USD consolidates gains

EUR/USD finds support

The US dollar pulls back as market sentiment stabilises. Coming off the start of the February sell-off at 1.0930, the pair is looking to keep the correction in check. The base of the bullish breakout at 1.0710 is an important level to retain the momentum. Its breach would dent the short-term optimism and trigger a deeper retracement towards 1.0600. The RSI’s oversold condition attracted some buying interests in the demand zone, but the bulls will need to reclaim 1.0860 before a higher high could materialise.

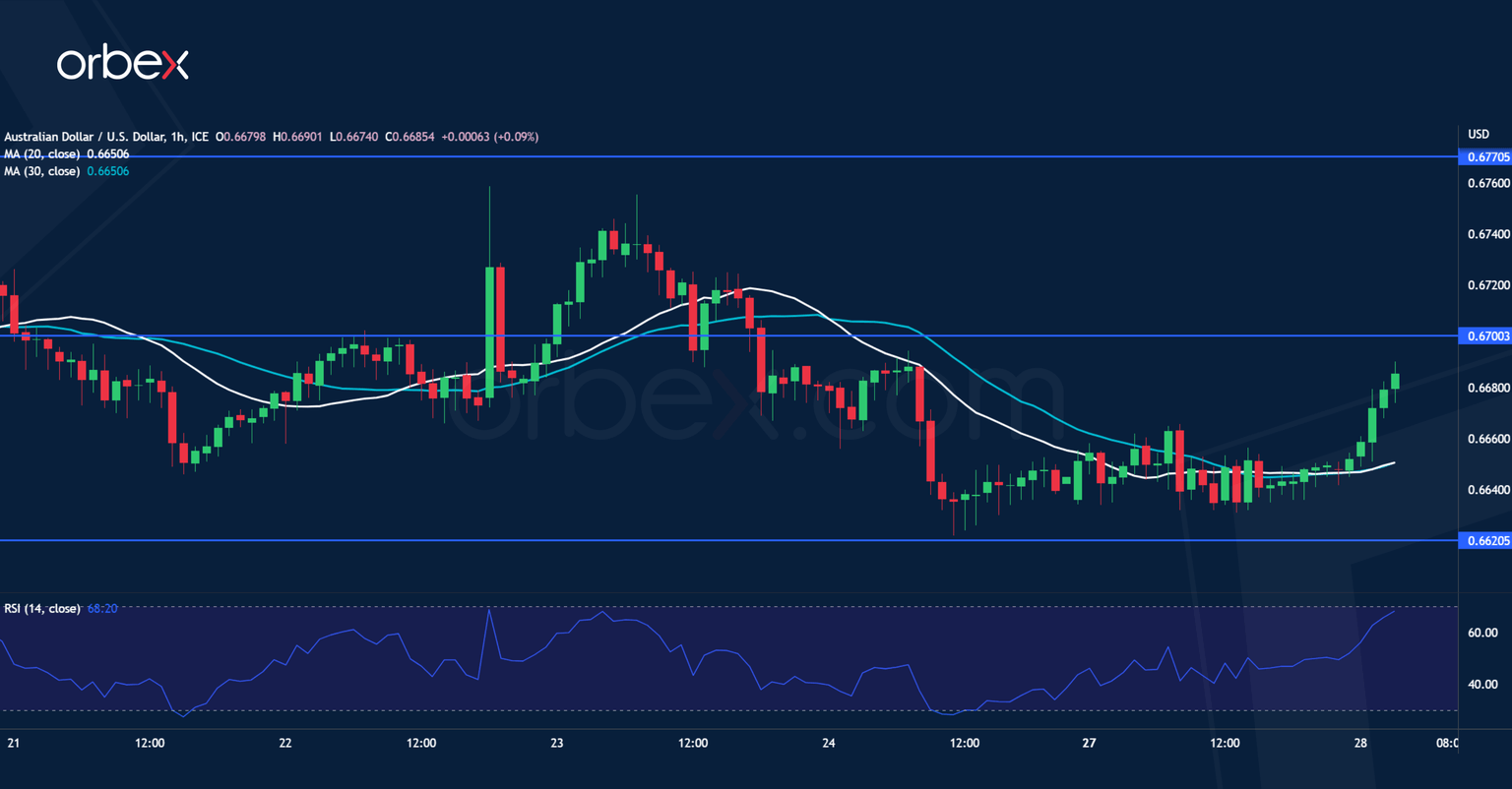

AUD/USD tests resistance

The Australian dollar may struggle over lacklustre retail figures in February. A drop below the swing low of 0.6650 has put the bulls on the defensive and proved that the supply zone around 0.6750 and on the 30- day SMA to be a tough level to crack for now. Sentiment remains cautious and 0.6620 might be buyers’ last chance to turn the tide with 0.6700 as the first hurdle to clear. A bearish breakout would cause a retest of this month’s low at 0.6570 where the aussie could be vulnerable to another leg of sell-off.

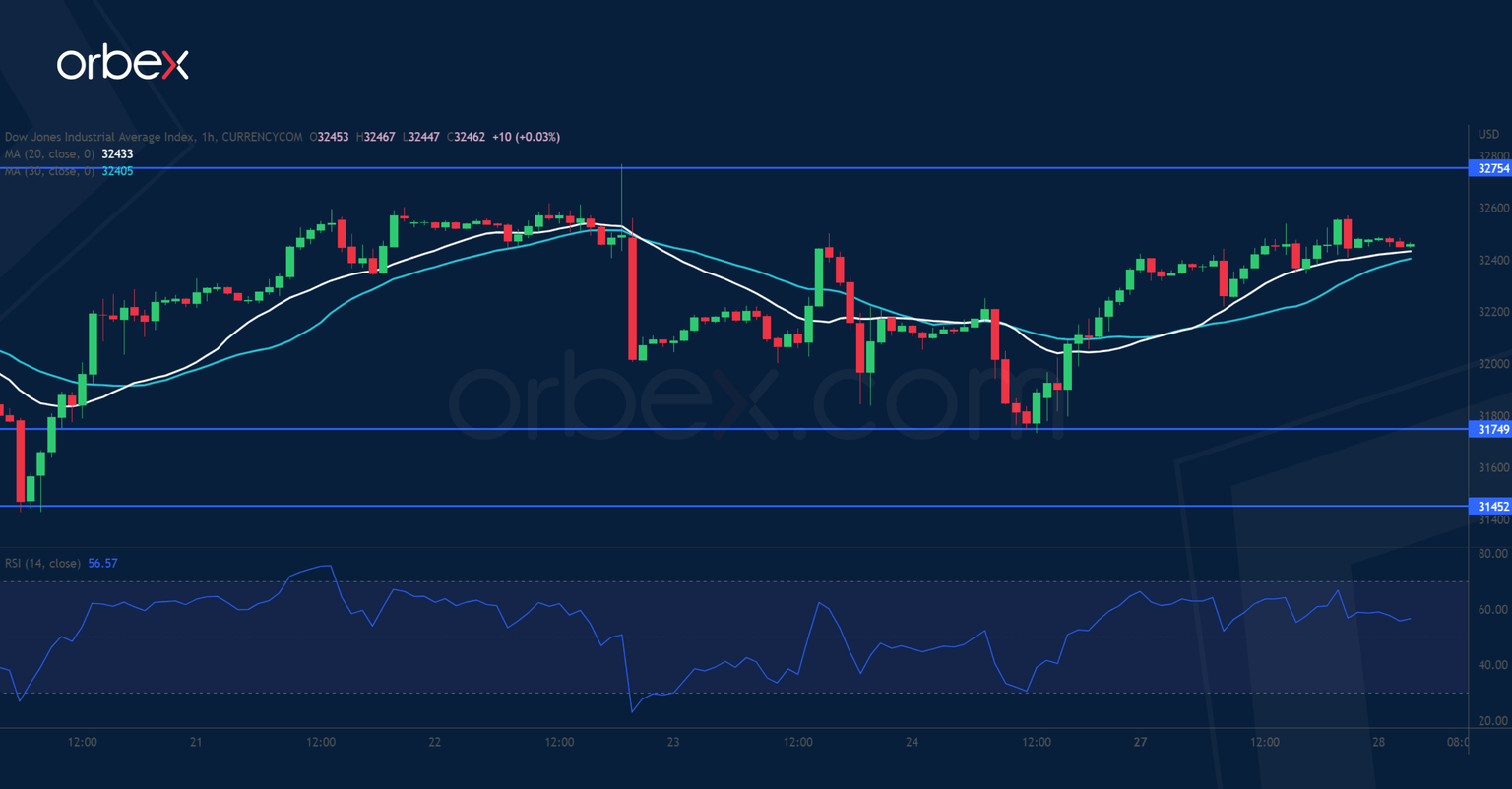

US 30 attempts to rebound

The Dow Jones 30 rallies as news of more emergency lending ease concerns about bank failures. A long spike at the support-turned-resistance of 32750 suggests strong resistance at last week’s breakout attempt. However, solid buying seems to have emerged in the demand zone 31450-31750. A convincing break above 32750 would prompt sellers to cover their positions and help buyers regain control of the direction in the short-term. Then 33500 would be the next target. Failing that, a fall below 31450 would expose 31000.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.