Trump’s Middle East dealmaking blitz: What does it mean for investors?

Key points

- Trump’s Middle East tour unlocked over $2.8 trillion in deals, spanning aviation, AI, defense, and energy—putting U.S. firms at the center of Gulf ambitions to modernize and diversify.

- Boeing, Nvidia, GE, and Raytheon emerged as major winners, securing multi-billion-dollar orders across Qatar, Saudi Arabia, and the UAE, while tech giants like Microsoft, Oracle, and Amazon gained cloud and AI infrastructure footholds.

- While the opportunity is massive, risks around AI chip export controls, execution delays, and geopolitical instability remain, requiring investors to stay selective and focused on policy-driven sectors with strategic tailwinds.

President Donald Trump’s May 2025 Middle East visit has unleashed a flurry of mega-deals, aimed at deepening U.S. trade ties, correcting trade imbalances, and reinforcing America’s leadership in defense and technology exports. From Boeing aircraft to Nvidia’s AI chips, the trip wasn’t just about diplomacy—it was a global sales pitch. And investors are taking notice.

Big tech’s Gulf expansion is accelerating

The Gulf is fast becoming a global AI and cloud hub—with sovereign AI campuses, massive chip import deals, and sovereign cloud infrastructure. U.S. tech giants like Nvidia, Microsoft, Oracle, Amazon, and Palantir are leading the charge.

- Investment implication: Strong structural tailwinds for U.S. chipmakers, cloud providers, and AI infrastructure enablers.

Aviation demand is taking off

Widebody jet orders from Qatar, UAE, and Saudi Arabia exceeded $115B, signaling a powerful post-COVID recovery in long-haul travel and fleet upgrades.

- Investment implication: Boeing (BA) and GE Aerospace (GE) could benefit as global airline capex returns.

Defense spending regains momentum

Over $180B in defense deals were announced or reaffirmed, focused on drones, missile systems, and aircraft—highlighting renewed regional security priorities.

- Investment implication: Raytheon (RTX), Lockheed Martin (LMT), Northrop Grumman (NOC), and other U.S. defense names could see more contracts.

Energy infrastructure still has global pull

The Gulf’s energy push spans LNG terminals in Qatar, oil and gas expansions in UAE, and clean energy investments in nuclear and critical minerals.

- Investment implication: Reinforces the strategic relevance of energy majors like ExxonMobil, Occidental, GE Vernova, and Holtec.

Geopolitics is driving capital flows

These aren’t just business deals—they’re strategic alignments. The U.S.-Gulf nexus is attracting long-cycle capital into sectors favored by policy and national interest.

- Investment implication: Investors should track global alliances and trade shifts, not just earnings guidance.

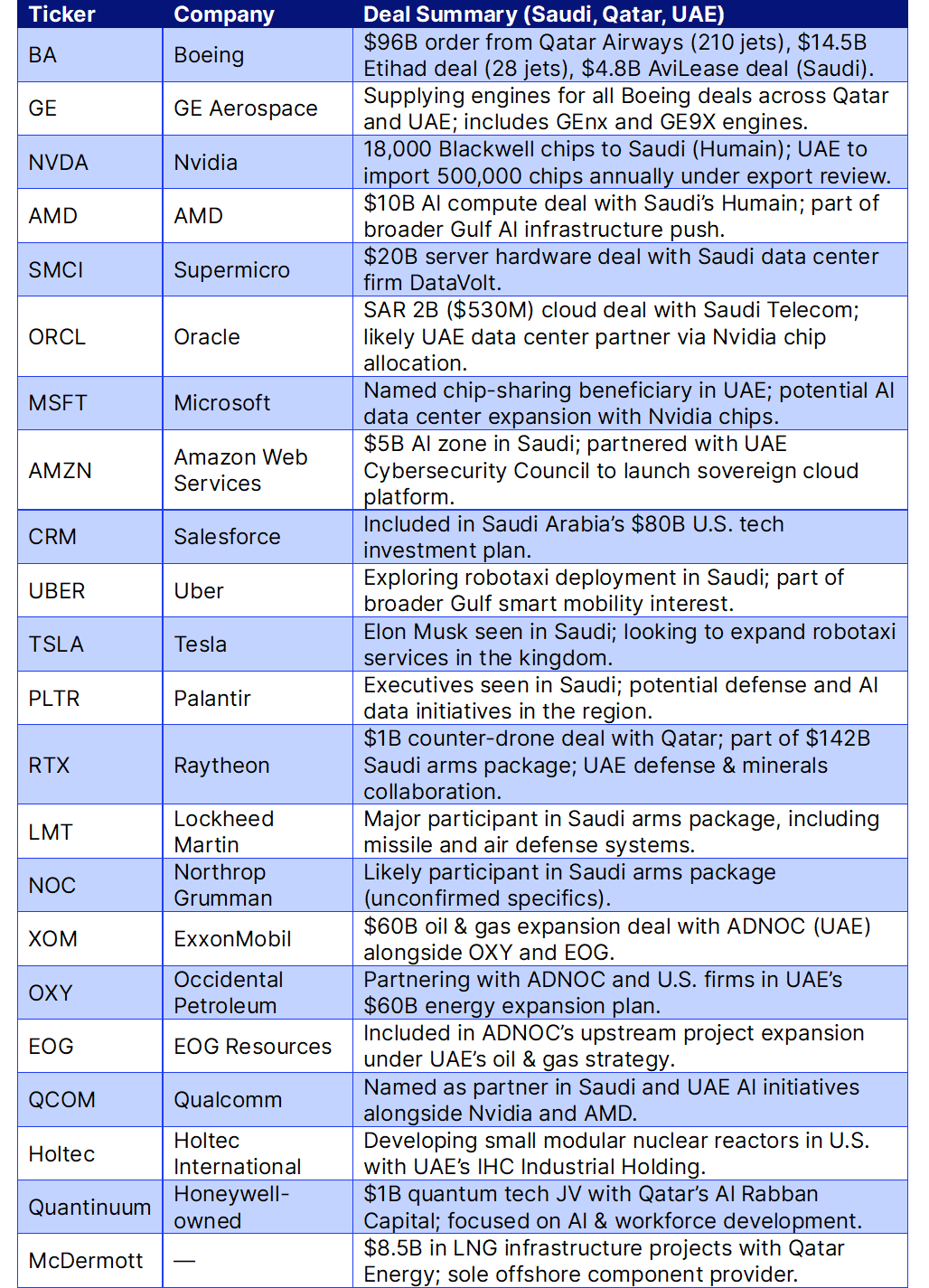

Key stocks to watch

Risks to consider

National security scrutiny on AI chip exports

The U.S. is reviewing whether to allow over 1 million advanced Nvidia chips to be exported to the UAE. Dual-use concerns (civil vs military applications) could lead to restrictions or deal cancellations.

- Investment risk: High for Nvidia (NVDA), AMD, and other chipmakers if export controls are tightened or reversed.

Supply chain bottlenecks could delay execution

While chipmakers may divert inventory from restricted markets like China to fulfill Gulf orders (e.g. UAE, Saudi), production capacity remains tight, and lead times on advanced GPUs are still long. Defense hardware (e.g. drones, aircraft parts, radar systems) faces even longer cycles, constrained by specialized components, skilled labor, and export compliance. LNG facilities, and energy infrastructure involve complex, multi-year timelines. These projects face risks from regulatory delays, cost inflation, or shifting local priorities.

- Investment risk: Execution delays could impact revenue timing for Nvidia, Raytheon, GE Vernova, and other infrastructure-heavy names.

Policy reversals and licensing risks

Export approvals, tech sharing, and defense licenses granted under current political conditions could be reversed or frozen under future U.S. administrations or geopolitical shifts.

- Investment risk: Sudden regulatory changes could disrupt long-term forecasts, especially for tech and defense stocks.

Strategic overexposure to sovereign clients

Many U.S. firms are now deeply tied to Gulf sovereign funds or state-owned enterprises (PIF, ADNOC, G42). This may limit flexibility or pose reputational risk if regional dynamics shift.

- Investment risk: High concentration risk and long-term dependency on state-linked partners.

Valuation risk in momentum stocks

Companies like Nvidia, Supermicro, and others have rallied strongly on AI optimism. Elevated expectations may be hard to meet if deal execution lags.

- Investment risk: High valuations leave little room for error—disappointments could trigger sharp pullbacks.

Regional geopolitical volatility

The Middle East remains a dynamic, but complex, region. Rising tensions (e.g. Iran, Israel-Gaza, Red Sea disruptions) could delay or derail cross-border deals and supply chains.

- Investment risk: Elevated for defense, energy, and logistics-linked names with on-ground exposure.

Read the original analysis: Trump’s Middle East dealmaking blitz: What does it mean for investors?

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.