USD/CAD Price Forecast: Traders seem non committed amid mixed fundamental cues

- USD/CAD attracts sellers for the second straight day, though the downside seems limited.

- Oil prices rise amid Middle East tensions and underpin the Loonie, weighing on the major.

- Reduced bets for a 50 bps Fed rate cut in November lend support to the USD and the pair.

The USD/CAD pair extends the overnight retracement slide from a one-week high and remains under some selling pressure for the second straight day on Wednesday. Fears of a full-out war in the Middle East escalated further after Iran launched over 200 ballistic missiles at Israel on Tuesday in retaliation to the Israeli aggression in Lebanon against the Iran-backed armed movement Hezbollah. Furthermore, Israeli Prime Minister Benjamin Netanyahu promised that Iran would pay for its missile attack. The development fuels worries that an Israeli attack on Iran's oil facilities could disrupt supply from the key producing region, which continues to lend some support to Crude Oil prices. This, in turn, is seen underpinning the commodity-linked Loonie and dragging the currency pair lower.

The US Dollar (USD), on the other hand, preserves its recovery gains registered over the past two days amid signs of a resilient US labor market and could help limit losses for the USD/CAD pair. In fact, the Job Openings and Labor Turnover Survey (JOLTS) published by the US Bureau of Labor Statistics (BLS) showed that the number of job openings unexpectedly increased after two straight monthly declines, to 8.04 million in August. This comes on top of the Federal Reserve (Fed) Chair Jerome Powell's relatively hawkish remarks earlier this week and forced investors to reassess the likelihood of a more aggressive policy easing. That said, the Institute of Supply Management's (ISM) Manufacturing PMI indicated that the business activity contracted for the sixth straight month in September.

This keeps the door open for another oversized 50 basis points interest rate cut by the Fed in November, which, in turn, holds back the USD bulls from placing aggressive bets and fails to assist the USD/CAD pair to attract any meaningful buyers. Meanwhile, expectations for a bigger interest rate cut by the Bank of Canada (BoC) should cap gains for the Canadian Dollar (CAD) and help limit losses for the currency pair. Traders might also prefer to wait for the US monthly employment details, popularly known as the Nonfarm Payrolls (NFP) report due on Friday, before positioning for the next leg of a directional move. In the meantime, Wednesday's release of the US ADP report on private-sector employment might produce short-term opportunities later during the North American session.

Technical Outlook

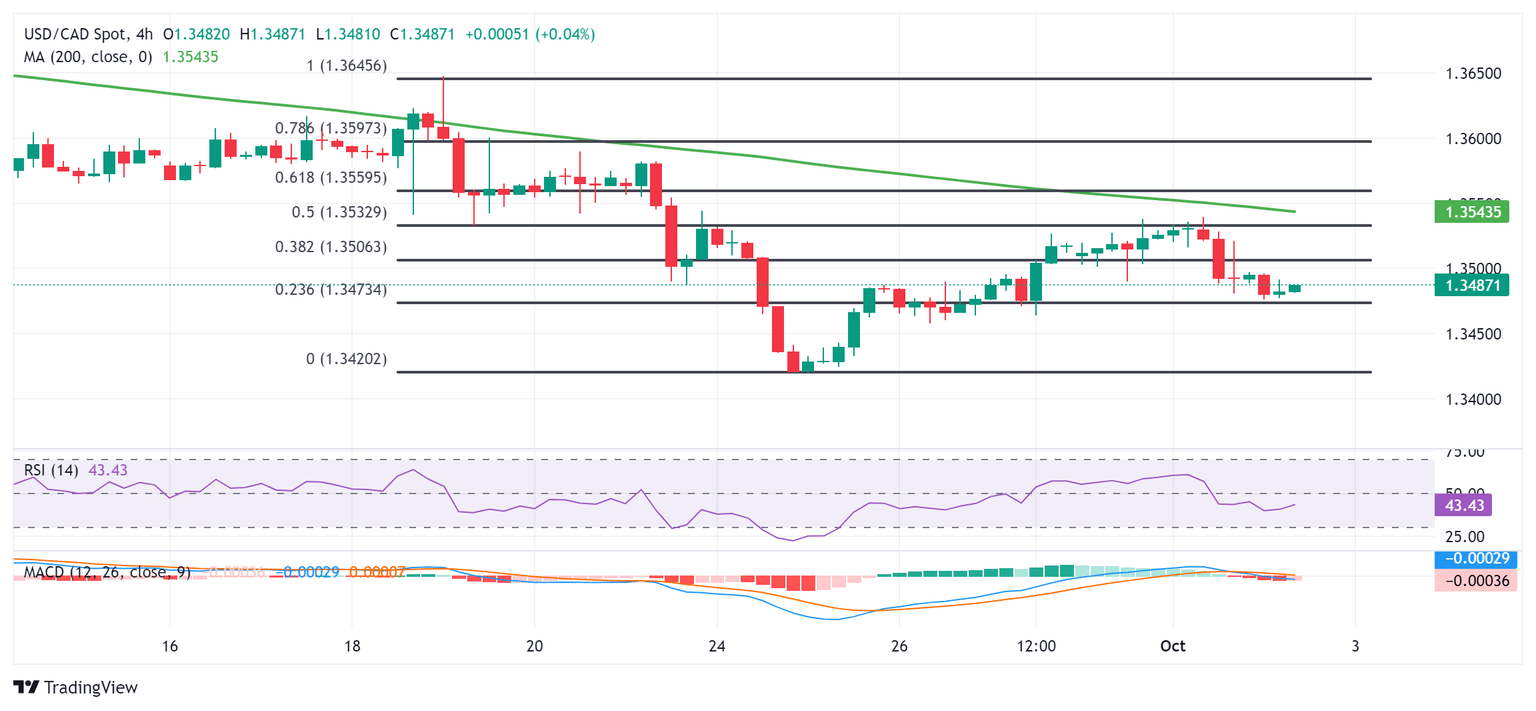

From a technical perspective, the overnight failure to find acceptance above the 50% Fibonacci retracement level of the recent downfall from the September monthly peak and the subsequent downfall favors bearish traders. Moreover, oscillators on the daily chart are holding in negative territory and have again started drifting lower on hourly charts, suggesting that the path of least resistance for the USD/CAD pair is to the downside. Hence, a further weakness below the 1.3475-1.3470 area, towards retesting the multi-month low around the 1.3420 region touched last week, looks like a distinct possibility. The latter is closely followed by the 1.3400 round figure, which if broken decisively will pave the way for the resumption of the recent well-established downtrend witnessed over the past two months or so.

On the flip side, any recovery attempt beyond the 1.3500 psychological mark might continue to face stiff resistance near the 1.3535-1.3540 region, or the 50% Fibo. level. That said, some follow-through buying beyond the 200-period Simple Moving Average (SMA) on the 4-hour chart might trigger a short-covering move and lift the USD/CAD pair to the 1.3580 supply zone. The latter is closely followed by the very important 200-day SMA, currently pegged just ahead of the 1.3600 mark. A sustained strength beyond the said handle will set the stage for a move towards challenging the monthly peak, around the 1.3645-1.3650 region.

USD/CAD 4-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.