US economic outlook: Brilliant disguise

Brilliant disguise

- Our forecast has not materially changed in this update, although our confidence in it has improved. The data have moved roughly in line with our expectations in the past month, demonstrating a slowdown in underlying domestic demand and hiring figures to support it.

- Trade has been the tail that wagged the dog in the first half of the year, and with trade policy still in flux, volatility isn't going anywhere. That said, the most massive swings in trade are likely behind us, and we expect underlying economic growth to slow further from here.

- The July jobs report brought with it material revisions that shaved over 250K jobs off of employment growth in the prior two months. While surprising, it provides some support to why we've seen a choosier consumer in recent months.

- Households have cut back on discretionary services spending and purchases of discretionary goods have been met with an air pocket after an initial pull-forward ahead of the first major round of tariffs.

- We have not changed our expectations for Fed easing. We still expect the FOMC to lower the federal funds rate by 25 bps at each of the remaining meetings this year in September, October and December. The target range for the federal funds rate would finish the year at 3.50%-3.75%. With downside risks to the Fed's employment mandate and upside risks to inflation, we think the Committee will move monetary policy toward a more neutral stance.

- The pivot to a more decidedly downbeat assessment in the economic data is the top-of-the-fold headline in August, but fiscal policy is set to be a tailwind for economic activity at the start of next year. That, in tandem with a less restrictive monetary policy backdrop, ought to be supportive of an acceleration in real GDP in 2026.

A run of better-than-expected data earlier this summer never quite rang true for us. There is not much joy in being right about negative outcomes, but the recent downward revisions and less sanguine data are more in line with the mild stagflationary shock that has been our long-held conviction throughout this year. In other words, our forecast has not materially changed, although our confidence in it has improved.

One thing that has changed since our July forecast update is that we do have a bit less uncertainty when it comes to trade policy. After financial markets initially recoiled to the Liberation Day announcements, the implementation of some of the heaviest tariffs were put on ice until the start of this month. Hours before that deadline, the administration rolled out a fresh set of comprehensive tariffs, which, by our estimates, puts the effective tariff rate at roughly 18% come August 7.

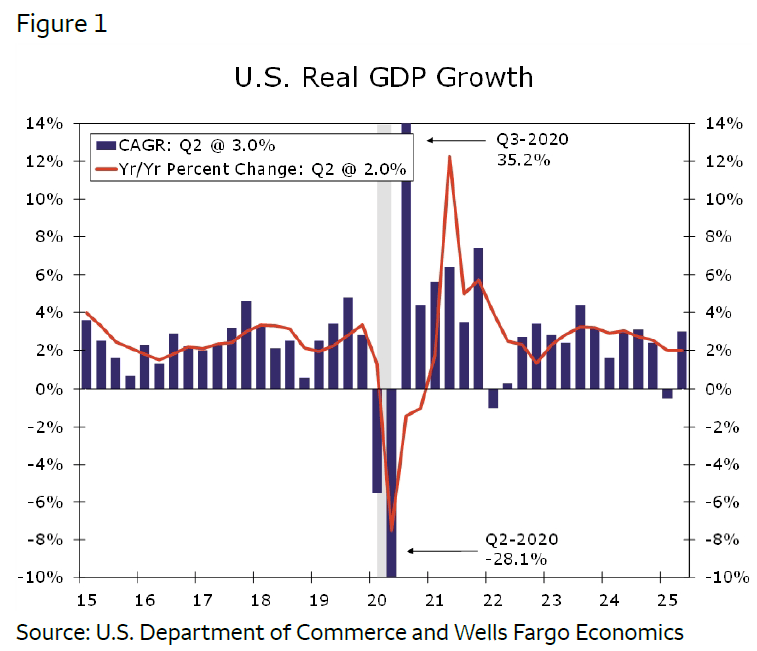

In the first half of the year, trade has been the tail that wagged the dog. The U.S. economy contracted in the first quarter and grew at a 3.0% annualized clip in the second (Figure 1). But just as the Q1 contraction in GDP understated the health of the economy, the better-than expected outturn in the second quarter certainly overstates it.

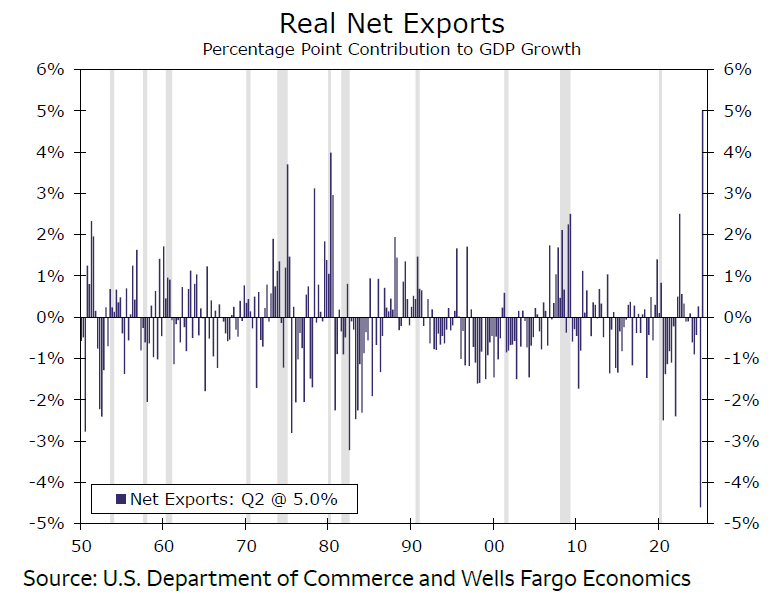

At a time when financial markets are trying to weigh the impact of tariffs on the economy, you need to be careful how you look at the GDP report. Mechanically, exports boost growth, while imports weigh on it. That is a useful insight anytime, but it becomes the primary lens through which to view growth amid a trade war. After net exports exerted the biggest drag on headline growth in more than 75 years in the first quarter, it offered the biggest boost on record in the second, a whopping 5.0 percentage points (Figure 2).

With trade policy still in flux, volatility is not going anywhere. However, the most massive swings in trade are now probably behind us. We look for a modest lift to economic growth from trade in the remaining quarters of the year. To gauge the larger impact of tariffs, look instead at how firms are prioritizing their spending: favoring intellectual property outlays over equipment spending and structures. We've pared the decline we had in capex spending in the second half of the year on a stronger near-term trend in investment outlays, but we still look for a slower second half amid mounting uncertainty and price pressure.

Author

Wells Fargo Research Team

Wells Fargo