UK Inflation Preview: Soaring prices may give sterling a shot in the arm, open door to rate hike

- Economists expect inflation to have shot up to 2.9% YoY in August.

- Higher price rises may tilt the divided BOE toward rate hikes.

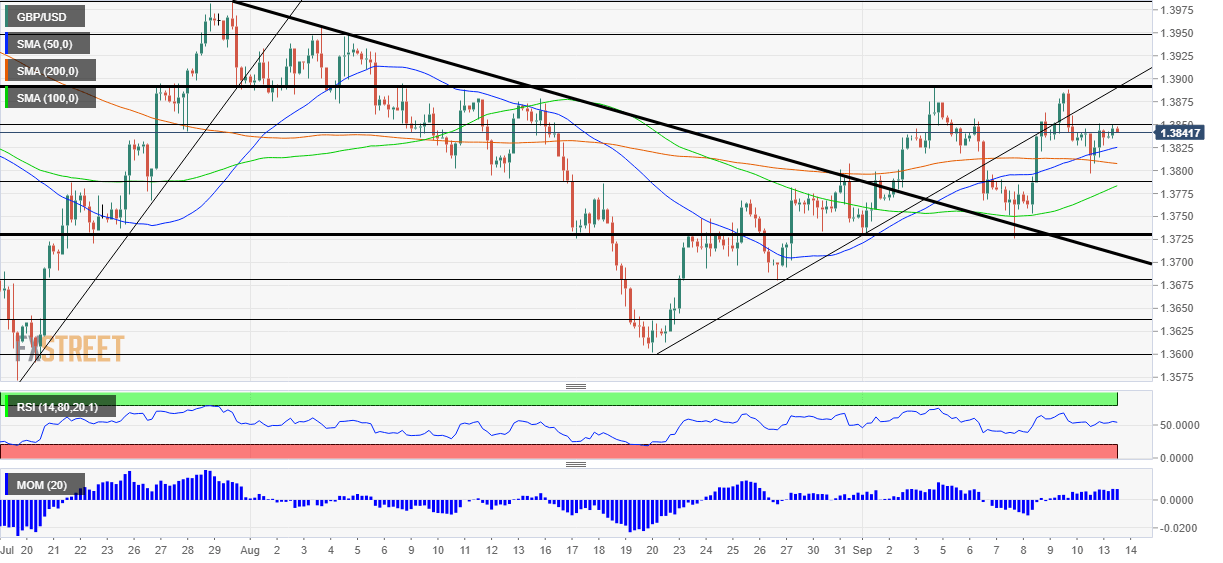

- GBP/USD has been trading under resistance, which could break now.

When will the Bank of England raise interest rates? That is a critical question for the pound, and has become even more pressing lately – and a surge in inflation could tip the scales in favor of tightening and a stronger sterling.

BOE Governor Andrew Bailey recently said that the Monetary Policy Committee (MPC) was split 4:4 on the question of conditions were met for hiking borrowing costs. The UK economy benefited from the return to normal in the spring and perhaps from "Freedom Day" – the loosening of most restrictions back in July.

On the other hand, jobless claims dropped by only 58,600 in August, less than expected. The more recent data suggests growth is slowing, but the last word belongs to inflation, which the BOE is mandated to keep in check.

Economists expect the headline Consumer Price Index (CPI) to leap to 2.9% YoY in August from 2% in July – a dramatic change. The bank's target is 2% CPI and any move outside the 1-3% band requires a formal explanation from the governor.

Apart from revealing that the MPC is split, Bailey also seemed to hedge his bets for every outcome, saying in that September 8 testimony that:"There are risks on both sides to inflation returning to target over the medium term." August's data will shed some light on where prices are going.

CPI and GBP/USD reaction

It would only take a small upside surprise to price in a rate hike as soon as this year. In that case, GBP/USD could advance and perhaps even break above the quadruple top of 1.3895.

On the other hand, CPI has had its misses in the recent past, and perhaps previous price pressures resulted in weaker demand and in turn, lower prices. If inflation rises only to around 2.5%, it would allow the BOE more breathing room. Officials could wait to see the full impact of the end of the furlough scheme before being pushed by inflation to raise rates. In that case, the double-bottom of 1.3725 would be in danger.

There is also some middle ground, but it is limited. An "as-expected" figure of 2.9% or 2.8% could be considered neutral for pound movements. However, the pandemic has resulted in substantial differences between what economists expect and real outcomes.

Conclusion

UK inflation figures are critical for the Bank of England´s path of rate hikes. A figure of 3% or higher would send sterling higher while something closer to 2.5% would pound the pound.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.