USD/JPY: Battle fot the control – The bulls are back [Video]

![USD/JPY: Battle fot the control – The bulls are back [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-currency-and-dollar-bank-note-60447626_XtraLarge.jpg)

USD/JPY

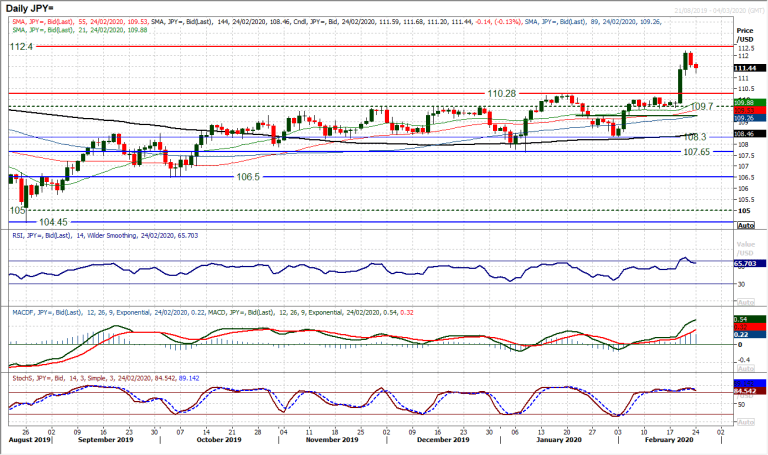

After months of false dawns and stunted bull runs, an incredible breakout on Dollar/Yen took the market soaring to a ten month high last week. Suddenly, we are seeing several days of two to three times the Average True Range (which is today at 54 pips). However, Friday’s retracement back of over -50 pips has left resistance at 112.20 in a move that has added strength to the long term key resistance at 112.40. The market is now threatening to unwind. The immediate question is over the support at 111.10/111.20 holding. If this is breached then the correction back could be quickly unwinding the market towards the 110.30 breakout. However, there is a battle for control now and coming into the European session, the bulls have fought back. There is still near term volatility to play out here but another negative candle today following such a strong move, could quickly tempt the profit-takers to move. An uncertain near term outlook.

Author

Richard Perry

Independent Analyst