US ADP Employment, ISM Manufacturing PMI Preview: First down, then up for US Dollar?

- ADP's private-sector labor report may disappoint, following a see-saw pattern.

- Low expectations for the ISM Manufacturing PMI may result in an upside surprise.

- Fears about another Fed rate hike will likely persist, supporting the US Dollar.

With or without the debt-ceiling crisis, the US Dollar is on the rise – but every trend has a countertrend, and a double-feature release creates opportunities. Ahead of Friday's Nonfarm Payrolls (NFP), Thursday's release of two critical leading indicators is set to rock markets.

Here is a preview of ADP's private-sector jobs report at 12:15 GMT and the Manufacturing Purchasing Managers' Index (PMI) from the Institute of Supply Management (ISM) at 14:00 GMT.

ADP Employment data tend to see-saw, this time it could disappoint

Automated Data Processing (ADP) is America's largest payroll provider, handling one of every six payslips – making its publication a leading indicator of the official jobs report. Nevertheless, the correlation between its figures and the Bureau of Labor Statistics NFP is shaky. Nevertheless, it tends to move markets.

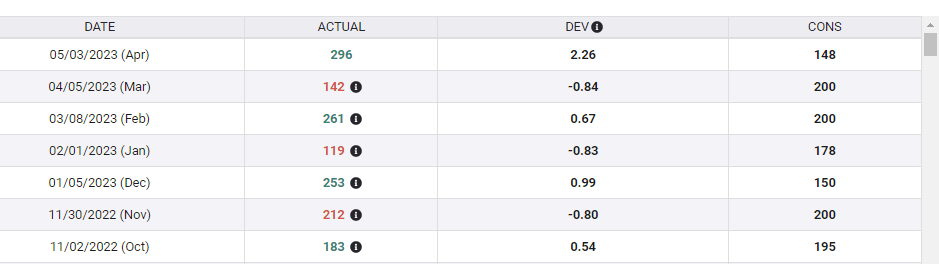

A quick look at the economic calendar shows economists expect an increase of only 170,000 jobs gained in May after 296,000 in April. Are estimates too low? Not necessarily, as a deeper look into this publication shows a see-saw pattern.

Source: FXStreet

Not only have ADP's figures jumped from miss to beat and the other way around, but these differences have also been significant, especially in recent months. After leaping to the highest level since July 2022 in the latest April publication, the upcoming May report could be weak.

If my scenario materializes, investors' knee-jerk reaction would be to sell the US Dollar on estimates that the odds for a rate hike in June are lower. It is essential to note that officials at the Federal Reserve (Fed) are split on whether to increase borrowing costs or pause. Bond markets reflect that uncertainty with roughly even odds – and any data point could make a difference.

ISM Manufacturing PMI may show some signs of stability

The second and last leading indicator before May's Nonfarm Payrolls is limited to the manufacturing sector, which is smaller than the larger services one. However, it has the last word, and ISM's strong reputation means markets react.

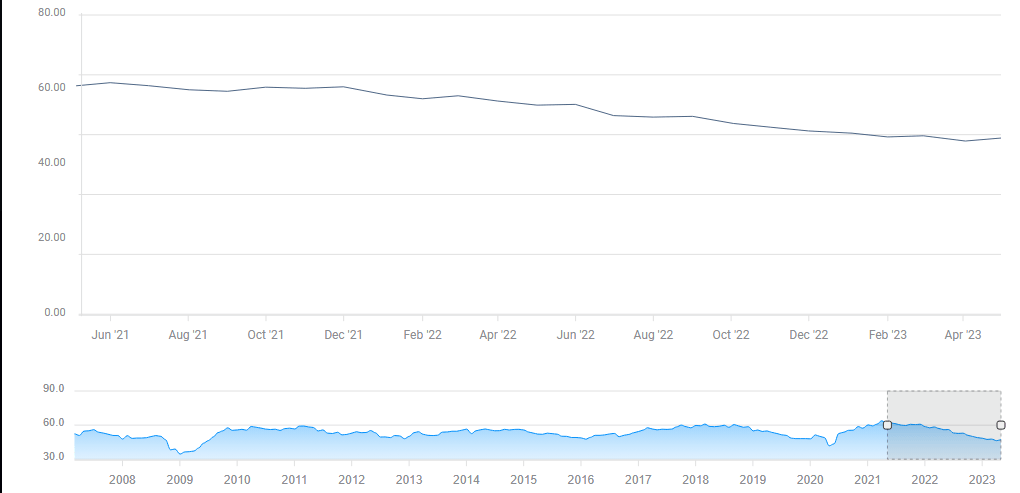

Contrary to ADP, economists have mostly been too optimistic in recent months, resulting in five consecutive misses – ending last month, when the headline ISM Manufacturing PMI beat estimates, stabilizing at 47.1 points. A look at the chart below, also shows some signs of bottoming out.

Source: FXStreet

America's manufacturing sector suffered from the post-pandemic re-opening when consumers shifted back to services such as flights, hotels and restaurants while shying away from goods such as cookware or Peloton bikes. Over a year after the last covid wave waned, and the sector is stabilizing.

The calendar points to stability in May – a minor drop from 47.1 to 47. Estimates for the employment component are more pessimistic, pointing to a drop from 50.2 to 48.5 points. That also allows for an upside surprise in the figure that matters for the Nonfarm Payrolls report.

Overall, there is room for an upside surprise in the ISM Manufacturing PMI and its key component, potentially leading to US Dollar strength.

Final thoughts

My scenario of US Dollar weakness followed by strength is only one of many outcomes. What is more certain is the high market sensitivity to economic indicators. The US bank holiday on Monday pushed ADP's release to Thursday instead of Wednesday, resulting in more last-minute positioning and more jittery markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.