USD/CAD Analysis: Seems resilient despite Middle East tensions-led rally in Oil prices

- USD/CAD retreats further from a multi-week high and is pressured by rising Oil prices.

- Escalating tensions in the Middle East trigger a rally in Crude and underpin the Loonie.

- The Fed rate uncertainty keeps the USD bulls on the defensive and fails to lend support.

The USD/CAD pair extends the previous day's pullback from the vicinity of mid-1.3400s, or a nearly four-week high and drifts lower through the early European session on Friday. Crude Oil prices rally over 2% in the wake of the risk of a further escalation of geopolitical tensions in the Middle East, which underpins the commodity-linked Loonie and exerts pressure on the currency pair. In fact, the US and UK military forces successfully conducted strikes against several targets in Yemen used by Houthi rebels in retaliation to drone and missile attacks by the Iran-backed group on international maritime vessels in the Red Sea. Adding to this, President Joe Biden said that the US will not hesitate to direct further measures. Furthermore, British Prime Minister Rishi Sunak said that the UK will always stand up for freedom of navigation and free flow of trade.

The US Dollar (USD), on the other hand, remains confined in a one-week-old trading band in the wake of the uncertainty over the Federal Reserve's (Fed) interest rate trajectory and does little to lend any support to the USD/CAD pair. Data released on Thursday showed that the headline US Consumer Price Index (CPI) increased more than expected, to the 3.4% YoY rate in December. Adding to this, hawkish remarks by Fed officials tempered market expectations for more aggressive policy easing by the US central bank. Cleveland Fed President Loretta Mester said that it would likely be too soon for the US central bank to cut its interest rates at the March policy meeting. Separately, Richmond Fed chief Tom Barkin noted that the central bank needs to be convinced that inflation is headed to target and will be open to lowering rates once inflation is on track to 2%.

Meanwhile, Chicago Fed Austan Goolsbee said that the central bank is still on a comfortable path forward on inflation and will have to evaluate policy restrictiveness as inflation continues to decline. Moreover, the CME group's FedWatch Tool indicates that the markets are still pricing in over a 65% probability of a rate cut in March. This keeps the yield on the benchmark 10-year US government bond below the 4.0% threshold and acts as a headwind for the Greenback. Moving ahead, traders will scrutinize the US Producer Price Index (PPI), due for release later during the North American session. Apart from this, a scheduled speech by Minneapolis Fed President Neel Kashkari might influence the buck, which, along with Oil price dynamics, should produce short-term trading opportunities around the USD/CAD pair on the last day of the week.

Technical Outlook

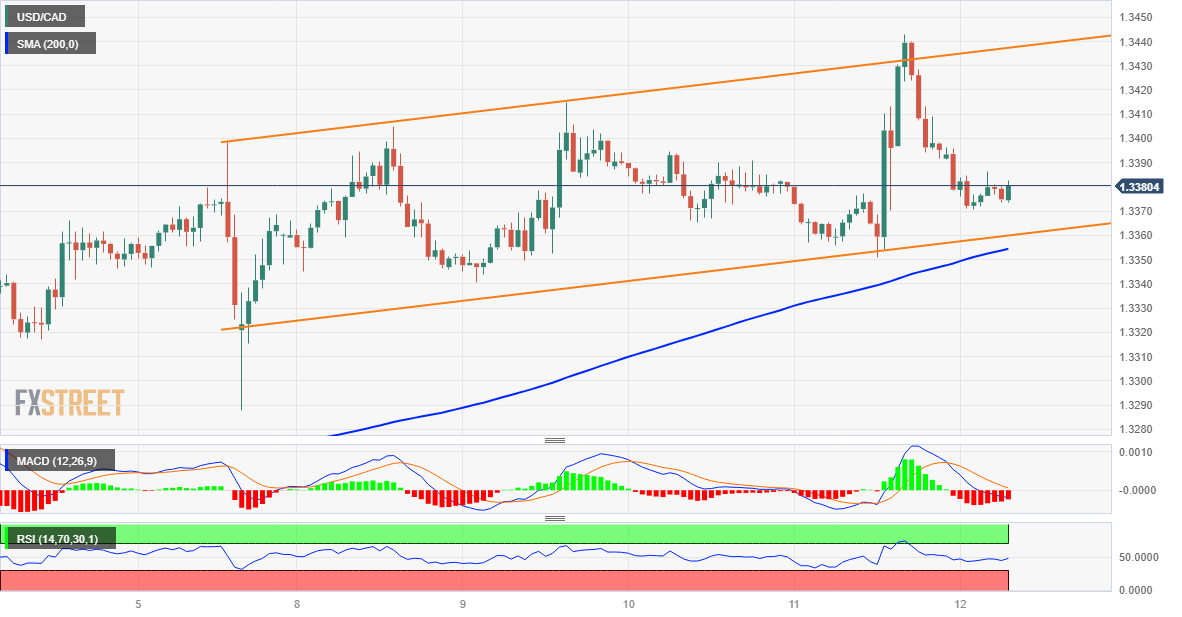

From a technical perspective, spot prices have been oscillating along an upward-sloping trend channel since the beginning of the current week. The lower end of the said channel nears the 200-hour Simple Moving Average (SMA) and should act as a pivotal point for intraday traders. A convincing breakdown through the said support, currently around the 1.3355 region, could drag the USD/CAD pair below the 1.3300 mark, towards testing the weekly low near the 1.3285 area. Some follow-through buying will suggest that the recent recovery from a multi-month low touched in December has run its course and pave the way for a slide towards the 1.3245-1.3240 intermediate support en route to the 1.3200 round figure.

On the flip side, bulls need to wait for sustained strength and acceptance above the 1.3400 mark before placing fresh bets. The next relevant hurdle is pegged near the 1.3440-1.3445 region, or the monthly peak touched on Thursday, which coincides with the trend-channel resistance. A convincing breakout through the said barriers will be seen as a fresh trigger for bullish traders and allow the USD/CAD pair to reclaim the 1.3500 psychological mark. This is closely followed by the 1.3515 heavy supply zone, which if cleared decisively could prompt a fresh wave of a short-covering move and lift spot prices to the 1.3600 round figure en route to the 1.3655 horizontal resistance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.