UK PMIs Preview: Without light at the end of the tunnel, the only way is down, GBP/USD may fall

- Markit's preliminary April PMIs are set to further deteriorate.

- Without a lockdown exit strategy, businesses will likely remain depressed.

- GBP/USD has room to fall in response to the data.

The UK coronavirus curve may have peaked – but growing uncertainty about exiting the crisis has likely depressed investor confidence. The Markit/CIPS preliminary Purchasing Managers' Indexes for April have likely extended their downfall and the figures – even if come out as expected – may hit the pound.

The Manufacturing PMI has been relatively upbeat, standing at 47.8 points in March – only marginally above the 50-point threshold separating expansion from contraction. However, the gauge is skewed by s sub-component that counts delivery delays as positive. That is set to end with the figure dropping to 42.

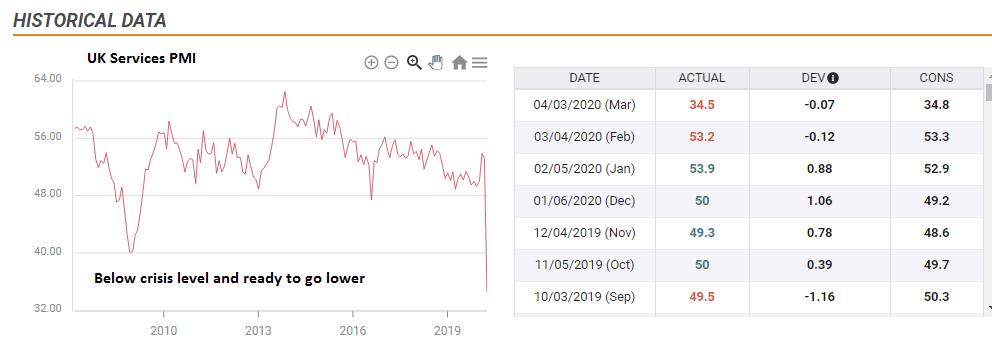

The services sector, which includes social activities such as restaurants, flights, and events, is set to dive deeper into depression territory. The PMI is set to drop from 34.5 to 29. The March read is already well below the 2008-2009 crisis levels, reflecting the shock.

Economists could be underestimating the downturn in business confidence. The British government extended the lockdown at least until May 7 and has failed to present any exit strategy. Foreign Secretary Dominic Raab, who is deputizing for Prime Minister Boris Johnson, may have hesitated to suggest ideas for the next moves. Even if lifting restrictions may be delayed, the dearth of detail is adding to the uncertainty.

Moreover, the government is coming under growing criticism for its handling of the crisis, from a slow response to mismanaging obtaining medical equipment.

How will GBP/USD react?

If the data comes out below expectations, pound/dollar has room to fall as it would reveal growing pessimism among decision-makers. It would also show that the current situation is worse than previously perceived.

If the figures meet expectations, they would still de gloomy. Sterling may hold up in its range in the immediate aftermath but fall afterward. Ongoing weak figures may take their toll.

Only in case of figures beating expectations – preferably holding up at March´s levels, the pound has room to rise. That would indicate that businesses focus on somewhat encouraging health statistics rather than the lockdown uncertainty.

Conclusion

Markit's UK preliminary PMIs are expected to fall in April and there are reasons to think expectations may be optimistic. The pound is poorly positioned and may come under pressure even if the figures meet expectations.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.