USD/JPY: Considerable overhead resistance around 109.60/109.70 to restrict the bulls [Video]

![USD/JPY: Considerable overhead resistance around 109.60/109.70 to restrict the bulls [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-currency-and-dollar-bank-note-60447532_XtraLarge.jpg)

USD/JPY

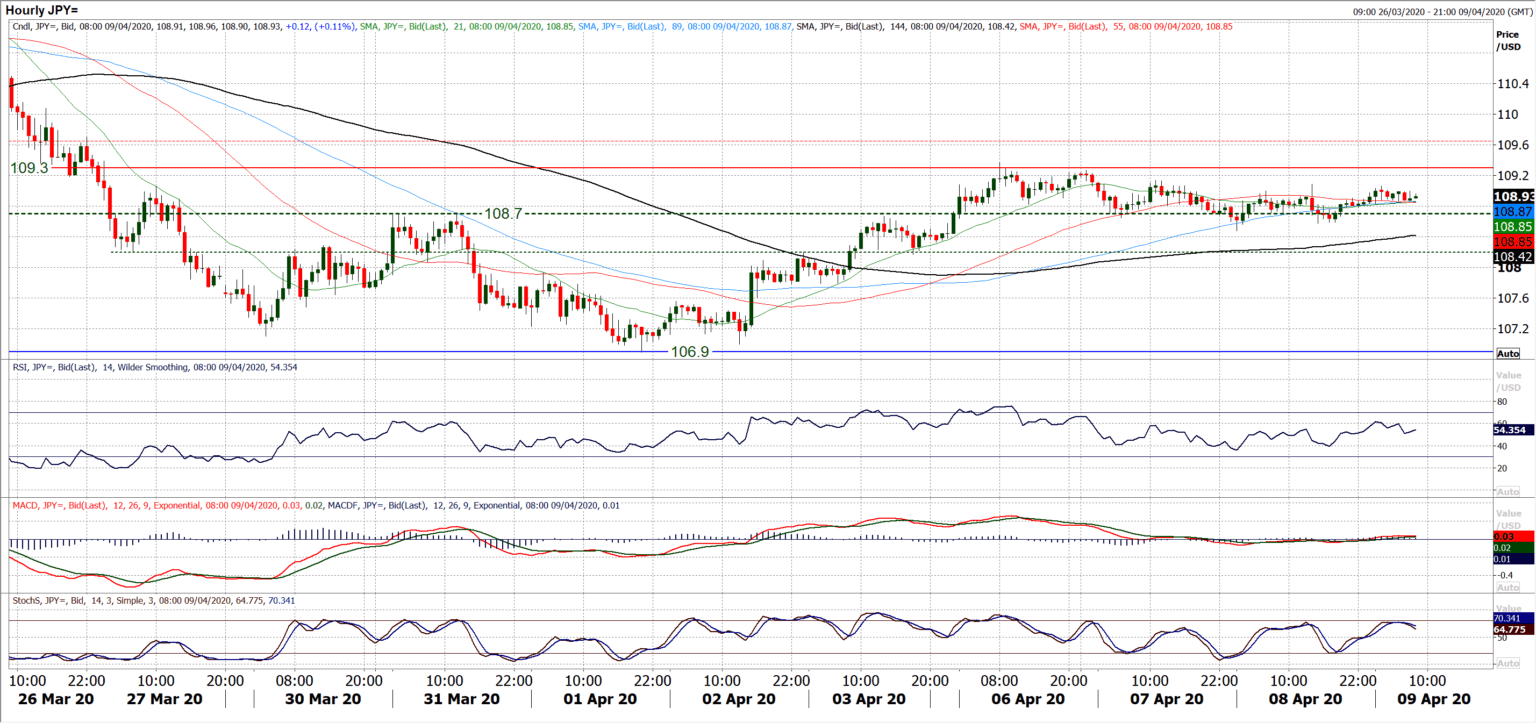

Having seen the rebound tail off in the past couple of sessions, yesterday’s small-bodied, tight ranged candle has done little to shake the market out of a growing consolidation. There are some risk events on the immediate horizon today (OPEC+ and the Eurogroup meeting) but this could also be a case of embattled traders limping towards the Easter break. This comes as momentum indicators have settled close to their respective neutral points, and moving averages have been converging to flatten off (there are just 35 pips separating all four moving averages we cover). The hourly chart reflects this consolidation too, with the market gravitating around 108.70 over recent days, whilst hourly RSI has stabilised between 35/65. The rally has faltered around 109.30 which is old overhead supply but the support forming around 108.70 (the previous breakout) suggests a lack of conviction either way for now. We are subsequently neutral on Dollar/Yen. Above 109.30 would improve again, but there is considerable overhead resistance around 109.60/109.70 to restrict the bulls. A move below 108.15 (an old pivot) would begin to leave a negative bias and increase downside pressure once more.

Author

Richard Perry

Independent Analyst