USD/CAD Price Forecast: Seems vulnerable to retest YTD low around mid-1.3700s

- USD/CAD lacks any firm intraday direction amid mixed fundamental cues.

- Sliding Oil prices undermine the Loonie and lend support to spot prices.

- A combination of factors keeps the USD depressed and caps the upside.

The USD/CAD pair struggles to capitalize on the overnight bounce from the 1.3815-1.3810 area or a two-week low, and seesaws between tepid gains/minor losses through the earlier European session on Thursday amid mixed fundamental cues. Crude Oil prices retreat further from a nearly one-month high touched on Wednesday, which undermines the commodity-linked Loonie and lends some support to the currency pair. However, the lack of any US Dollar (USD) buying interest acts as a headwind for spot prices.

On Wednesday, the Energy Information Administration (EIA) reported a surprise, 1.3 million-barrel rise in US crude stockpiles during the week ended May 16. Adding to this, a report that members of the Organization of the Petroleum Exporting Countries (OPEC) and their allies, known as OPEC+, are discussing a production increase for July raises concerns about oversupply. This, in turn, exerts downward pressure on Crude Oil prices for the second straight day, though the uncertainty over US-Iran nuclear talks could limit losses.

Meanwhile, hotter-than-expected Canadian core inflation figures released on Tuesday dashed hopes for a Bank of Canada (BoC) interest rate cut in June. This further holds back traders from placing aggressive bearish bets around the Canadian Dollar (CAD) and caps the USD/CAD pair amid a broadly weaker USD. Against the backdrop of the growing acceptance that the Federal Reserve (Fed) will lower borrowing costs again in 2025, the worsening US fiscal outlook keeps the USD depressed near a two-week low touched on Tuesday.

The Republican-controlled US House of Representatives Rules Committee voted to advance President Donald Trump’s dubbed "One Big, Beautiful Bill," setting the stage for a vote on the House floor. The sweeping tax cut and spending bill could add around $3 trillion to $5 trillion to the country’s already hefty debt pile and worsen the US budget deficit at a faster pace than previously expected. Adding to this, renewed US-China trade tensions and a slugging US economic growth outlook continue to weigh on the Greenback.

The aforementioned fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the downside. Traders now look forward to the US economic docket – featuring the release of flash PMIs, the usual Weekly Initial Jobless Claims, and Existing Home Sales data. This, along with trade-related developments, might influence the USD and provide some impetus to the USD/CAD pair. Apart from this, Oil price dynamics should contribute to producing short-term trading opportunities around the pair.

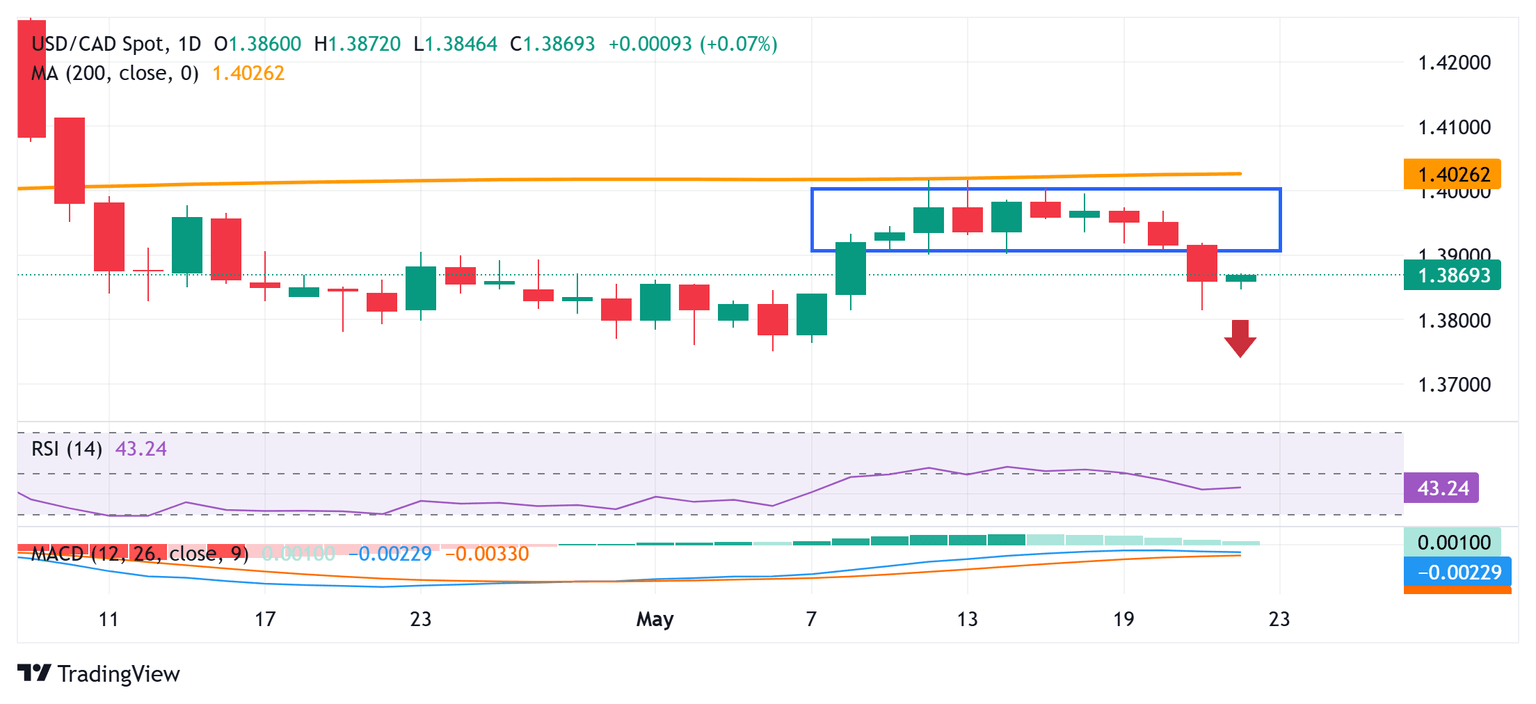

USD/CAD daily chart

Technical Outlook

From a technical perspective, Wednesday's breakdown below the 1.3900 round figure, or the lower end of a short-term trading range, was seen as a fresh trigger for bearish traders against the backdrop of the recent failures near the 200-day Simple Moving Average (SMA). Moreover, oscillators on the daily chart have just started gaining negative traction and validate the near-term negative outlook for the USD/CAD pair.

Hence, any attempted recovery is more likely to attract fresh sellers near the 1.3900 support breakpoint, now turned resistance. A sustained strength beyond the said handle, however, could trigger an intraday short-covering move and lift the USD/CAD pair further toward the 1.3960-1.3965 horizontal zone. A subsequent move up, meanwhile, could get sold into and remain capped near the 1.4000 psychological mark, or the 200-day SMA.

On the flip side, a two-week low, around the 1.3815-1.3810 area touched on Wednesday, now seems to protect the immediate downside. Some follow-through selling, leading to a subsequent slide below the 1.3800 mark, will reaffirm the negative bias and make the USD/CAD pair vulnerable to accelerate the fall towards challenging the year-to-date low, around mid-1.3700s, before eventually dropping to the 1.3700 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.