USD falls behind

EUR/USD breaks resistance

The US dollar retreats as the market awaits Fed Chair Jerome Powell’s testimony before Congress. A break above the first resistance of 1.0640 eased some of the downward pressure. Then the bulls managed to lift offers in the supply zone of 1.0690 from a previously faded rebound, opening the door for an extension to the previous spike at 1.0760. 1.0620 is a fresh support should the single currency need to consolidate its gains. 1.0550 is key in keeping the current bounce valid or a new round of sell-off could be triggered.

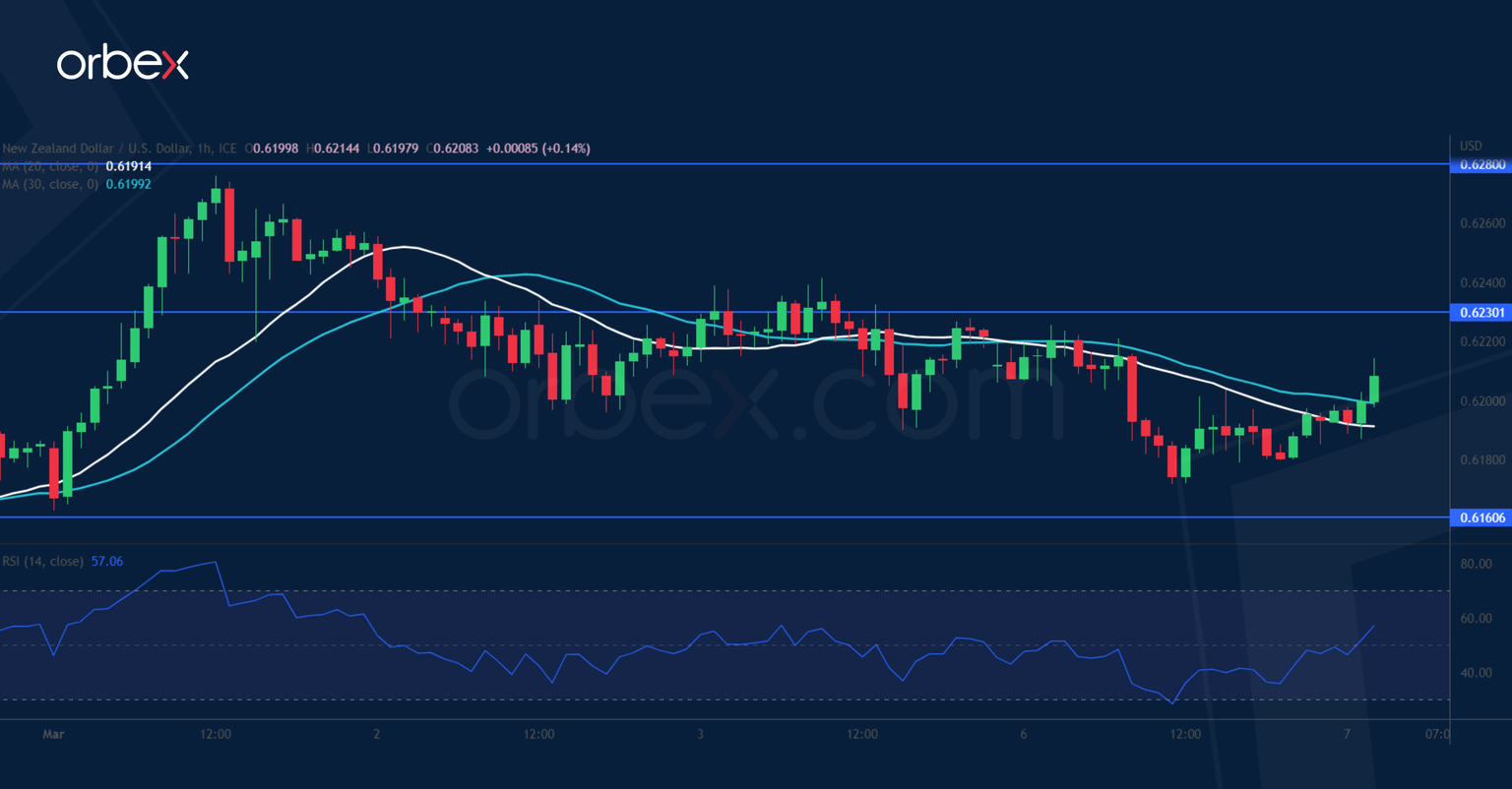

NZD/USD tests support

The New Zealand dollar softened after traders were underwhelmed by China's 5% growth target. On the daily chart, the kiwi came under pressure at 0.6280 on the 20-day SMA following its break below the January low of 0.6200. On the hourly time frame, 0.6160 at the base of the latest bullish momentum is an important support to gauge the strength of buying interest, and a bearish breakout would confirm a lack of it. Then 0.6070 would be the next stop on the way down with 0.6230 as a fresh resistance.

Dow Jones 30 bounces back

The Dow Jones 30 inches higher as bond yields pull back from their recent highs. A bounce off December’s low of 32500 and above 33000 has prompted short-term sellers to cover, turning the latter into a fresh support. As the RSI returns to the neutral area, follow-up buying could be expected from those who missed the initial pop. The index has recouped half of the losses from the mid-February tumble and 33800 is a key hurdle to clear before the bulls could hope for a sustained recovery towards the recent peak of 34500.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.

-638137711375855440.png&w=1536&q=95)