United States: Will the Fed be sufficiently cautious when it stops QT?

Regardless of their monetary policy stance, the major central banks have embarked on balance sheet reduction programmes (quantitative tightening, QT). The main risk associated with these programmes is their potential to dry up money markets by depriving commercial banks of the central bank reserves they need to satisfy the liquidity requirements set by Basel III. The US Federal Reserve’s first QT experiment failed in 2019 for this very reason. In its effort to proceed with caution, and due to the lack of clarity regarding the optimal level of reserves (neither scarce nor abundant), the Fed set itself the goal of halting its second QT at the first tangible signs of tension in the money markets. In line with this plan, on October 29, it announced that it would halt its QT2 on December 1.

Reasons for stopping QT

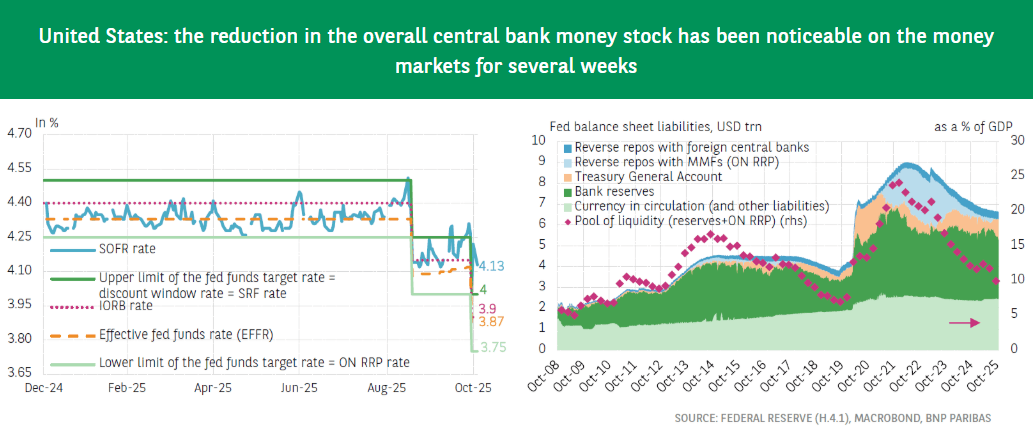

The trends in short-term market rates indicate that the total pool of central bank money (consisting of bank reserves at the Fed and money market fund deposits under the ON RRP1) can no longer be regarded as abundant (see left-hand chart). The cost of accessing liquidity has increased in recent weeks: the median rate for securities repurchase agreements (SOFR) now regularly exceeds the interest rate on reserves (IORB) and is close to, or even higher than, the Fed's discount window rate. Liquidity withdrawals from the Fed (under the Standing Repo Facility, SRF) are becoming increasingly common.

What next?

In line with its operational framework the Fed will maintain the size of its balance sheet for some time (weeks or months). Subsequently, to ensure its supply of reserves remains at a level it considers sufficiently “ample” (likely around 9%-10% of GDP, as shown in the right-hand chart), it will once again increase its balance sheet. By 2026, its monthly purchases of T-bills could reach USD 25-30 bn (in addition to USD 15-20 bn from the reinvestment of principal payments from its MBS holdings) to maintain the weight of its balance sheet at 20% of GDP.

However, the Fed should be more cautious. The ability of large banks to access central bank liquidity remains limited. Only one of the shortcomings of its liquidity injection tool has been addressed: since the end of June, the SRF window has been available during hours that are more suited to the needs of market participants. However, the other two shortcomings—the lack of centralised clearing for Fed repo loans and the risk of stigma associated with its use—remain.

Recent developments have also highlighted the irrelevance of the effective federal funds rate (EFFR) for assessing borrowing conditions in the money markets and ensuring the smooth transmission of monetary policy. At the beginning of October, based on its very low elasticity to fluctuations in the total stock of reserves, the Fed assessed that reserves continued to be abundant. Furthermore, while tensions are currently evident in the repurchase agreement markets, borrowing levels in the federal funds market remain modest, with a median rate that, although increasing (see left-hand chart), is still favourable (below the IORB). As Lorie Logan, President of the Dallas Fed, has suggested, it may be time to adjust the measuring instrument.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.