US factory activity picks up in March; cost pressures building

US Feb Durable goods data came in below expectations as production took a hit on account of weather and shortage of components. The overall sentiment seems to be that of caution. The reflation rally is taking a bit of a breather.

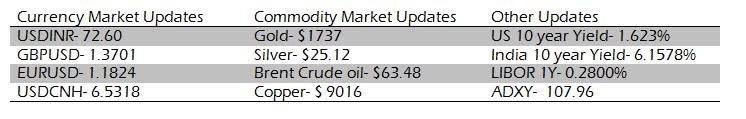

There has been little change in US yields and break evens overnight. The Dollar strengthened yesterday but is steady overnight. The Nasdaq ended 2% lower. Asian equities are trading with modest gains. Asian currencies are trading weak against the US Dollar.

There has been a massive rally in corporate bonds and SDLs and to some extent in Gsecs as well over the last 2-3 sessions. 10y SDL cutoffs were lower by 20bps compared to last time. Yields on 10y AAA PSU bonds are down nearly 35bps compared to last week. Cancellation of Gsec auction, correction in US yields and crude prices, aggressive purchases by EPFO are all factors that have contributed to the rally.

The Nifty shed 1.79% yesterday but is likely to recoup some of the losses today.

1y forwards cooled off 6p yesterday in the latter part of the session. LD-Fd continues to remain elevated at 19p.

Strategy: Exporters are advised to cover a part of their near-term exposure on upticks towards 73.50. Importers are advised to cover through forwards on dips towards 72.30. The 3M range for USDINR is 72.50 – 74.40 and the 6M range is 73.00 – 76.00.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.