US 10-Year Treasury Auction: Temporary relief

- CPI stable in February, core inflation rate declines.

- Treasury demand on $38 billion soft but adequate.

- 10-year yield at bond auction was 1.523%.

- Dow Index and S&P 500 gain, dollar fades.

Fears of spiking US interest rates from a weak Treasury sale on Wednesday failed to materialize as auction data showed sufficient demand to keep the benchmark yield stable.

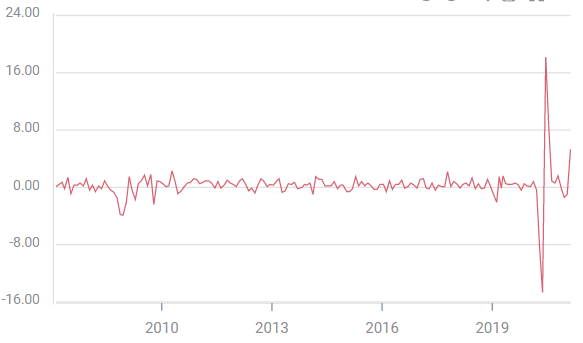

The Treasury sold $38 billion in 10-year notes at a return of 1.523%. Yields had closed at a 13-month high of 1.594% on Tuesday prompted by fears of rising inflation from a combination of massive federal government debt and a swiftly reviving economy. Interest rates move inversely to prices to compensate for fixed bond coupons.

10-year Treasury yield

CNBC

Consumer Price Index

Data from the US Bureau of Labor Statistics released before the 1 pm auction had helped to alleviate worries as it showed no acceleration in prices in February. The Consumer Price Index (CPI) rose 0.4% on the month and 1.7% on the year as predicted. The core index was slightly weaker than expected, 0.1% and 1.3% from a 0.2% and 1.4% estimate.

Inflation concerns had surfaced last month when the Producer Price Index (PPI) jumped 1.3% in January from 0.3% in December and the annual rate soared to 1.7% from 0.8%. Consumer demand also vaulted in January as Retail Sales rose 5.3% with households spending the $600 December pandemic relief payment.

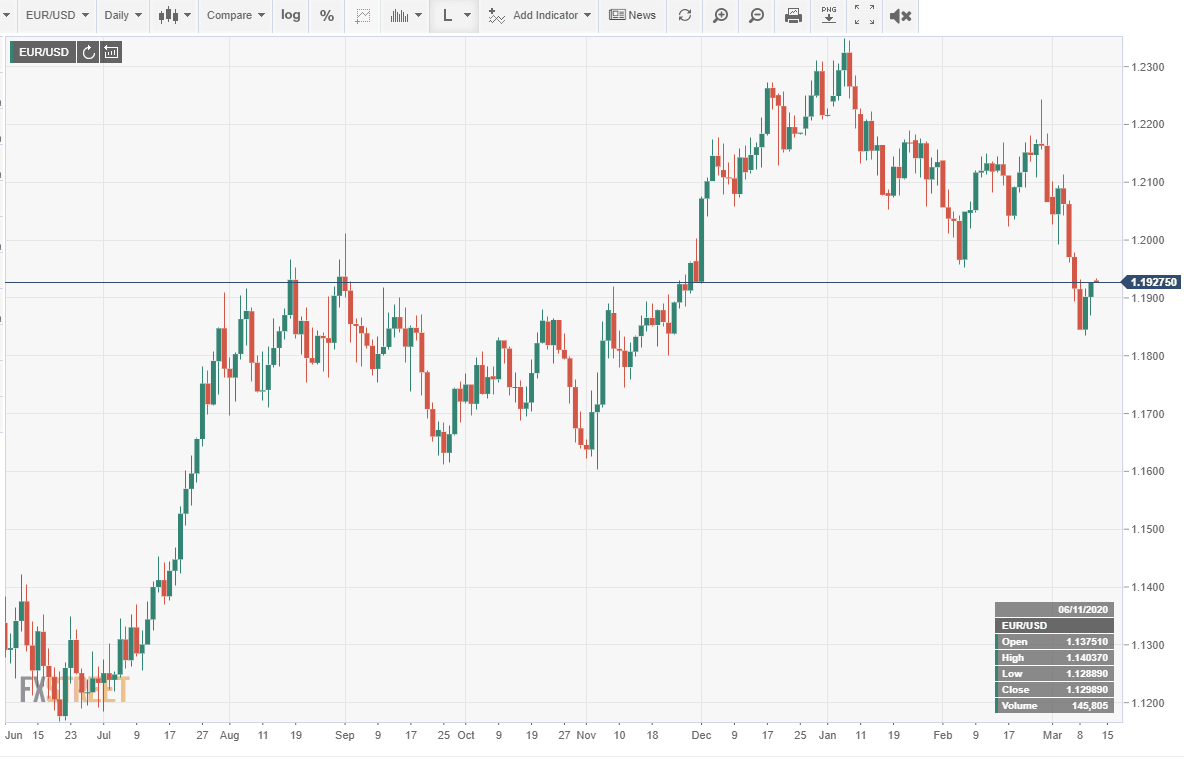

Retail Sales

FXStreet

Stimulus and debt

The latest stimulus package passed by Congress this week will award eligible US families a $1400 check. That stipend is expected to prompt a second round of consumer spending in March and April.

Another credit concern that eased somewhat today was over the size of the swiftly growing federal debt. This month's issuance of $414 billion was an all-time record. Analysts have wondered if the market would be able to absorb the enormous debt that has been used to fund pandemic relief.

The $1.9 trillion bill sent for President Joe Biden's signature is the third legislative attempt to support the economy though it is the thinnest in actual payments with just 10% of its total going to individuals.

The Treasury Department has printed $3.6 trillion in new government debt in the past year. Weak demand at the 7-year auction in February, which incurred the greatest before and after yield spread in history, had pushed middle and long-term Treasury rates higher. The 10-year Treasury reached 1.613% on Monday its highest since last March, before closing at 1.594%.

Market response

Equities rose sharply with the successful Treasury auction and stationary interest rates.

The Dow jumped 464.28 points, 1.46% to close at a record 32,297.02. The S&P 500 added 0.6% to 3,898.81, with cyclical growth stocks in the lead. The Nasdaq Composite had been up as much as 1.6% in the session but closed down 0.1% at 13,068.83. Yesterday, the tech-biased index had rallied 3.7%, its best day since November.

The dollar added a small amount to its losses against the euro closing at 1.1927, after finishing at a three-and-a -half month high on Monday at 1.1845. The USD/JPY slipped to 108.38 from Monday's 14-month high at 108.91.

Conclusion

The relative success of the 10-year auction and the evident relief of the credit and equity markets is temporary. Economic, cultural and financial factors are in line to maintain upward pressure on US interest rates.

As the pandemic wanes US economic growth will accelerate. The Atlanta Fed GDPNow estimate for the first quarter is 8.4%. After a year of isolation and restrictions the US consumer can be counted on for a spending catharsis, especially with bank accounts full of of government cash.

In federal financing the extraordinary has become commonplace. Trillion dollar plus deficits are now standard Washington accounting every year. As the global economy expands the safety of US debt becomes less important and yields return as a competitive measure.

Notwithstanding their uneven path, rising interest rates are not something to be feared. They are a sign of US economic recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.