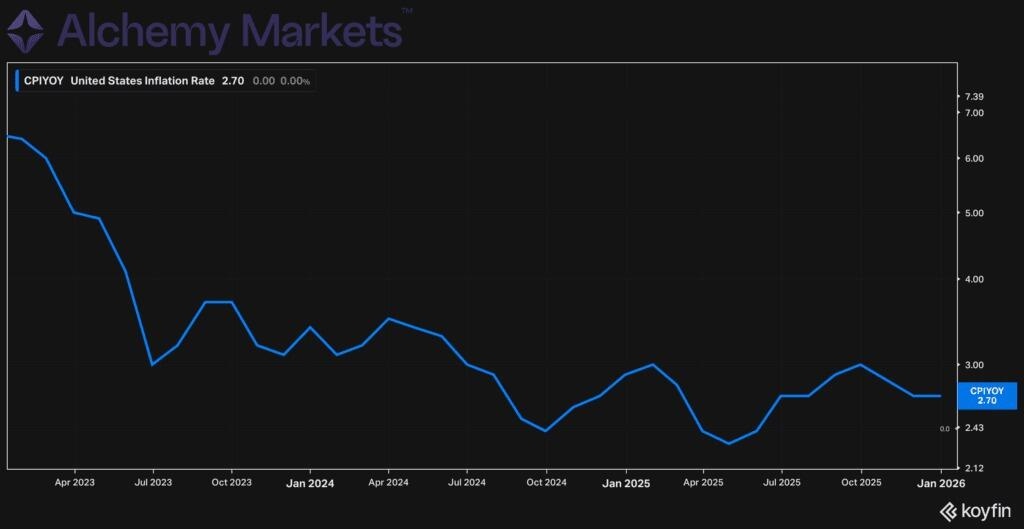

US CPI data holds steady at 2.7% — What it means for the Dollar and stocks

US inflation stays steady

The latest U.S. Consumer Price Index (CPI) data, released today, showed that headline inflation rose 0.3% month-over-month and 2.7% year-over-year in December — perfectly in line with market expectations.

Meanwhile, core CPI, which excludes volatile food and energy prices, increased 0.2% m/m and 2.6% y/y, slightly below forecasts.

The data suggests inflation is cooling gradually but remains above the Federal Reserve’s 2% target — keeping the central bank cautious but under no immediate pressure to raise rates.

Market reaction: Calm, not complacent

Markets greeted the report with muted optimism.

U.S. equities opened slightly higher, with the S&P 500 edging toward record levels, while Treasury yields dipped modestly as traders priced in a prolonged Fed pause.

The U.S. dollar weakened slightly, reflecting relief that inflation didn’t surprise to the upside.

Cryptocurrencies also caught a bid — Bitcoin climbed toward $92,000, as traders bet that the Fed’s next move could be a rate cut later this year.

Federal Reserve outlook

Today’s CPI print reinforces the view that the Federal Reserve will hold rates steady at its next meeting in late January.

With core inflation softening, the probability of another rate hike has virtually disappeared.

However, Fed officials are unlikely to pivot quickly. Futures markets now expect the first rate cut to arrive around mid-2026, assuming inflation continues to drift lower without rekindling.

Market implications

U.S. Dollar (DXY)

The U.S. dollar holds a slightly bearish bias following the December CPI print.

With inflation coming in as expected and core readings softening, traders see reduced odds of additional Fed tightening.

The greenback eased modestly as markets leaned toward a “Fed on hold” narrative — keeping rate-cut hopes alive for mid-2026.

S&P 500 (SPX)

The S&P 500 remains mildly bullish, supported by steady inflation and a Fed likely to maintain its current stance.

However, technically, the index looks increasingly toppy after a strong recovery into the upper bound of its rising channel.

Price action shows the SPX trading above the anchored VWAP from the October lows — a sign that momentum remains positive and trend-followers are still in control.

That said, the RSI is diverging, printing lower highs even as price pushes higher — a classic warning that upside momentum is slowing.

In short, the trend is intact, but the risk of short-term exhaustion is rising.

Traders may want to watch for a potential consolidation or pullback toward the 6,850–6,900 support area before any sustainable breakout resumes.

Bottom line

Inflation in the U.S. remains steady, not stagnant.

The December CPI data confirmed that the disinflation trend is intact, but the road back to 2% is slow.

In the meantime, investors can expect a balanced environment — where the Fed stays patient, the dollar drifts, and equities find cautious support.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.