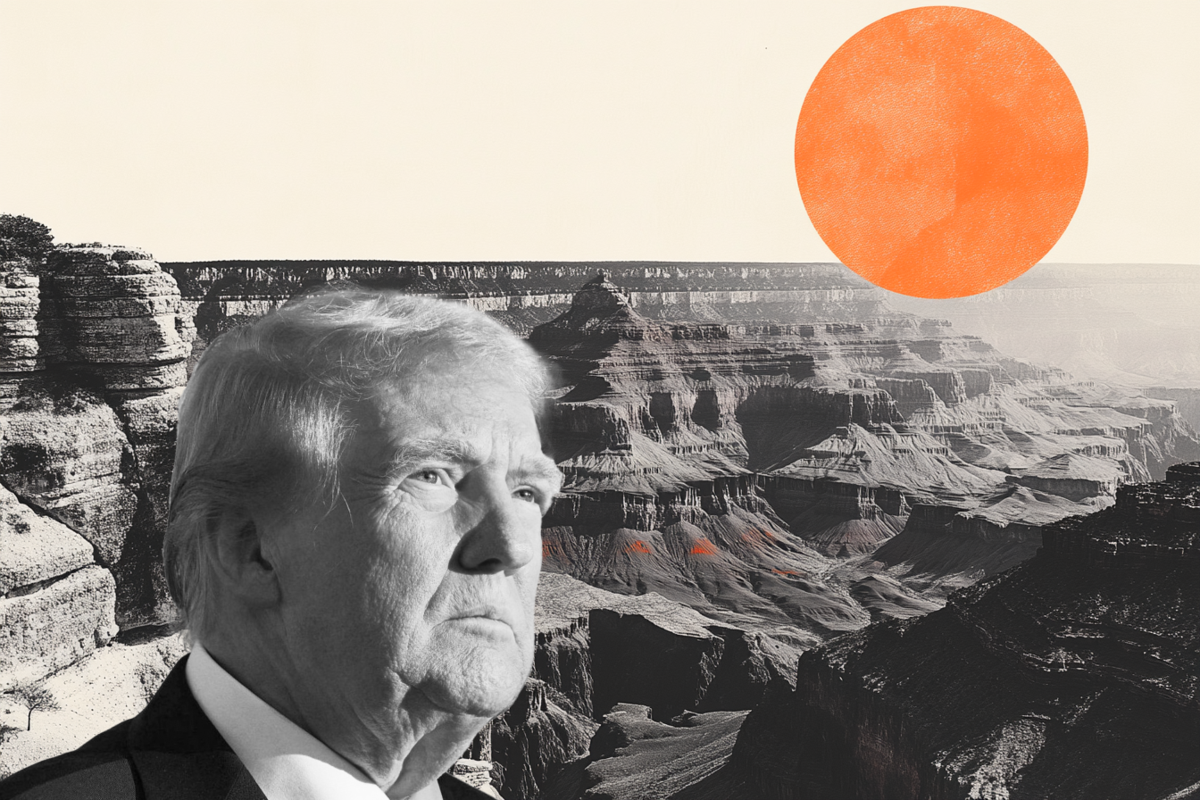

Trump tariffs unnerve markets once again

-

Stock market recovery runs into a Trump sized roadblock.

-

Tech rebound stumbles

-

Is this Trump’s Liz Truss moment?

-

Can Wednesday’s CPI report boost sentiment?

Hopes for a broad-based market recovery on Tuesday have been dashed. US markets had a mixed open, the S&P 500 and the Dow Jones faltered when markets opened, while the Nasdaq initially rallied, led by some tech stocks including Tesla, Netflix and Meta. However, news that President Trump has slapped a further 25% tariff on steel and aluminum imports from Canada has sapped market confidence. Tariffs on these imports are now at 50% and are seemingly in retaliation for Ontario’s decision to impose a 25% tariff on electricity exports to the US.

Trump’s reactionary trade policies thwart a market recovery

The tit-for-tat tariff policy that was started by Donald Trump, is bad news for equity market bulls. Back in November, the focus was on the positive impact from Trump’s economic policies, however, now they are reality his policies are negative for growth, at least in the short to medium term. Trump’s erratic and reactionary trade policy is eroding faith in US exceptionalism and fueling recession fears. There is now a 25% chance of a US recession this quarter, according to Bloomberg’s recession monitor, not long ago that threat was negligible. The more tariffs that Trump imposes, and the longer they are in place, then the higher recession odds will become. This is a disaster for US stock markets.

Tech stock rebound stumbles

US equities have turned lower once again and hopes of a recovery in the tech sector have been dashed. Tesla jumped by 5% at the open on Tuesday, reversing about a third of Monday’s decline. That has now withered away to approx. 1%, as Trump’s tariffs weigh heavily on tech. As we have said before, the tech trade, and the AI trade in particular, is reliant on stable economic policy and good global trade relations to thrive. These pillars have been knocked over by the Trump regime, and tech bulls are paying the price.

The only hope for a recovery in the short term is the outcome of President Trump’s round table with top US CEOs, which is scheduled for later today. The market will want to see 1, some rolling back of tariff threats and 2, potentially some support for equity markets. We think that both are unlikely, which may spook markets further.

Trump’s Liz Truss moment hits stocks, not bonds

President Trump’s economic policies have been compared to Liz Truss’s in recent days. However, while the shock and awe approach to economic policy is similar, the impact is different. Trump’s policies are hitting stocks hard and weighing on domestic equity market valuations, in contrast Liz Truss’s policies decimated the UK bond market. Treasuries are rising on the back of President Trump’s economic policies and yields are falling. The market is looking through the risk of a US recession exacerbating the huge budget deficit, for now. However, if economic data does start to deteriorate sharply, then we could see Treasuries also come under pressure.

Vex surges as Dollar finds a floor, for now

Volatility is continuing to rise, and the Vix index is back at its highest level since August. This is triggering a rush to safe havens. The gold price is up nearly $25 an ounce on Tuesday, and it is comfortably above $2,900. Breaching the $3,000 level for the yellow metal seems like only a matter of time. The dollar has failed to attract safe haven bids, and although it is off its lows, the dollar index remains weak. EUR/USD is above $1.0900, but it has backed away from the $1.0930 high so far on Tuesday.

Sentiment-driven market leaves all stocks out in the cold

European stocks are also seeing the sell off accelerate as we progress through the afternoon. The FTSE 100 is the best performer, but it is still lower by more than 1%. Stocks are a sentiment driven market. Interestingly, the sell off in stocks is broad based, for example, the market capitalization weighted S&P 500 is falling alongside the equal weighted S&P 500, which suggests that value stocks are also out of favour. This is a sentiment driven market that is based on the economic policies of one man: Donald Trump. If he leaves the US Business Roundtable without at least some words of comfort, then the sell off could get uglier later today.

Can the CPI save markets?

There are few positive factors driving the S&P 500 right now, and downside momentum has taken hold. All sectors of the S&P 500 are lower, which suggests that this sell off is indiscriminate and based on fear. A benign CPI report on Wednesday could go some way to boosting sentiment, if it increases expectations of Fed rate cuts. However, a stock market recovery may only be possible if Donald Trump backtracks on some of his most damaging economic policies, the question is, can the stock market force him to do this?

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.