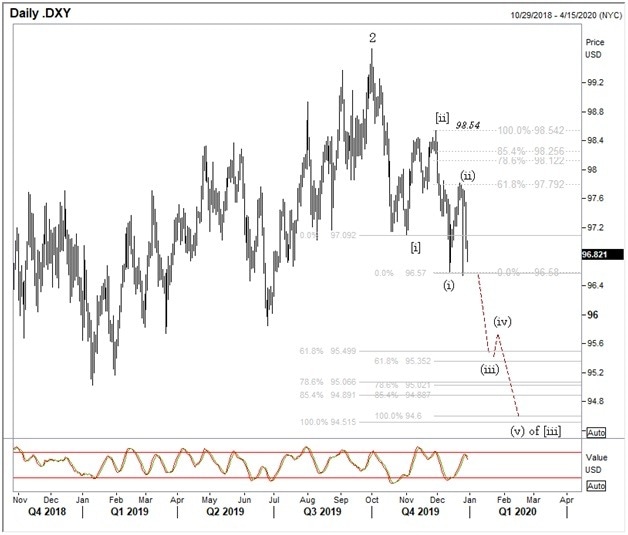

Dollar Index - Pg. 2 (a break of 96.56 swing low sets up 95.50)

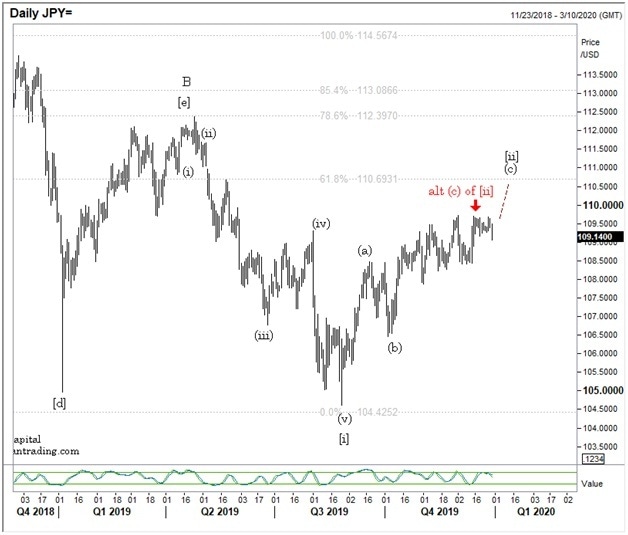

USD/JPY Pg. 3-4 (still a bit confused here)

EUR/USD Pg. 5 (into some near-term retracement resistance)

USD/CHF Pg. 6 (looking for a reaction higher soon)

GBP/USD Pg. 7-8 (watching for a reaction lower for possible long entry)

USD/CAD Pg. 9 (longer term picture seems clear; daily not so much)

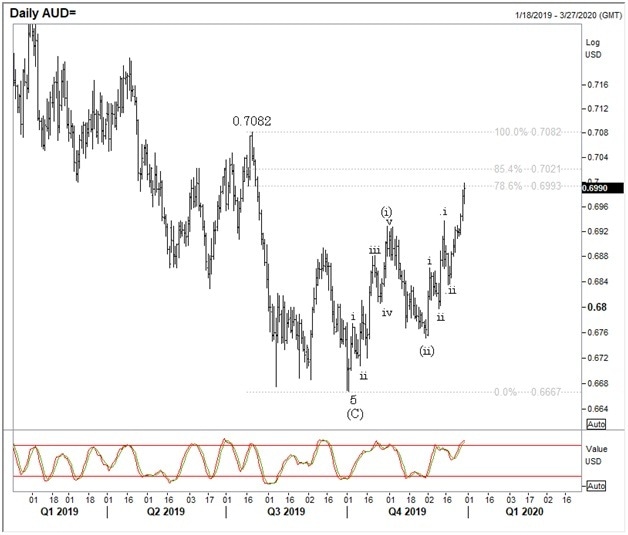

AUD/USD Pg. 10 (fresh swing high)

US $ Index Daily: No change. Working from the premise minor correction rally Wave (ii) is complete at 97.82; targeting to 95.35 for minor Wave (iii); swing support comes in at 96.57.

USD/JPY Daily: A double-top at 109.72. Our primary view is a move toward 110.69-94 extended Wave (c) of [ii] by 61.8% of (a). Alternative Wave [ii] top at 109.72. Confidence low here; but the rally does seem corrective, suggesting the next top either 109.72 or 110.69 will be a longer-term top.

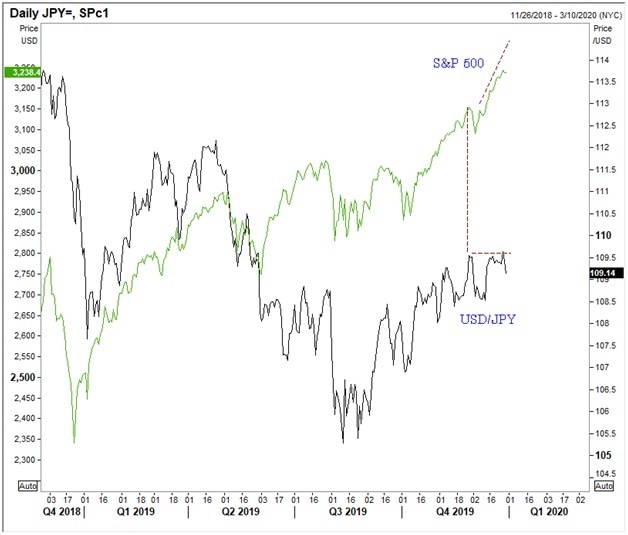

Divergence in the recent tight correlation between USD/JPY and Stocks continues…

EUR/USD Daily: A new daily swing high today, as the pair rallied into the 61.8% retracement level (1.1418 high/1.0877 low). Maybe some near-term “profit taking” at this level. But remaining long for a push toward 1.1367 or more.

USD/CHF Daily: We wouldn’t be surprised to see a minor corrective rally in Wave (iv) here; as we were targeting to 0.9710 on for minor Wave (iii)—the low today is 0.9712.

GBP/USD Daily: It appears intermediate-term Wave 2 is complete at 1.2903 (just below at 38.2% retracement level); setting the stage for a sharp rally in Wave 3; we are targeting up toward 1.3600 for Wave 3. Looking for an opportunity to add long here on a corrective pull-back (see 240-min chart next page).

GBP/USD 240-min View: A bit extended into a 38.2% retracement today at 1.3136. Will we get a chance for a long entry on a near-term correction? Watching.

USD/CAD Weekly: Our daily analysis has been sketchy for CAD of late, to say the least. But on a weekly basis the pattern seems clearer. We suspect we will push much lower in this pair; it supports our optimism for commodity currencies across the board.

AUD/USD Daily: Pushing higher; now into 78.6% retracement from the 78.6% retracement level. We remain long from 0.6839.

Author

Jack Crooks

Black Swan Capital

Experience Jack has over 30 years of experience in the currency, equity, and futures arena. He has held key positions in corporate financial analysis, brokerage, investment research, money management, and trading.