US Inflation Cheat Sheet: Dollar selling opportunity? Three scenarios for the critical event

- Fears of a pick-up in inflation have risen sharply in recent days, pushing the greenback higher.

- Core inflation is more likely to remain far from the Fed's target.

- A turn to the downside in the dollar is the most likely scenario of three.

Everything costs money – and sometimes more than previously. Fears of rising inflation have taken hold of markets since Friday, when producer prices jumped more than projected, putting an even greater spotlight on Tuesday's Consumer Price Index data for March.

Costs at factory gates had been forecast to leap on an annual basis – due to the plunge back in March 2020, when the pandemic broke out – but also surprised with a monthly advance of 1%. That was double the early expectations.

Consumer prices are less volatile and more important – one of the Federal Reserve's mandates is keeping inflation in check. While Fed officials have been reiterating that they will see through temporary increases, markets fear that gains will begin taking hold, forcing policymakers to hike interest rates sooner rather than later. The dollar has been rising, but is it justified?

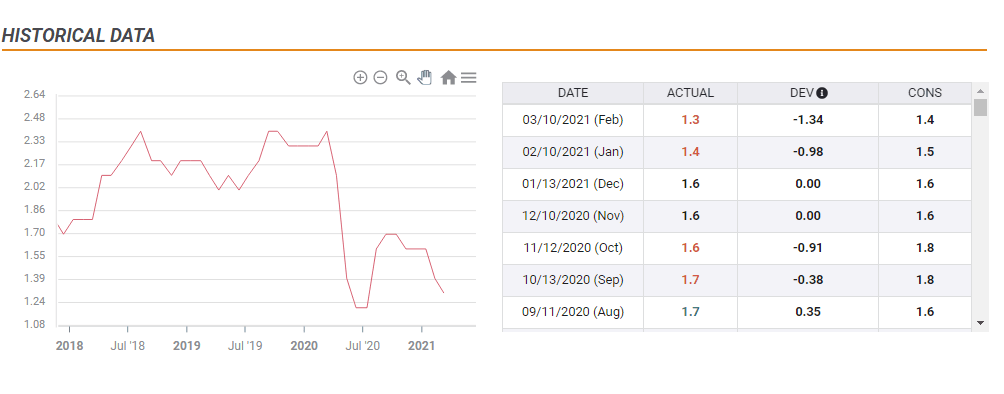

The central bank focuses on Core CPI – underlying inflation which excludes volatile items such as food and energy. The economic calendar is pointing to an acceleration from 1.3% in February to 1.6% in March, which would still leave core prices below the Fed's 2% objective.

As the chart below shows, a return to 1.6% would put the gauge at levels seen in December 2020 – and below pre-pandemic rates of 2% or higher. However, with the impact of base effects and other unknowns, the result could be different.

How will the dollar react? Here are three scenarios:

1) Within expectations – sell the fact

If Core CPI hits 1.6% YoY as forecast– or even 1.7% – that would merely be within what economists expected but below the hype-driven market expectations. In this scenario, which has the highest probability, the greenback could suffer in a classic "buy the rumor, sell the fact" response.

The pound could stand out, after correcting to the downside and as the country is reopening amid an accelerated vaccination campaign.

2) Above estimates – dollar rises

Perhaps traders have it correctly and producer prices were not too high. In case Core CPI hits 1.8% and especially if it touches 2%, the greenback would gain amid growing chances that the Fed raises rates or at least tapers down bond-buys sooner. This scenario has a medium probability.

USD/JPY would be the preferred currency pair to buy, as Treasury yields would jump and dollar/yen is best correlated with returns on US debt.

3) Below forecasts – market rally

In the unlikely case that base-effects hardly push Core CPI higher and put it only at 1.4% or 1.5%, it would be a positive shock to stock markets – which would assume lower rates for longer. For the dollar, it would result in an even more significant sell-off.

The biggest winners would be commodity currencies, which tend to have an outsized reaction to equity rallies. The Canadian, Australian and New Zealand dollars would have room to surge higher.

Conclusion

US inflation figures for March are critical for markets and expectations are high – probably too high. The dollar could drop if reality does not meet estimates.

Bank to the Future: Interest rates return to market center stage

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.