Top Trade Setups in Forex - U.S. Iran Uncertainty Plays

The U.S. stock indexes retreated from record highs, as sentiment was dampened by a U.S. airstrike in Baghdad that killed QassemSoleimani, a top general of Iran's Islamic Revolutionary Guard Corps. The Dow Jones Industrial Average slipped 233-point (-0.8%) to 28634, the S&P 500 dropped 23 points (-0.7%) to 3234, and the Nasdaq Composite was down 71 points (-0.8) to 9020.

Regarding U.S. economic data, the ISM Manufacturing PMI posted 47.2 in December (49.0 expected, 48.1 in November). Construction spending increased 0.6% on month in November (+0.4% expected, +0.1% in October).

Minutes of the latest U.S. Federal Reserve monetary-policy meeting showed that officials would hold interest rates steady in the following months.

USD/JPY - Fibonacci Retracement In-Play

The USD/JPY closed at 108.101 after placing a high of 108.627 and a low of 107.839. Overall the movement of the USD/JPY pair remained strongly bearish that day.

At 8:00 GMT, the Manufacturing Purchasing Manager's Index (PMI) from the Institute for Supply Management (ISM) for December was contracted to 47.2 from the expectations of 49.0 and weighed on the U.S. dollar.

The Construction Spending for November exceeded the expectations of 0.4% and came in favor of the U.S. dollar at 0.6%. The ISM Manufacturing Prices showed that the prices increased when came in as 51.7 against the expectations of 47.7 and supported the U.S. dollar.

The closely watched ISM Manufacturing PMI on Friday showed that the Manufacturing Industry of the United States was contracted in December and dragged the pair USD/JPY in the downward direction.

USDJPY - Daily Technical Levels

| Support | Pivot Point | Resistance |

| 107.88 | 108.07 | 108.31 |

| 107.64 | 108.5 | |

| 107.21 | 108.93 |

USD/JPY - Daily Trade Sentiment

The USD/JPY seems to price out the bearish movement driven by the U.S. Iran war sentiment. The USD/JPY pair is likely to exhibit bullish correction until 108.470. We need to keep an eye on two things, the bearish channel, which is extending resistance around 108.200 and 50 periods EMA which may keep USD/JPY bearish below 108.500.

The Stochastics is staying in a bearish zone, indicating bearish bias on a medium-term basis. Consider staying bullish above 107.780 today.

USD/CAD - Rangebound Market Amid Weaker Dollar

The USD/CAD closed at 1.30002 after placing a high of 1.30051 and a low of 1.29606. Overall the trend for USD/CAD remained bullish that day. On Friday, the U.S. President Donald Trump ordered an airstrike in Baghdad airport. The Defence Department announced that the U.S. military took action on the directions of Donald Trump to protect U.S. personnel abroad by killing QassemSuleimani. He was the head of the Islamic Revolutionary Guard Corp-Quds Force, which was designated by the U.S. as a Foreign Terrorist Organization.

Oil prices rose on this news on the fear of reaction by Iran. The target killing of the Iranian general will be revenged. The Crude oil shipments through the Strait of Hormuz would now be disturbed, and this raised the fears of oil shortage, increasing the price of crude oil in financial markets.

The WTI Crude was surged to $64.05 from $61.17 on Friday and supported commodity-linked currency Loonie. The currency was also supported by the sentiment that the Bank of Canada shifted to hawkish than dovish monetary policy. However, the pipeline constraints in Alberta did not let the Canadian dollar to surge on Friday, and hence, the USD/CAD pair dropped.

The Bank of Canada, Deputy Governor Wilkins, spoke on Friday, but the BoC has not published her remarks, which means that she hasn't talked about monetary policy.

The ISM Manufacturing PMI from the United States was released, which showed that manufacturing activity in the U.S. has declined in December and weighed on the U.S. dollar. The Crude Oil Inventories from the United States for last month decreased to -11.5M from the expected -3.1M. This also helped the Canadian dollar to surge on Friday.

USD/CAD- Daily Technical Levels

| Support | Pivot Point | Resistance |

| 1.2973 | 1.2991 | 1.3021 |

| 1.2943 | 1.304 | |

| 1.2894 | 1.3088 |

USD/CAD- Daily Trade Sentiment

Just like USD/JPY, the USD/CAD is also trading above the double bottom area, which is supporting the pair around 1.2955. Chances of a bullish retracement remain pretty solid, however, the bearish breakout of 1.2955 level can drive selling until 1.2905.

As per 50 periods EMA, the overall trend of USD/CAD is bearish below 1.3030, but on the way, 1.3000 may give a hard time to the commodity currency pair. Let's look for selling trades below 1.3034 for now.

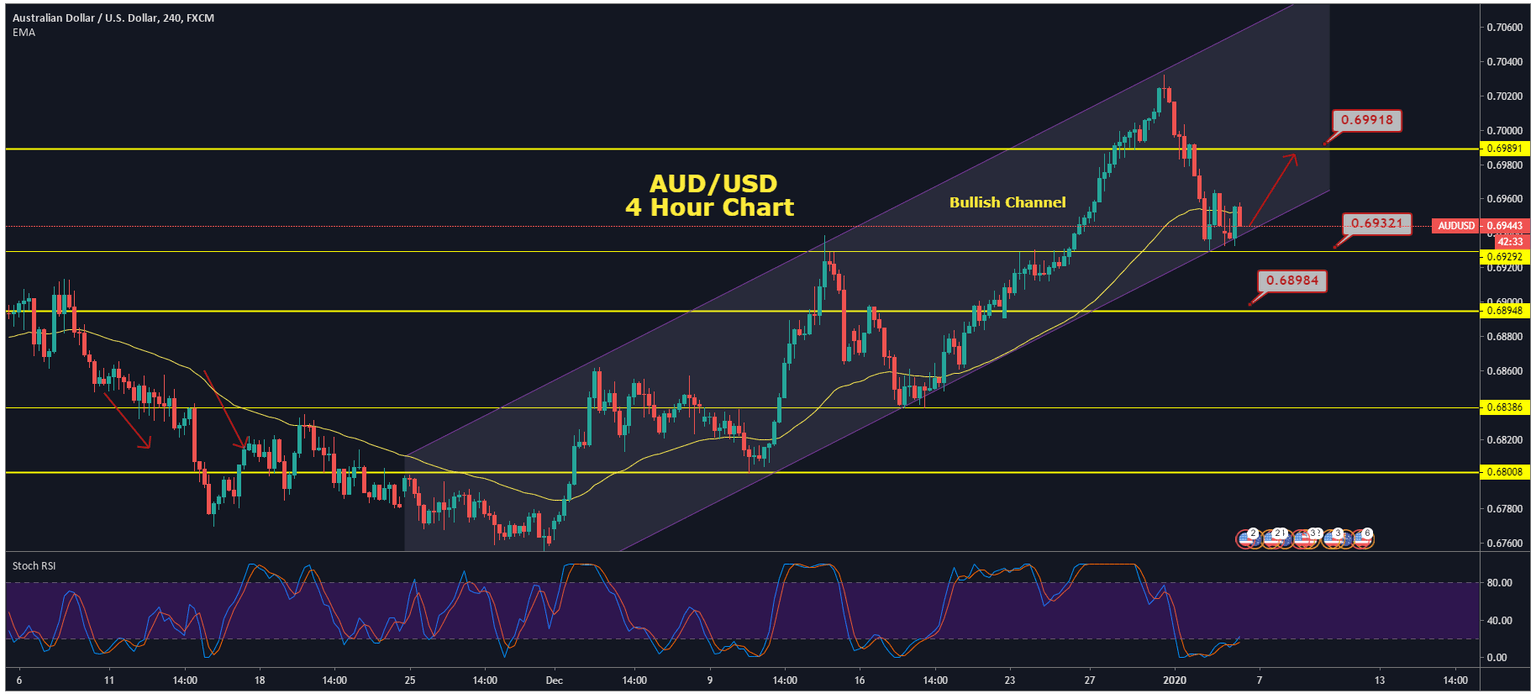

AUD/USD – Bullish Channel in Highlights

The AUD/USD closed at 0.69444 after placing a high of 0.69925 and a low of 0.69300. Overall the movement of AUD/USD pair remained strongly bearish that day.

Aussie dropped more than 0.5% on Friday on the back of U.S. airstrike to kill Iranian general in Baghdad. The riskier currencies like the Australian dollar came under pressure when Iran said that it would retaliate with military action.

The escalated geopolitical tension in the Middle East and the United States dragged the AUD/USD pair on Friday to the lowest level of 0.69300. The U.S. President Donald Trump ordered a targeted airstrike in Baghdad airport to kill QassemSuleimani, the Iranian general.

The risk-off mode emerged in the global market on the back of increased fears that Iran & the U.S. would fall under war. However, in Australia, the weeks of wildfire disruptions could weigh on the Australian economy.

Australia has faced a huge bill from unprecedented fires that have already burned an area larger than Belgium size. The cost of disruptions due to smoke and fire in Sydney in the region AUD$12M to AUD$50M per day.

There was no macro-economic data from Australia on Friday; however, from the United States, the ISM Manufacturing Prices surged in December to 51.7 and supported the U.S. dollar.

On the trade development front, there was no new information regarding the trade deal between the U.S. & China. The phase-one deal is expected to be signed by both countries on January 15 in Washington.

The FOMC meeting minutes from the United States Federal Reserve would also impact the movement of AUD/USD on Monday.

AUD/USD - Technical Levels

| Support | Pivot Point | Resistance |

| 0.693 | 0.6948 | 0.6966 |

| 0.6912 | 0.6985 | |

| 0.6876 | 0.7021 |

AUD/USD - Daily Trade Sentiment

The AUD/USD is trading bearish near 0.6930 due to the bearish channel. The pair is crossing below 50 periods EMA around 0.6960, which is likely to drive more selling the Aussie dollar today. However, the immediate support stays at 0.6930, which is extended by a bullish channel trendline. Below 0.6930, the AUD/USD has the potential to drop further until 0.6895.

I will consider looking for buying positions above 0.6930 and selling trades below the same level today.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and