USD/CAD Price Forecast: Bulls pause for a breather ahead of us data, BOC/Fed decisions

- USD/CAD is seen digesting its recent strong gains registered over the past week or so.

- Traders opt to wait on the sidelines ahead of the key BoC and FOMC policy decisions.

- The fundamental backdrop favors bulls and backs the case for a further appreciation.

The USD/CAD pair enters a bullish consolidation phase on Wednesday and oscillates in a range just below a five-week high set the previous day as traders opt to move to the sidelines ahead of key central bank events. The Bank of Canada (BoC) and the Federal Reserve (Fed) will announce their policy decisions later during the North American session. However, the fundamental backdrop seems tilted in favor of bullish traders and suggests that the path of least resistance for spot prices is to the upside.

The Canadian central bank is expected to hold overnight rates steady at 2.75% for the third consecutive meeting and opt for a wait-and-see approach amid trade-related uncertainties. In fact, US President Donald Trump has said that he does not expect to reach a trade deal with Canada. Trump has already imposed a blanket 25% tariff on imports of certain Canadian goods, as well as a 50% tariff on aluminium and steel imports and a 25% tariff on all cars and trucks not built in the US. Furthermore, Trump said that US importers buying goods from Canada will face a 35% tax if no deal is reached before the 1 August deadline. This, to a large extent, overshadows a further rise in Crude Oil prices and continues to undermine the commodity-linked Loonie.

However, a modest US Dollar (USD) pullback from its highest level since June 23, touched on Tuesday, amid some repositioning trade heading into the crucial FOMC policy update, acts as a headwind for the USD/CAD pair. Any meaningful USD corrective slide seems elusive in the wake of the growing acceptance that the Fed will keep interest rates higher for longer amid the upside risks to inflation from higher US tariffs. The US central bank is anticipated to leave interest rates unchanged in the 4.25-4.50% range despite relentless political pressure. Hence, the focus remains on the accompanying policy statement, which, along with Fed Chair Jerome Powell's comments during the post-meeting presser, will be scrutinized for cues about the rate-cut path.

This, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the USD/CAD pair. In the meantime, traders on Wednesday will take cues from the release of the US ADP report on private-sector employment amid signs of a slowdown in the labor market. In fact, the Job Openings and Labor Turnover Survey (JOLTS) published by the US Bureau of Labor Statistics on Tuesday showed that the number of job openings on the last business day of June stood at 7.43 million. This follows the previous month's downwardly revised reading of 7.71 million and missed estimates for 7.55 million.

Separately, the Conference Board's Consumer Confidence Index rose to 97.2 in July from 95.2 the previous month, suggesting that consumers are feeling optimistic. This could translate into increased consumer spending and play a significant role in stimulating economic activity. Hence, investors will also keep a close eye on the Advanced Q2 GDP print, which could provide some impetus to the buck and the USD/CAD pair later during the North American session.

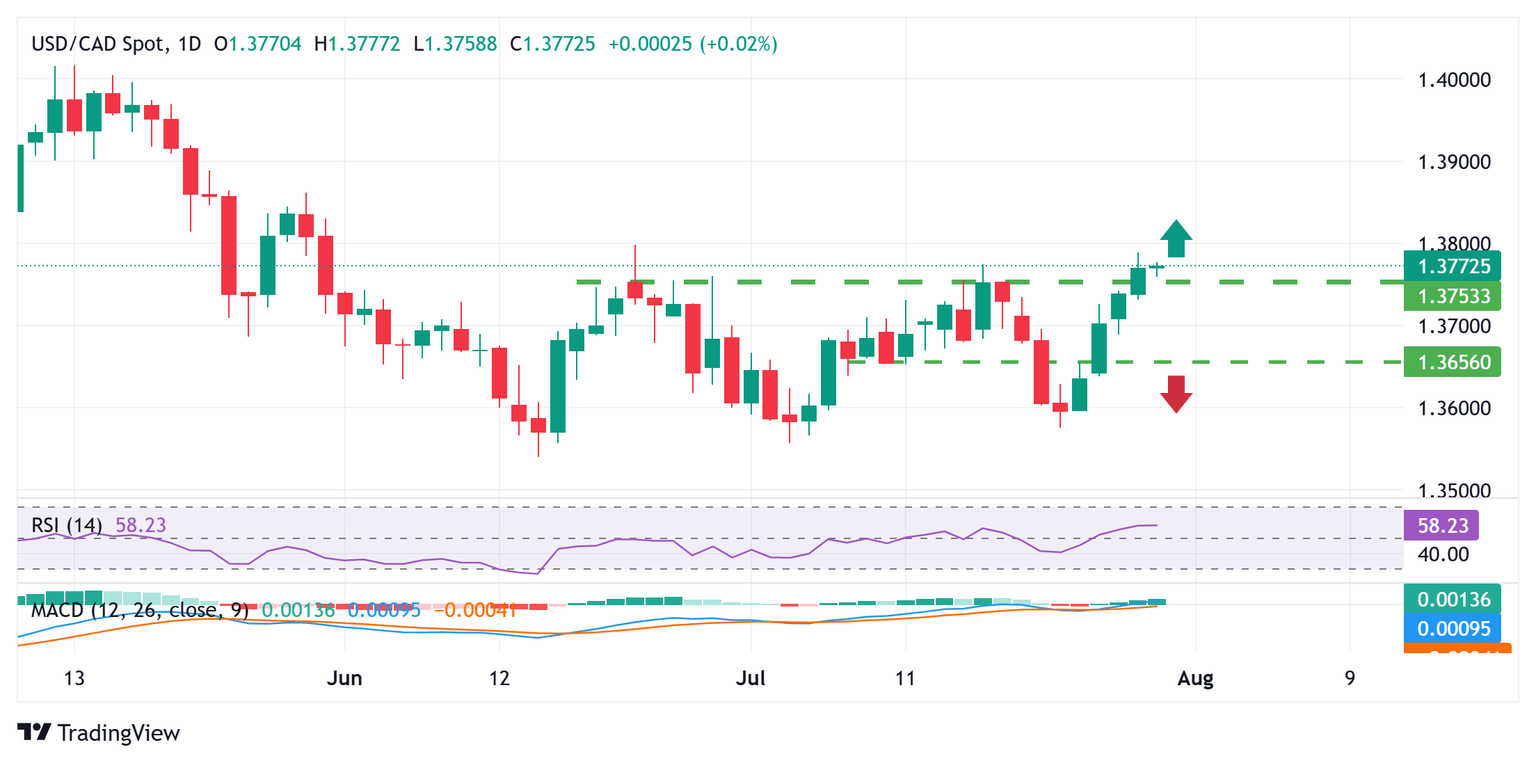

USD/CAD daily chart

Technical Outlook

The overnight sustained move and close above the 1.3750 area was seen as a fresh trigger for the USD/CAD bulls. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought zone, validating the near-term positive outlook. Some follow-through buying beyond the overnight swing high, around the 1.3785-1.3790 region, will reaffirm the constructive setup and lift spot prices to the 1.3840 intermediate hurdle en route to the 1.3900 neighborhood.

On the flip side, any corrective slide below the 1.3750 immediate support could attract some dip-buyers around the 1.3720 region. This should help limit the downside for the USD/CAD pair near the 1.3700 mark, which should now act as a strong support and a key pivotal point. A convincing break below the latter, however, could drag spot prices to the 1.3655-1.3650 intermediate support en route to the 1.3610-1.3600 region. Some follow-through selling might shift the bias in favor of bearish traders and pave the way for deeper losses.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.