USD/CAD Outlook: Bulls pause near 1.3650 barrier, await BoC before placing fresh bets

- USD/CAD retreats further from a multi-month low, though the downside seems limited.

- The recent bullish run in Oil prices undermines the Loonie and is seen capping the major.

- Bets for one more Fed rate hike in 2023 favour the USD bulls and should help limit losses.

- Traders now look forward to the BoC policy decision before placing fresh directional bets.

The USD/CAD pair attracts some intraday sellers on Wednesday and moves further away from its highest level since March 28, around the 1.3670 region touched the previous day. Spot prices remain on the defensive heading into the European session, though any meaningful corrective decline still seems elusive. The recent bullish run in Crude Oil prices is seen underpinning the commodity-linked Loonie, which, along with a modest US Dollar (USD) pullback from a six-month top, exerts some pressure on the major. It is worth recalling that Oil prices rallied to a fresh YTD peak on Wednesday after Saudi Arabia and Russia extended their voluntary supply cuts to the end of the year. The surprise move comes on top of expectations that OPEC+ will extend output cuts to the end of 2024 and adds to worries about tight global supply.

Higher Oil prices, meanwhile, will only contribute to inflationary pressures and increase the likelihood of more fiscal tightening, reinforcing expectations that the Federal Reserve (Fed) will keep interest rates higher for longer. Moreover, the markets are still pricing in the possibility of one more 25 bps lift-off by the end of this year and the hawkish outlook remains supportive of elevated US Treasury bond yields. This, along with the prevalent cautious market mood, is likely to act as a tailwind for the safe-haven buck. Furthermore, concerns that the worsening economic conditions in China will dent fuel demand hold back bulls from placing fresh bets around Oil prices, at least for now. This might further contribute to limiting the downside for the USD/CAD pair ahead of the latest monetary policy update by the Bank of Canada (BoC).

The Canadian central bank is scheduled to announce its decision later during the early North American session and leave its policy rate unchanged at 5%. Moreover, investors seem convinced that the BoC could be relatively quick to cut interest rates in the wake of signs that the Canadian economy is cooling rapidly. It is worth recalling that Statistics Canada reported last Friday that the economy unexpectedly contracted in the second quarter, at an annualized rate of 0.2%, and growth was most likely flat in July. Furthermore, fears that a bubble in Canadian home prices is bursting should allow the BoC to maintain the status quo. Traders on Wednesday will further take cues from the release of the US ISM Non-Manufacturing PMI, which, along with Oil price dynamics, should provide some meaningful impetus to the major.

Technical Outlook

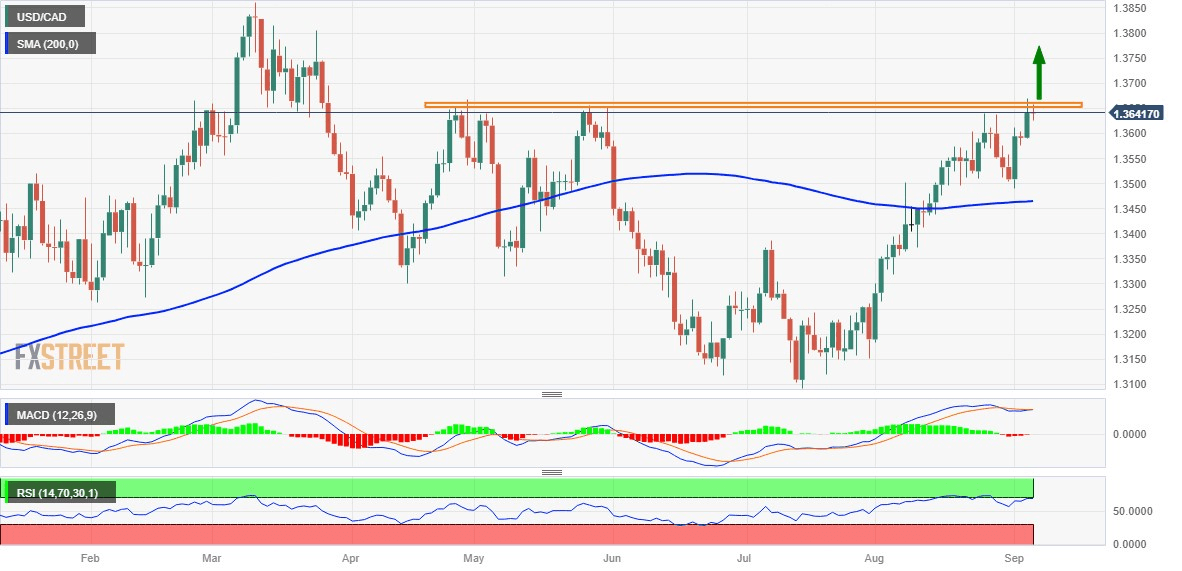

From a technical perspective, the overnight sustained strength beyond the 1.3600 mark was seen as a fresh trigger for bullish traders. The said handle should now protect the immediate downside, which if broken might prompt some technical selling and drag the USD/CAD pair to the next relevant support near the 1.3525 region. Some follow-through selling will expose the 1.3500 psychological mark before spot prices drop to test the very important 200-day Simple Moving Average (SMA), currently around the 1.3460 area. The latter should act as a pivotal point, which if broken might shift the bias in favour of bearish traders.

On the flip side, the 1.3665-1.3670 area, or the overnight swing high, could act as an immediate resistance, which if cleared should allow the USD/CAD pair to reclaim the 1.3700 mark. The positive momentum could get extended further towards the 1.3730 resistance zone en route to the 1.3800 round figure and the YTD peak, around the 1.3860 region touched in March.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.