UK Retail Sales jump, British Pound steady

The British pound has steadied on Friday against the US Dollar after climbing 0.6% a day earlier. GBP/USD is trading at 1.2655 in the European session, down 0.1% on the day.

UK Retail Sales jump 1.7%

UK retail sales sparkled in January, climbing 1.7% m/m. The reading crushed the market estimate of 0.3% and bounced back from an upwardly revised -0.6% in December. This was the fastest pace since May 2024 and was largely driven by a sharp increase in food store sales. Annually, retail sales climbed 1%, down from 2.8% in December but above the market estimate of 0.6%.

UK consumer confidence remains low, but there was a slight improvement in February. The GfK consumer confidence index rose to -20 from -22, above the market estimate of -22. Consumers were less pessimistic about economic conditions, which may have resulted from the Bank of England’s rate cut last month. Still, consumer confidence is mired in negative territory, as consumers are in a sour mood.

The UK economy barely registered any growth in the second half of 2024 and the BoE cut in half its forecast for economic growth in 2025. Meanwhile, inflation is moving the wrong way. In January, CPI surprised to the upside and hit 3%, a ten-month high. Low growth and high inflation has policymakers concerned about stagflation, which could cause significant damage to the economy.

UK PMIs for February were a mixed bag. Manufacturing PMI ease to 46.4, down from 48.3 in January and shy of the market estimate of 48.4. It was the lowest level since Dec. 2023 as output and employment levels declined. The services sector is in better shape and the PMI rose to 51.1 from 50.8, indicating weak expansion.

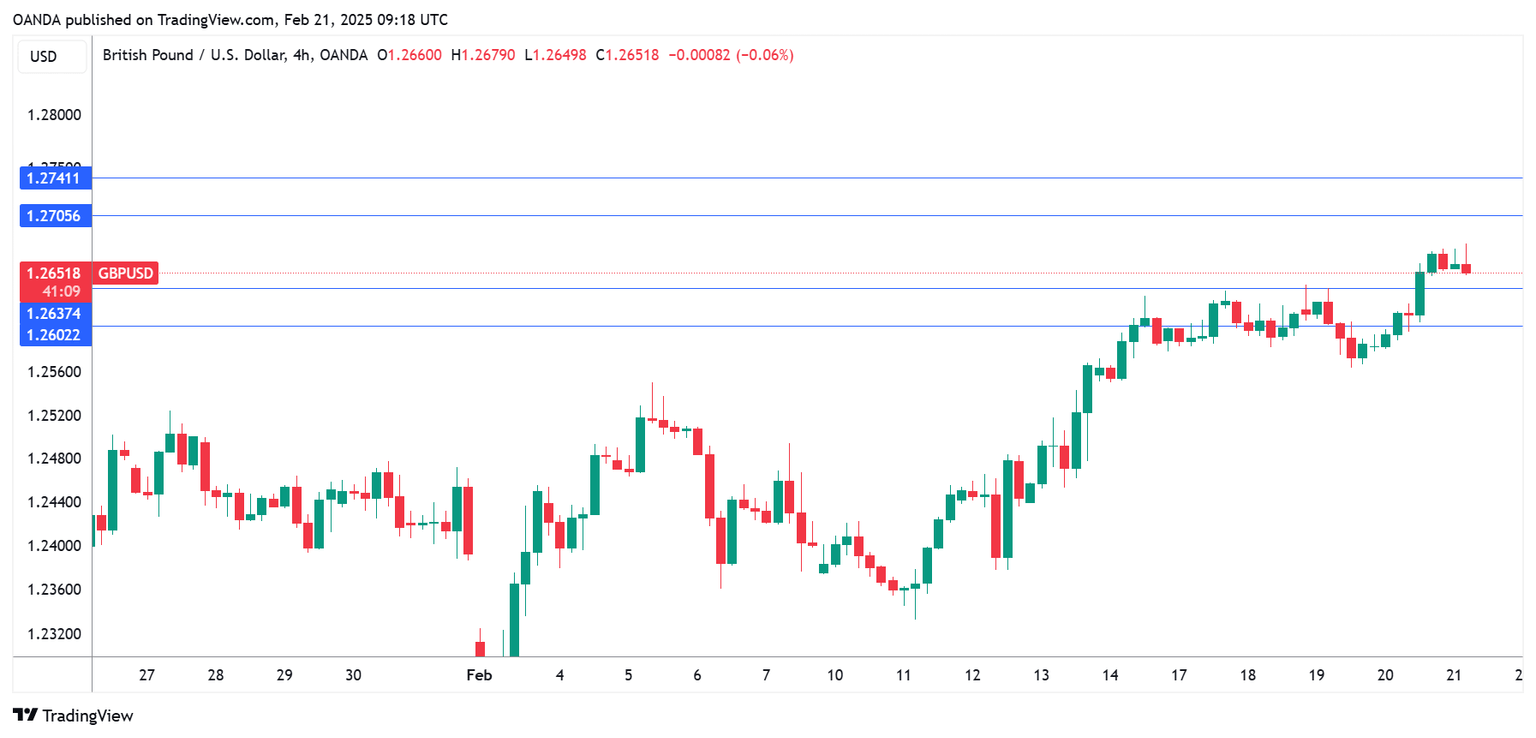

GBP/USD technical

-

GBP/USD is testing support at 1.2637. Below, there is support at 1.2602.

-

1.2705 and 1.2740 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.