USD extends gains, rising to a three-week high

Euro Extends Declines For Third Consecutive Session

The euro currency is posting declines for the third consecutive day. As a result, the common currency fell to a four-week low intraday before recuperating some of the losses.

The broadly stronger greenback has pushed the EURUSD lower, which has been pending a correction for quite a while. For the moment, the euro is seen consolidating near the 1.2177 level.

With the Stochastics oscillator currently oversold, there is scope for prices to post a rebound. The longer-term hidden bullish divergence could however see price making an attempt to push higher.

As long as the previous highs of 1.2343 holds, we expect the overall trend to remain flat.

GBP/USD Breaks Down Lower From Descending Triangle

The British pound sterling finally gave way as price broke down from the descending triangle pattern. This comes even as prices broke down past the key support/resistance level near 1.3500.

However, following the initial decline to a two week low, the cable is recovering from the intraday lows. We could now expect prices to potentially retest the lower support area near 1.3542 – 1.3500.

As long as this level stalls from price posting gains, we could expect to see further downside. The Stochastics oscillator is currently oversold and coincides with the rebound.

However, if prices rise above the 1.3542 level, then it would invalidate the descending triangle pattern. We could expect to see the price either consolidating or renewing its bullish momentum.

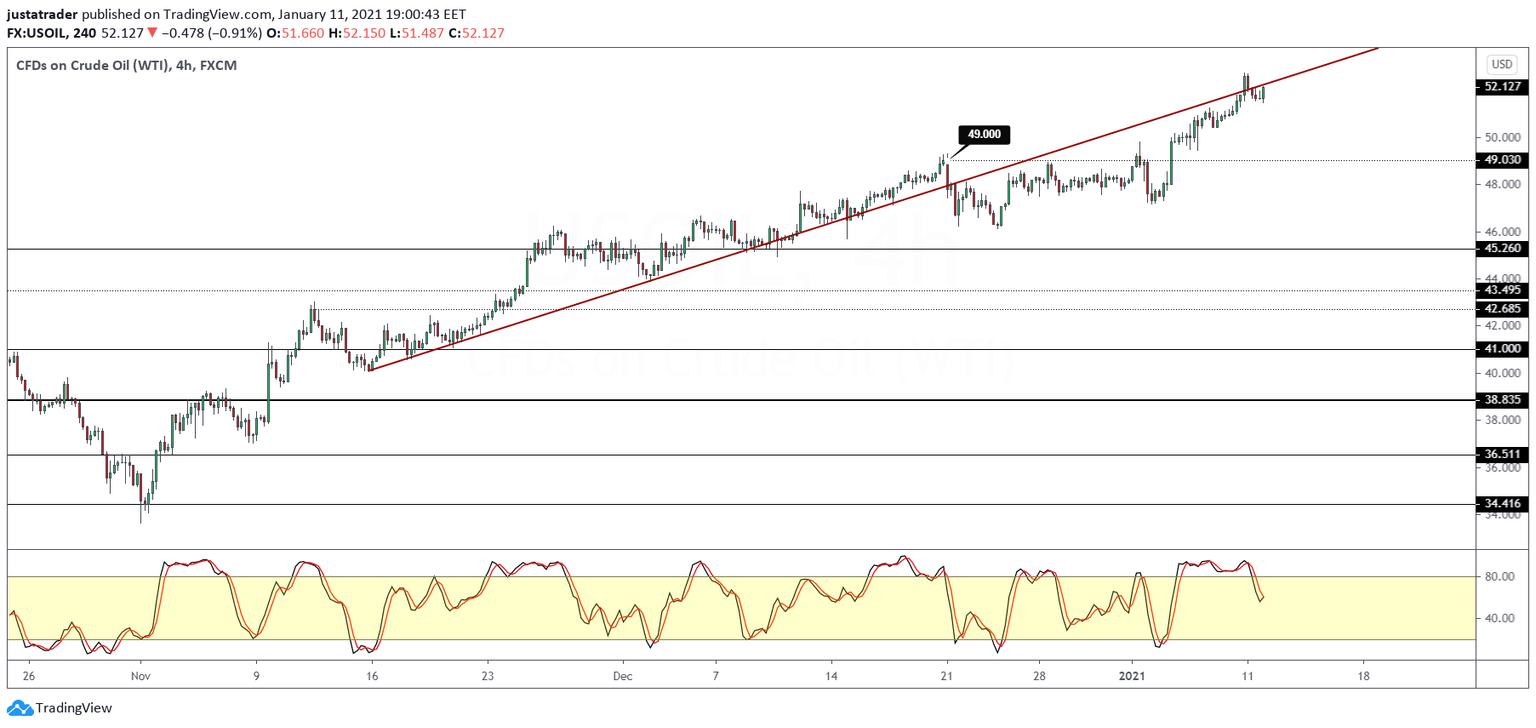

Oil Price Gains Pause After A 4-Day Gain

WTI crude oil prices are taking a breather following the strong winning stretch from last week. Price action is largely muted, even failing to post any new highs.

As a result, oil prices are confined within last Friday's range. Since the overall bias remains to the upside, there is scope for the commodity to continue to edge higher.

However, on the short term charts, we see the trendline coming under a retest once again from below.

If the trendline begins to act as resistance, then we could see some downside correction. The immediate lower support level near 49.00 comes into the picture.

This should ideally support prices in the near term. But given that the Stochastics oscillator is likely to signal further upside, oil prices are likely to break the trendline to the upside.

Gold Trades Flat Following Last Week's Declines

The precious metal is on track to close flat on Monday. Price briefly slipped to test the 1817.80 level before pulling back.

Overall, gold prices are currently confined to trade within the 1850 and 1817.80 levels. Only a strong breakout from this range will confirm the next direction.

The bias remains to the downside for the moment, but that could change if gold prices manage to rise above the 1850 handle.

This will then potentially set the stage for gold to test the 1911.50 level. The Stochastics oscillator remains near the oversold levels and somewhat mixed.

Author

Orbex Team

Orbex