USD/CAD Price Forecast: Not out of the woods yet; seems vulnerable while below 100-day SMA

- USD/CAD attracts buyers for the third successive day, though the upside remains capped.

- Bearish Oil prices, dovish BoC, and trade jitters undermine the Loonie and support the pair.

- Rising Fed rate cut bets keep the USD bulls on the defensive and might cap spot prices.

The USD/CAD pair trades with a positive bias for the third straight day on Monday, though it lacks follow-through and remains confined in a range held over the past week or so. Friday's disappointing release of Canadian monthly employment details, along with bearish Crude Oil prices, continues to undermine the commodity-linked Loonie and acts as a tailwind for the currency pair. However, the emergence of fresh US Dollar (USD) selling keeps a lid on any meaningful upside for spot prices.

Statistics Canada reported on Friday that the economy shed 40,800 jobs in July, giving back substantial gains of 83,000 jobs in the previous month. Furthermore, the Unemployment Rate remained elevated near a multi-year high level of 6.9%. This comes on top of persistent trade-related uncertainties and the Bank of Canada's (BoC) dovish tilt, which, in turn, is seen exerting pressure on the Canadian Dollar (CAD). In fact, US President Donald Trump recently lifted the tariff rate on Canada from 25% to 35%. Adding to this, the White House also announced a 40% transshipment tariff on goods rerouted through third countries to avoid the duties. Given that about 75% of Canada’s exports go to the US, higher tariffs could dampen the outlook for Canadian exports and weigh on the domestic economy.

Meanwhile, Crude Oil prices languish near a two-month low touched on Friday as investors await the outcome of talks between the US and Russia later this week on the war in Ukraine. Investors remain hopeful that a peace deal should pave the way for a potential end to sanctions that have limited the supply of Russian oil to international markets. This keeps the black liquid on the defensive ahead of the looming US-China tariff truce, which is set to expire on Tuesday. However, the USD selling bias offers some support to the commodity. The growing acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle in September fails to assist the Greenback in capitalizing on Friday's modest bounce from a two-week low, which further contributes to capping the upside for the USD/CAD pair.

Traders might also refrain from placing aggressive directional bets and opt to wait for this week's release of the US inflation figures. The crucial US Consumer Price Index (CPI) is due on Tuesday, which will be followed by the Producer Price Index (PPI) on Thursday. The data will play a key role in influencing market expectations about the Fed's rate-cut path, which, in turn, will drive the USD demand and provide some meaningful impetus to the USD/CAD pair. Apart from this, trade-related developments and geopolitics should contribute to infusing volatility during the latter part of the week.

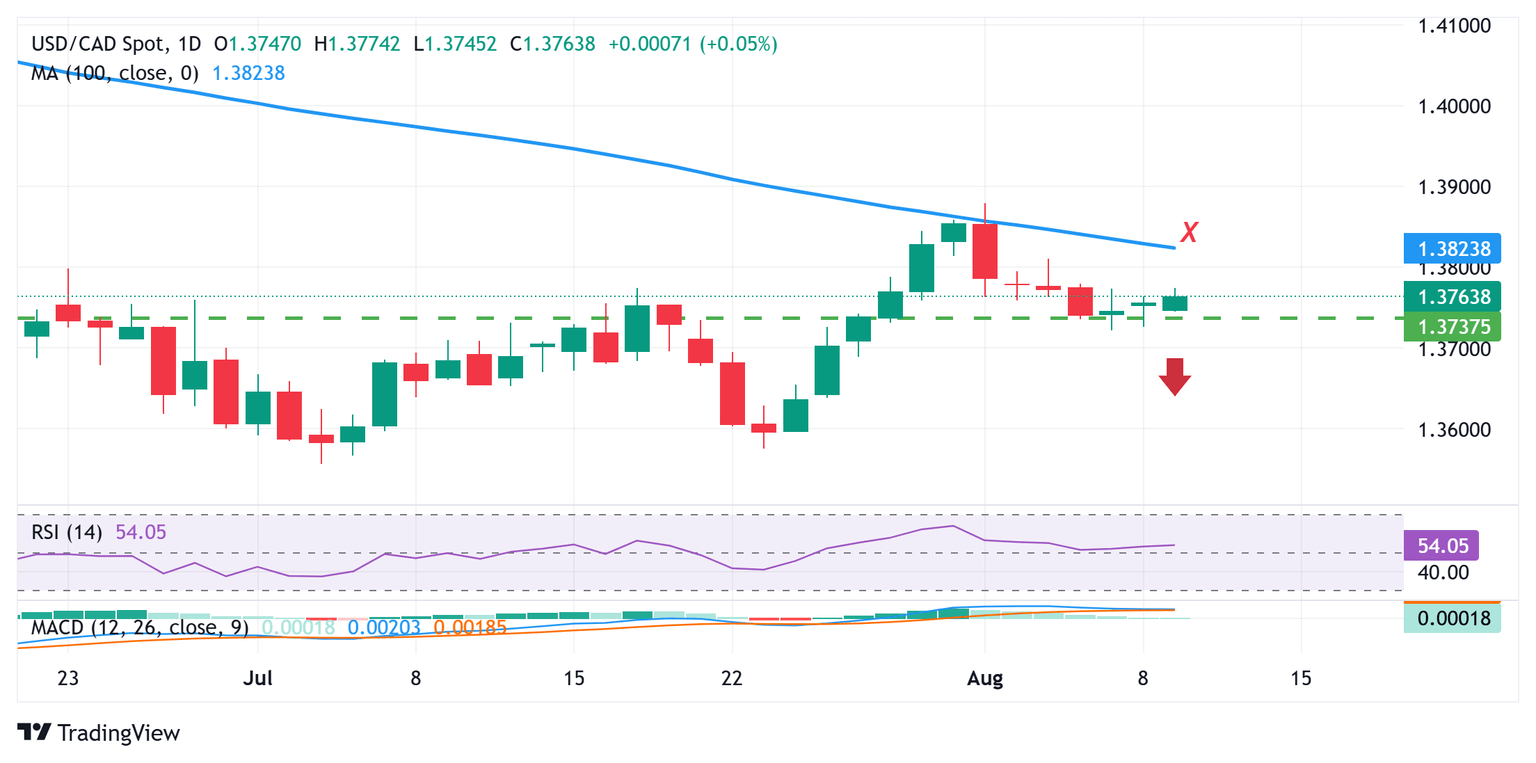

Technical Outlook

The recent failure near the 100-day Simple Moving Average (SMA) favors bearish traders. However, positive oscillators on the daily chart make it prudent to wait for some follow-through selling below last week's low, around the 1.3720 area, before positioning for further losses. The USD/CAD pair might then weaken further below the 1.3700 round figure, towards testing the next relevant support near mid-1.3600s. The downward trajectory could extend further towards the 1.3600 mark en route to the year-to-date low, around the 1.3540 region touched in June.

On the flip side, any subsequent move up is more likely to confront stiff resistance near last week's swing high, around the 1.3800-1.3810 region. This is closely followed by the 100-day SMA barrier, currently pegged near the 1.3825 area, above which the USD/CAD pair could climb to the 1.3875-1.3880 region. Some follow-through buying, leading to a subsequent strength beyond the 1.3900 mark, would shift the bias in favor of bullish traders and lift spot prices to the 1.3950 region en route to the 1.4000 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.