United States: Lackluster summer employment data will prompt the Fed to act

The August Employment Situation featured weak payroll growth and a rise in the unemployment rate. The release confirmed the downside risks surrounding the US labour market. The FOMC is expected to lower the Fed Funds Target Range (-25 bps) for the first time in 2025 at its 16-17 September meeting.

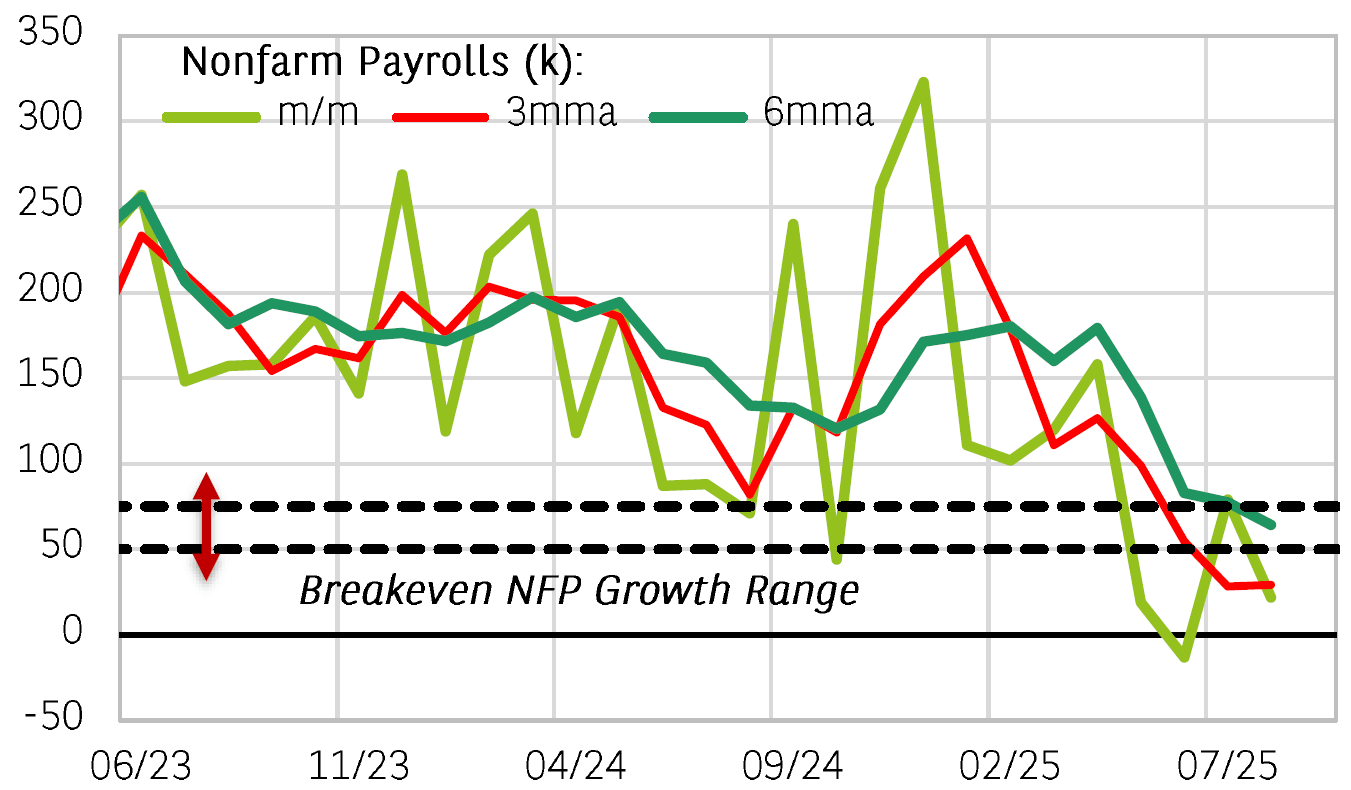

Nonfarm payrolls (NFP) further weakening in August

They came in lower than expected and dropped to +22k (consensus: 75k) from +79k in July. The data extended the downward trend, with 3- and 6-month moving averages (29k and 64k) at their lowest levels since 2010[1]. The weakness of the NFP, which fell below our estimate of the breakeven threshold allowing unemployment rate's steadiness (50k – 75k), triggered an increase in the latter to 4.3%, its highest level since October 2020, taking it above its equilibrium level (4.2% according to the Fed). Meanwhile, the labour force participation rate rose for the first time since April, albeit slightly (62.3%, +0.1pp). Wage growth was stable on a monthly basis (+0.3% m/m) but slowed slightly year-on-year (3.7%, -0.2pp). Finally, the first data released after the dismissal of Erika McEntarfer, former director of the Bureau of Labour Statistics (BLS), did not give rise to any significant revisions for previous months (a cumulative total of -21k for June and July).

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.