USD/CAD Outlook: Awaits hawkish BoC before the next leg down

- A late pickup in the USD demand assisted USD/CAD to gain traction on Tuesday.

- Bullish oil prices continued underpinning the loonie and cap gains for the major.

- Investors seemed to have moved on the sidelines ahead of the BoC policy meeting.

The USD/CAD pair attracted some dip-buying on Tuesday and finally settled with modest gains, albeit lacked any follow-through. The intraday positive move of around 50 pips was sponsored by a modest pickup in demand for the US dollar, which drew some support from upbeat US macro data. The Conference Board's US Consumer Confidence Index reversed a three-month downward trend and improved to 113.8 in October from 109.8 previous. Additional details of the report showed that the Present Situation Index rose from 144.3 to 147.4, while the Expectations index climbed from 86.7 in September to 91.3.

Separately, Richmond Fed Manufacturing Index surpassed even the most optimistic estimates and jumped to 12 for the current month from -3 in the previous month. Adding to this, US New Home Sales increased by 14% in September to an 800,000 annualized pace, up from a downwardly revised pace of 702,000 in August. This marked the highest level in six months and underscored solid underlying demand. However, the dominant risk-on mood, along with an extension of the recent decline in the US Treasury bond yields held traders from placing aggressive bullish bets around the safe-haven greenback.

On the other hand, a fresh leg up in crude oil prices underpinned the commodity-linked loonie and further collaborated to cap gains for the major. In fact, WTI shot back closer to multi-year tops touched earlier this week, though a larger than expected increase in the US crude stockpiles acted as a headwind. Nevertheless, the pair ended in the green for the second successive day but remained below weekly tops, around the 1.2400 mark through the Asian session on Wednesday. Investors preferred to move on the sidelines and wait for a fresh catalyst from the Bank of Canada policy meeting.

The Canadian central bank is scheduled to announce its decision during the North American session and is expected to taper its asset purchases further to C$1 billion a week from C$2 billion. The BoC is also anticipated to upgrade its inflation and growth forecasts, setting the stage for the first interest rate hike during the first half of 2022. The decision will be followed by the post-meeting press conference, which will be looked upon for fresh clues on whether the central bank is turning more hawkish. This should be enough to provide a strong boost to the Canadian dollar and pave the way for the resumption of the pair's recent downward trajectory from the vicinity of the 1.2900 mark, or September monthly swing highs.

Heading into the key event risk, traders might take cues from the release of US Durable Goods Orders data. This, along with the US bond yields and the broader market risk sentiment, will influence the greenback demand. Apart from this, oil price dynamics might further contribute to produce some short-term trading opportunities around the major.

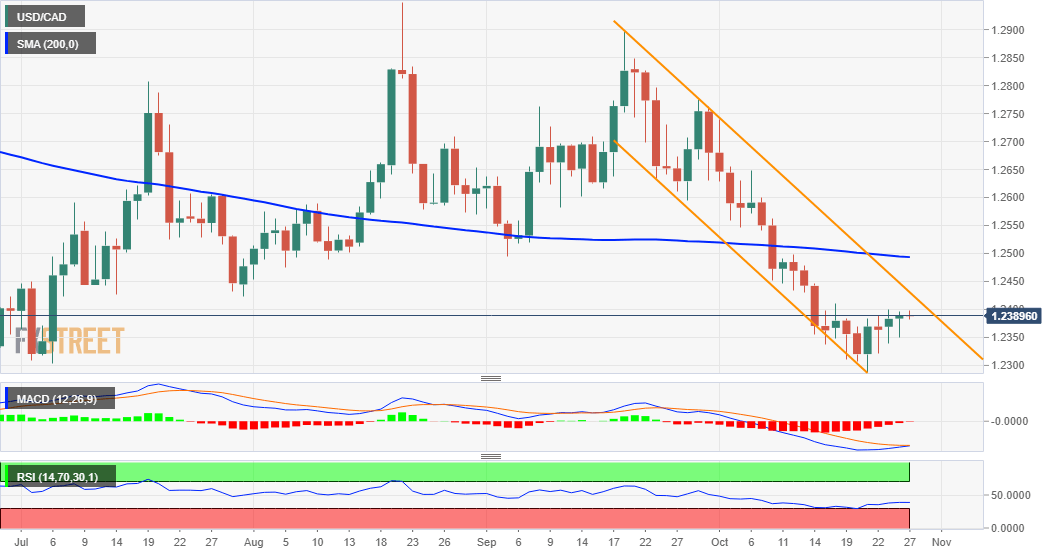

Technical outlook

From a technical perspective, the formation of a descending trend-channel points to a well-established downtrend that has been underway over the past six weeks or so. The pair’s inability to register any meaningful recovery further suggests that the recent selling bias might still be far from being over. Hence, any subsequent move beyond the 1.2400 mark is likely to confront stiff resistance near the top boundary of the channel, currently around the 1.2425-30 region. A convincing breakthrough might prompt some short-covering move towards the very important 200-day SMA, around the key 1.2500 psychological mark. Some follow-through buying will negate the negative bias and pave the way for a further near-term appreciating move.

On the flip side, immediate support is pegged near the 1.2350-40 region ahead of the 1.2320-15 area. Failure to defend the mentioned support levels would turn the pair vulnerable to break below the 1.2300 mark and challenge the trend-channel support, currently near the 1.2230-25 region. This could act as a pivotal support for the pair, which if broken decisively will be seen as a fresh trigger for bearish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.