US30 gathering new buyers above 38,266 [Video]

![US30 gathering new buyers above 38,266 [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/dow-jones-industrial-average-on-iphone-4-stocks-app-16978003_XtraLarge.jpg)

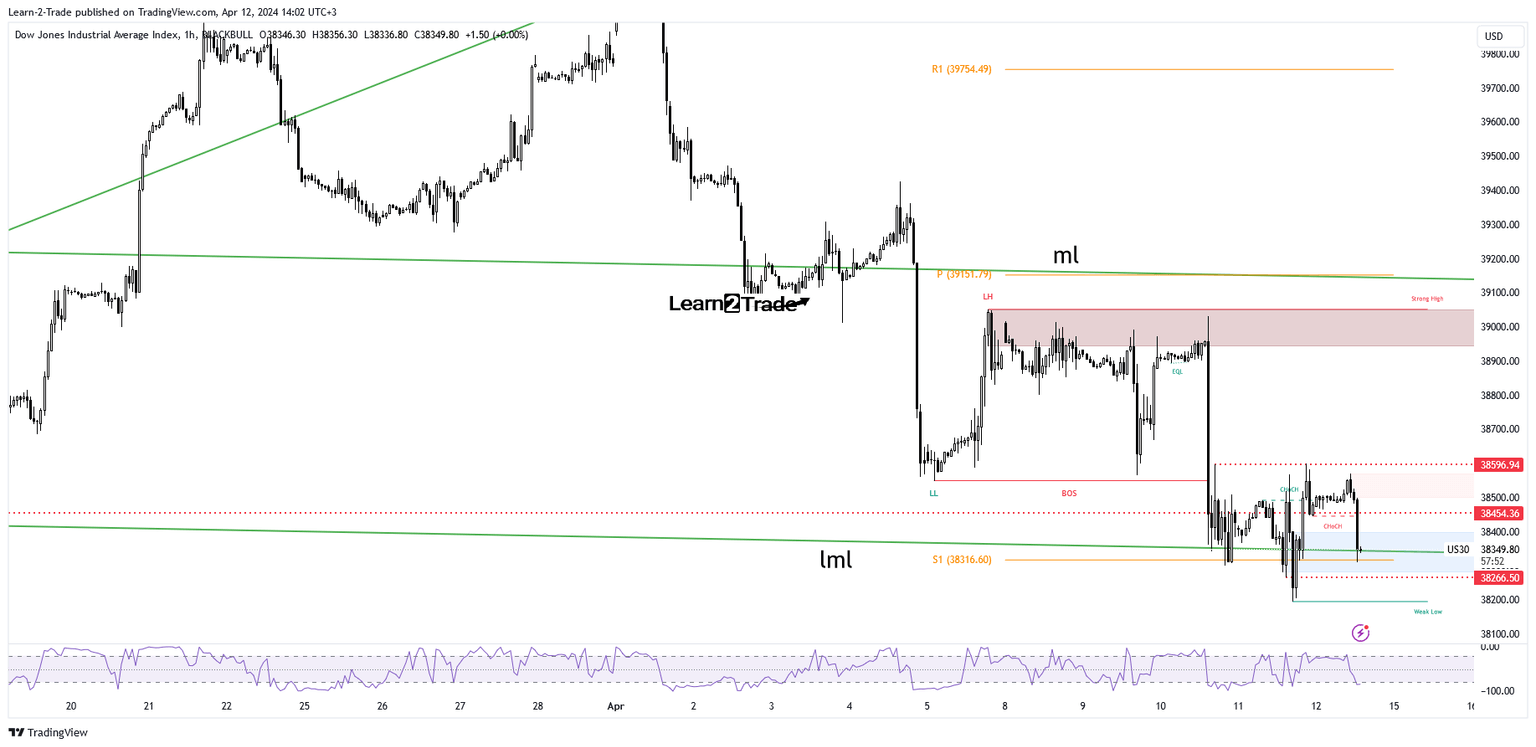

The US30 dropped as the Dollar Index is strongly bullish and now is located at 38,349. The downside pressure remains high after the US reported higher inflation than expected in March. Today, the Prelim UoM Consumer Sentiment could be decisive. The economic indicator may drop from 79.4 points to 79.0 points.

Technically, the rate found support and demand on the weekly S1 of 38316 and on the lower median line (lml) of the descending pitchfork. As long as it stays above the 38,266, the US30 could develop a new leg higher. It’s trapped between the 38,596 and 38,266 levels. Escaping from this pattern brings new opportunities.

Join Learn 2 Trade VIP Group now!

Join Learn 2 Trade VIP Group now!

Author

Olimpiu Tuns

Learn 2 Trade

Olimpiu is a seasoned Market Analyst / Trader with 11 years of experience in the financial markets having expertise in Forex, Commodities, Index, Cryptocurrencies, and Stocks.