US Retail Sales Preview: Relentless shopper may provide dollar-selling opportunity ahead of the Fed

- Economists expect US Retail Sales to have risen by a modest 0.4% in February.

- Robust consumption figures in previous months open the door to an upside surprise.

- A knee-jerk rise in the dollar could serve as a selling opportunity ahead of a potentially dovish Fed.

Even war cannot stop America's shopping spree – and retail sales figures for February capture the time before Russia invaded Ukraine. There is room for an upside surprise in this key economic indicator, providing a boost to the US dollar. Only a temporary one.

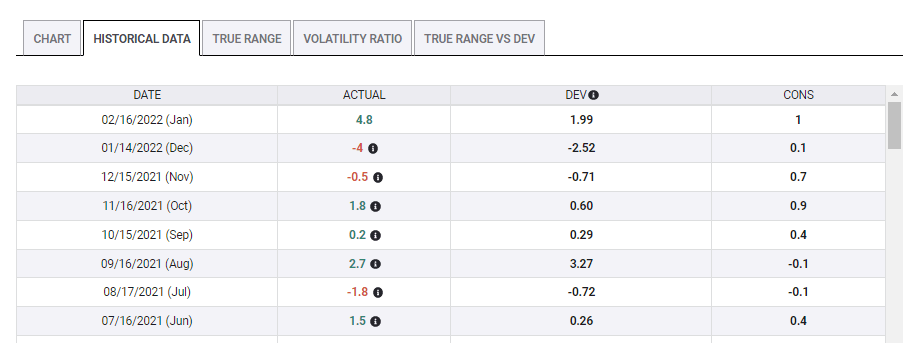

US Retail Sales jumped by 3.8% in January and the all-important Control Group – aka "core of the core" – frog leaped by 4.8% in the first month of 2022. Analysts took that positive shock as compensation for a crash in December's volume of sales, and both figures as distortions related to changing seasonal habits – Christmas shopping began earlier due to supply-chain worries.

However, a broader look at sales shows a more consistent pattern of generally upbeat expenditure. Americans have more money in their pockets due to a booming labor market and higher wages. Moreover, rising inflation pushes shoppers to buy earlier, before prices rise. More often than not, retail sales figures have been beating estimates.

Since America embarked on a massive vaccination scheme, most releases have substantially beat estimates.

Source: FXStreet

That may happen again, especially as expectations are low

For February, economists expect some cooling down in sales growth, with an increase of only 0.4% in both the headline and core data.

The Fed and dollar action

If that is indeed an underestimate, how will markets respond? These important statistics – roughly 70% of US economy is in consumption – are released several hours before the Federal Reserve announces its first rate increase after the pandemic. Markets are jittery, and the release is set to impact expectations.

Traders are interested in what is coming after Wednesday's 25 bps hike – and bond markets are pricing such a hike in every single meeting the Fed has in 2022. A robust data point may increase such estimates, or push investors to expect a faster pace of increases. That would push the dollar higher.

However, while the labor market is booming and inflation is steaming hot, Russia's war in Ukraine continues raging, and that implies the highest level of uncertainty about the future. Will the global economy falter due to hostilities and sanctions? Or will it end soon, trigger rapid rebuilding and even higher inflation?

These are questions that nobody has answers to – not Federal Reserve Chair Jerome Powell, nor Russia's President Vladimir Putin. Therefore, the Fed will likely be "humble and nimble" as Powell said, especially noncommital.

There is a good chance the Fed would prefer refraining from bold statements on raising rates, allowing some hot air to come out of the US dollar.

Conclusion

Overall, an upbeat US Retail Sales report is set to temporarily support the dollar, but probably without any follow-through. That is a potential selling opportunity.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.