USD/CAD Price Forecast: Extends the range play around 1.3900; not out of the woods yet

- USD/CAD attracts fresh sellers on Thursday and is pressured by a combination of factors.

- The weakening confidence in the US economy and Fed rate cut bets weigh on the USD.

- A modest uptick in Oil prices underpins the Loonie and contributes to the intraday decline.

The USD/CAD pair meets with a fresh supply on Thursday and reverses a part of the previous day's move higher to the weekly top – levels just above the 1.3900 mark. The US Dollar (USD) drifts lower following a sharp two-day recovery from a three-year low touched earlier this week. Moreover, the emergence of some dip-buying around Crude Oil prices underpins the commodity-linked currency – Loonie – and exerts some downward pressure on the currency pair.

Investors have been losing confidence in the American economy amid US President Donald Trump's rapidly shifting stance on trade policies. In fact, the Federal Reserve's (Fed) Beige Book released on Wednesday painted a gloomy outlook and showed that pervasive uncertainty around US President Donald Trump’s shifting tariff plans threatens to curtail growth in the months ahead. The report further revealed that consumer spending remains mixed, while the labor market has shown signs of cooling after stalling or edging lower in many Fed districts. This validates the view that the Fed will resume its rate-cutting cycle soon and fails to assist the USD to build on its strong gains registered over the past two days.

Apart from this, a generally positive risk tone contributes to denting sentiment around the Greenback, which, in turn, is seen weighing on the USD/CAD pair. US Treasury Secretary Scott Bessent denied reports that the White House is considering unilaterally slashing tariffs on Chinese imports and added that high duties imposed by both sides need to come down mutually before talks can begin. Investors, however, remain hopeful for a resolution to the US-China trade standoff. This comes after Trump said that he has no intention of firing Fed Chair Jerome Powell before the expiry of his term in May 2026, which eased fears about the central bank's independence, and remains supportive of the upbeat mood.

Meanwhile, Crude Oil prices regain positive traction following the overnight pullback from a nearly three-week low amid optimism over a possible US-China trade deal. This offers some support to the Canadian Dollar (CAD) and contributes to the USD/CAD pair's downtick. However, a potential OPEC+ output increase and expectations and signs of progress in the US-Iran nuclear deal talks might keep a lid on any meaningful gains for the black liquid. Apart from this, the domestic political uncertainty ahead of the Canadian snap election on April 28 might hold back the CAD bulls from placing aggressive bets. This, in turn, warrants some caution before positioning for any further depreciating move for the currency pair.

Traders now look to the US economic docket – featuring the release of the usual Weekly Initial Jobless Claims, Durable Goods Orders, and Existing Home Sales data later during the North American session. Apart from this, trade-related developments and the broader risk sentiment will drive the USD demand. This, along with Oil price dynamics, might contribute to producing short-term trading opportunities around the USD/CAD pair. Nevertheless, the mixed fundamental backdrop makes it prudent to wait for a convincing breakout through a short-term range held over the past week or so before traders start positioning for the next leg of a directional move.

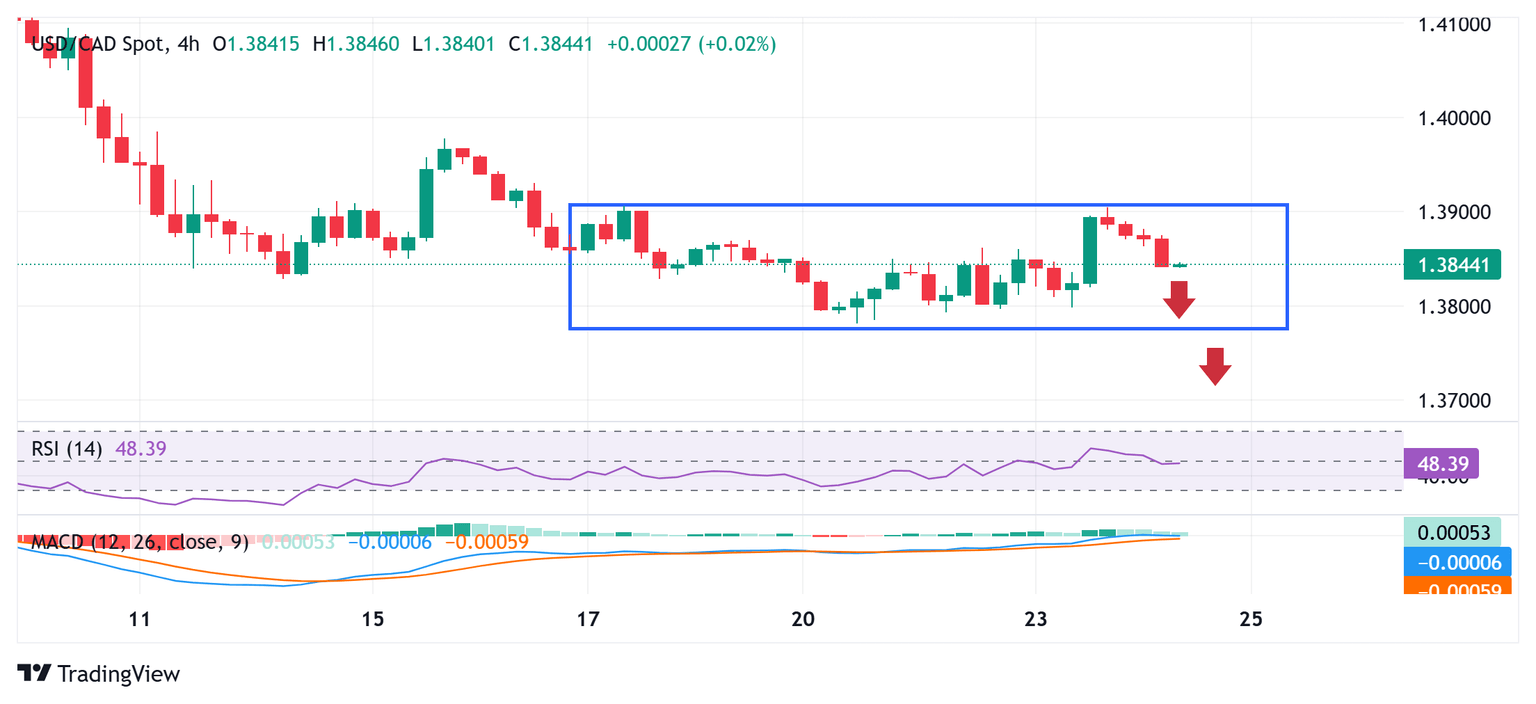

USD/CAD 4-hour chart

Technical Outlook

From a technical perspective, the recent range-bound price action might still be categorized as a bearish consolidation phase against the backdrop of a sharp pullback from over a two-decade high touched in February. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, favors bearish traders and suggests that the path of least resistance for the USD/CAD pair is to the downside.

That said, any subsequent slide might continue to find decent support around the 1.3800 round-figure mark. Some follow-through selling below the 1.3780 region, or the year-to-date touched on Monday, will reaffirm the negative bias and pave the way for deeper losses. The USD/CAD pair might then slide to the 1.3740 intermediate support before aiming to test sub-1.3800 levels.

On the flip side, sustained strength and acceptance above the 1.3900 mark could trigger a short-covering move and lift the USD/CAD pair to the 1.3950-1.3955 region. Any subsequent move up might still be seen as a selling opportunity near the 200-day Simple Moving Average (SMA), currently pegged around the 1.4000 psychological mark, which should now act as a key pivotal point.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.