USD/JPY Analysis: Recovers a part of Tuesday’s post-BoJ slump, not out of the woods yet

- USD/JPY gains some positive traction and draws support from a combination of factors.

- As investors digest the BoJ’s hawkish twist, a positive risk tone is undermining the JPY.

- Hawkish Fed, rising US bond yields help revive the USD demand and remain supportive.

The USD/JPY pair edges higher during the Asian session on Wednesday and moves away from over a four-month low touched the previous day in reaction to the Bank of Japan's policy tweak. In a surprise move, the Japanese central bank stunned markets by reviewing its yield curve control policy and decided to widen the range for fluctuations in the 10-year government bond yield. This was seen as a precursor to the end of the BoJ's ultra-accommodative monetary policy, which, in turn, triggered a sell-off in bond markets and prompted aggressive buying around the Japanese Yen.

That said, a late recovery in the US equity markets kept a lid on any further gains for the safe-haven JPY and assisted the USD/JPY pair to find some support in the vicinity of mid-130.00s. Apart from this, the emergence of some US Dollar buying, bolstered by a further rise in the US Treasury bond yields, provides a modest lift to the major. In fact, the yield on the benchmark 10-year US government bond climbs to a fresh monthly low in the wake of a more hawkish commentary by the Fed last week, indicating that it will continue to raise interest rates to crush inflation.

It, however, remains to be seen if bulls can capitalize on the attempted recovery move or if the USD/JPY pair meets with a fresh supply at higher levels. Market participants now look forward to the release of the Conference Board's US Consumer Confidence Index, due later during the early North American session. Apart from this, the US bond yields will influence the USD price dynamics, which, along with the market risk sentiment, should provide some impetus to the major. The focus, however, will remain on the final US Q3 GDP print and the US Core PCE Price Index (the Fed's preferred inflation gauge), scheduled for release on Thursday and Friday, respectively.

Technical Outlook

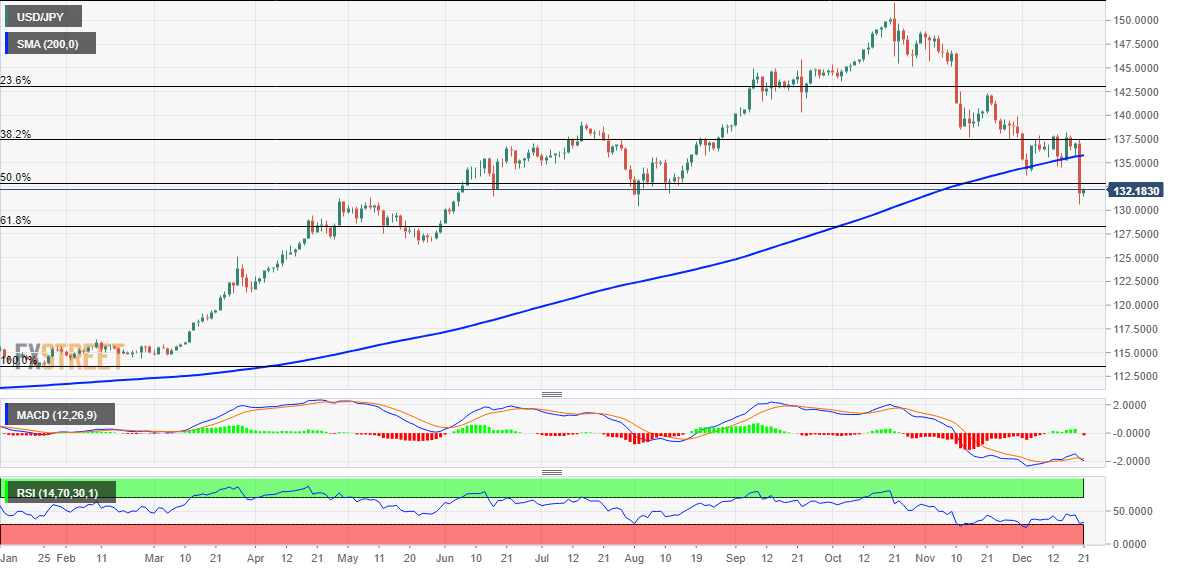

From a technical perspective, the overnight sustained weakness below the very important 200-day SMA and a subsequent break through the 50% Fibonacci retracement level of the strong 2022 rally was seen as a fresh trigger for bearish traders. That said, extremely oversold oscillators on intraday charts helped limit the downside, only for the time being.

Any further recovery, however, is likely to confront resistance near the 132.70 area (50% Fibo. level). Some follow-through buying beyond the 133.00 mark might prompt some short-covering move towards the 134.00 round figure. The next relevant hurdle is pegged near the 134.40 horizontal zone, above which the USD/JPY pair could aim to reclaim the 135.00 psychological mark.

On the flip side, weakness back below the 132.00 mark now seems to find some support near the Asian session low, around the 131.50 region, ahead of the 131.20 zone and the 131.00 mark. Failure to defend the latter would make the USD/JPY pair vulnerable to retesting the multi-month low, around the 130.55 region, and slide further towards the 130.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.