USD/CAD pushes higher, Canadian employment next

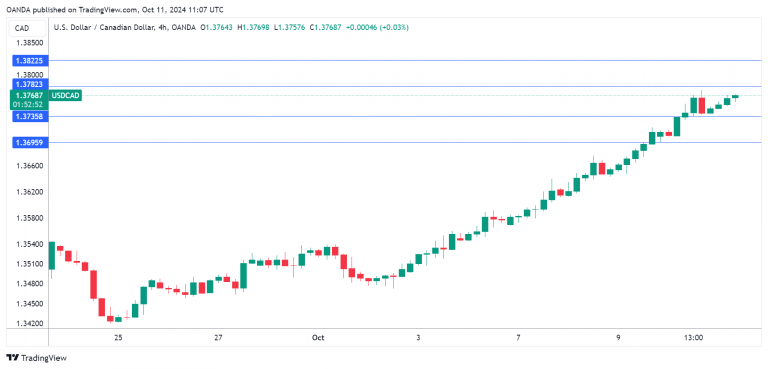

The Canadian dollar has edged lower on Friday. In the European session, USD/CAD is trading at 1.3767 at the time of writing, up 0.19%.

The Canadian dollar has hit a rough patch and is on a seven-day slide in which it has fallen 1.6%. On Thursday, the Canadian dollar weakened to 1.3775, its lowest level against the US dollar since August 7.

Canada’s job growth expected to rise slightly

Canada releases the September employment report later today, with no dramatic changes expected. Job growth is expected at 27 thousand, compared to 22.1 thousand in August. The unemployment rate is projected to tick up to 6.7%, following 6.6% in August.

The Bank of Canada has been a leader in the new rate-cutting cycle, having already cut rates by a quarter-point three times this year. This has brought the cash rate down to 4.25% but the economy has been slow to respond and the BoC is expected to continue cutting rates. The BoC doesn’t want rates to diverge to widely from those in the US and will be keeping a close eye on the Fed’s expected cuts in November and December.

The US ends the week with the producer price index for September, which could be a mixed bag. Headline PPI is expected to tick lower to 1.7% y/y, compared to 1.6% in August. The core rate, however, is projected to rise to 2.7%, up from 2.4% in August. With inflation largely beaten, the Federal Reserve’s primary focus has shifted from inflation to employment. Still, an unexpected PPI reading in either direction could have an impact on the movement of the US dollar today.

USD/CAD technical

-

There is resistance at 1.3782 and 1.3822.

-

1.3735 and 1.3695 are the next support levels.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.