Up six times in a row?

S&P 500 pumped higher on light volume Friday as called – what‘s both a bit surprising and indicative, is no real selling into the close. The earlier talked Zweig breadth thrust signal is thus alive and well in the making, and another up day in S&P 500 with slowly catching on Nasdaq, and continued volatility crush leave little doubt as to where the market participants‘ initiative is.

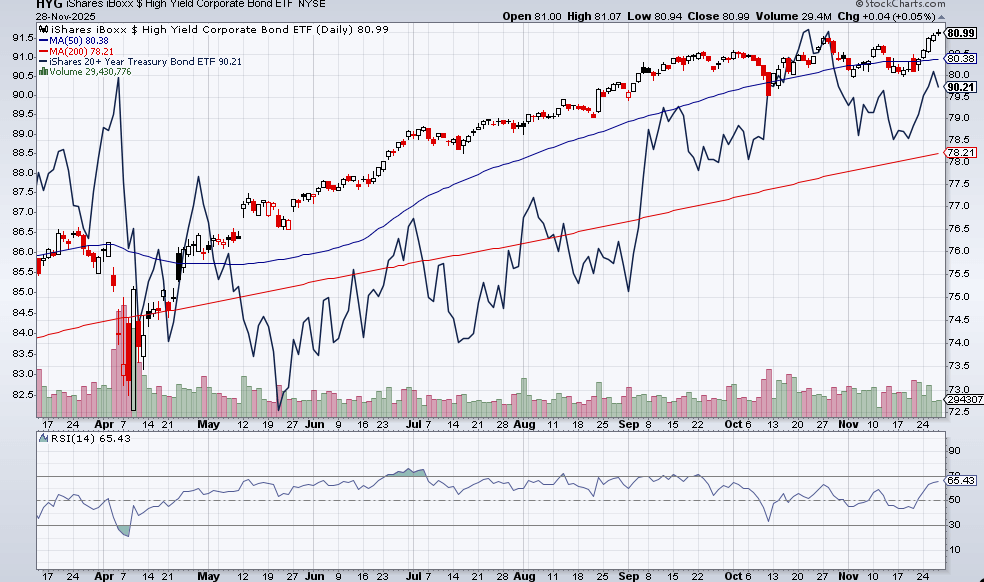

While the below bond overlay chart begs to differ with „only way is up“ interpretation – and also formed the essence of my long gains protection call made to clients on Sunday, bringing Trading Signals and Stock Signals clients a gain of +76 ES points since Nov 25 – bond market volatility attests to decreasing fear and more satisfaction with Dec rate cut expectations (25bp cut now has 86% odds vs. 71% a week ago).

This did send USD down on the week, yet there is a tentative higher low forming – helping spur fresh move higher in precious metals, and not bearing much on Bitcoin.

New month is starting - make the most of my premium services.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.