Told'ya: Silver soars above $60 for the first time in history

What happened since I posted yesterday’s analysis simply confirmed it.

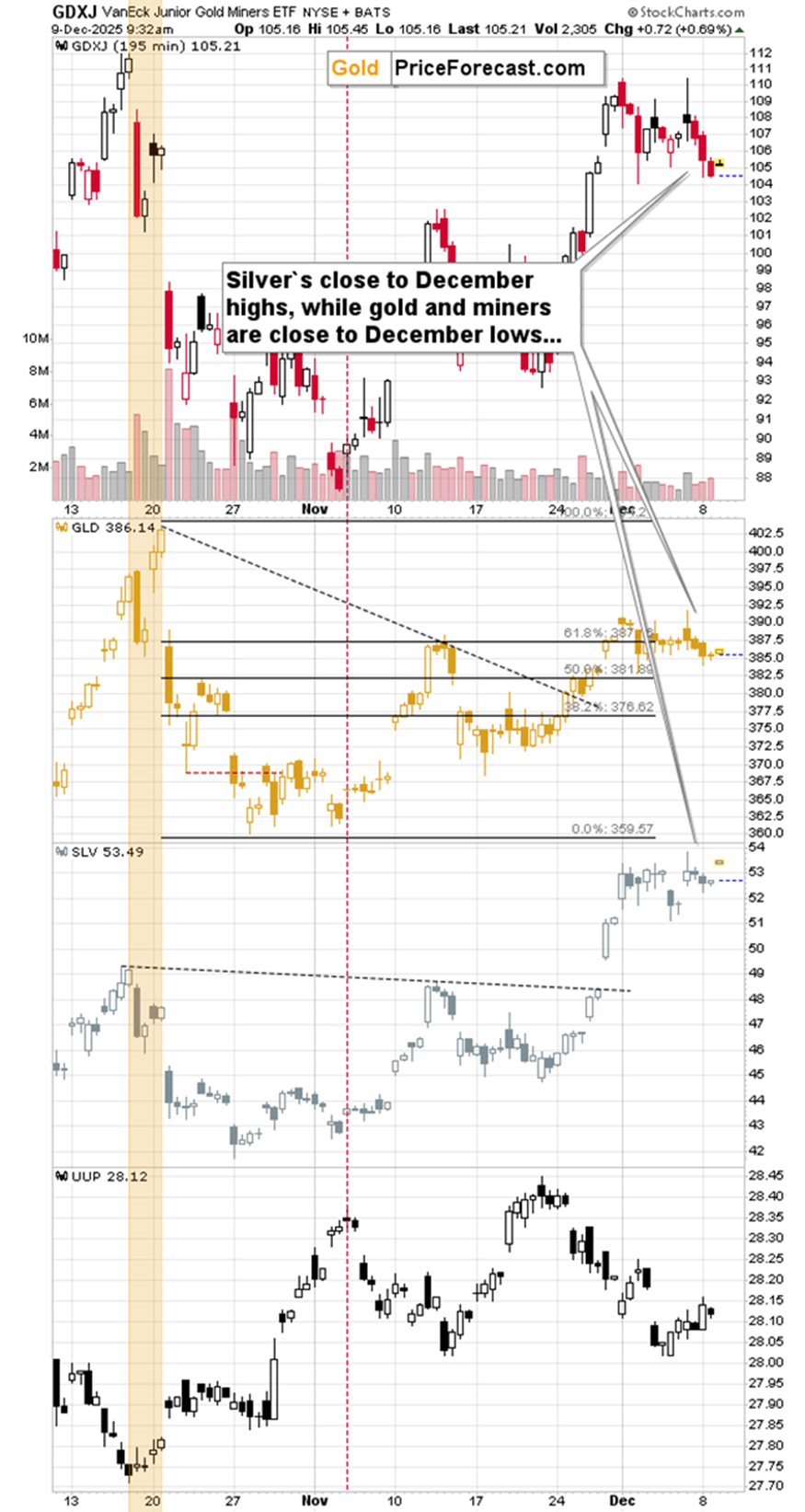

My key observation was that silver is trading at monthly highs, while gold and miners are trading at monthly lows. My comment was that it confirms the thesis that silver is disconnecting from the rest of the precious metals sector.

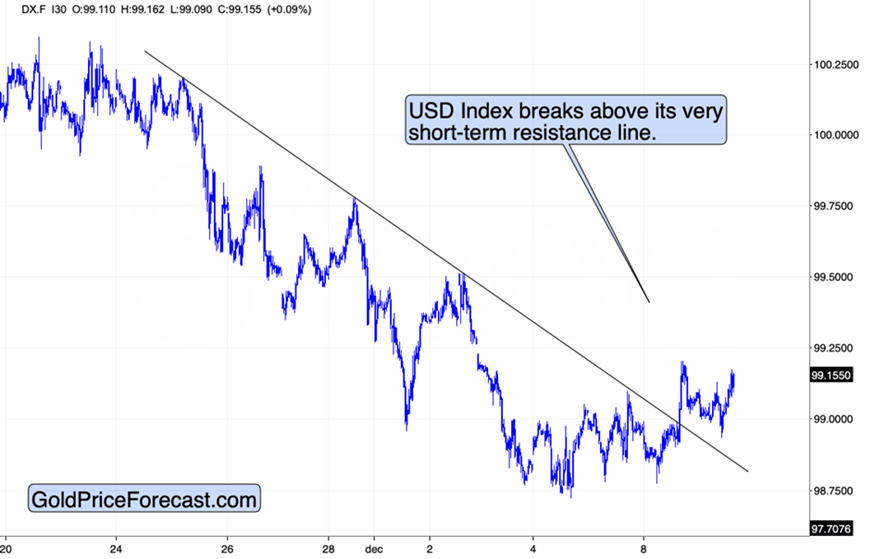

My other claim was that the USD Index could be breaking out here.

Yesterday’s call confirmed

What happened in both markets simply confirmed it.

The USD Index first broke above its declining resistance line, and then it moved back down – verifying the breakout – and now it’s rallying once again, pretty much in tune with mine and Anna’s expectations.

It would be best to see two more daily closes above this line to further confirm the breakout’s validity, but right now it’s already more likely than it was the case yesterday.

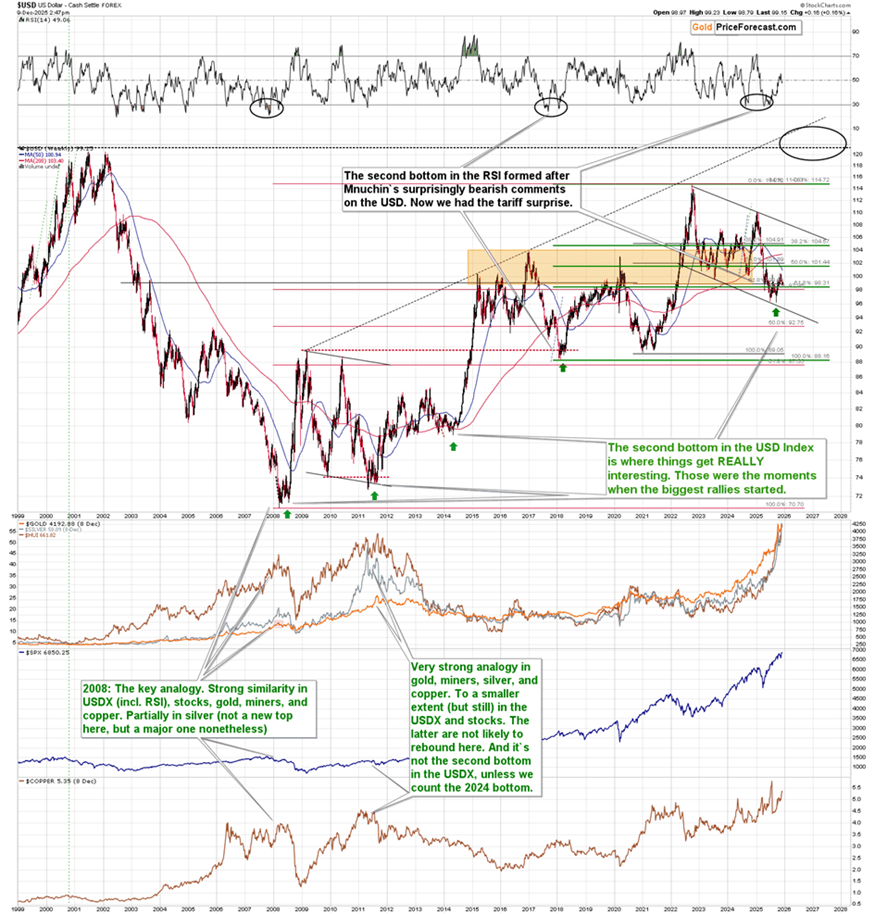

That’s important because of the USD Index’s long-term picture:

The USD Index is after a major double-bottom pattern – something that launched the biggest rallies in previous years.

The current short-term breakout might be just the first tiny step before the rally really picks up – just as it should be based on the fundamental situation (tariffs are positive for the USD, and the latter declined based on them being announced instead of rallying).

Precious metals’ response is particularly interesting:

Gold and silver declined in the last few days as the USD Index moved higher, but this was not the case with silver.

Conversely, the white metal is testing its recent highs.

New all-time highs imminent

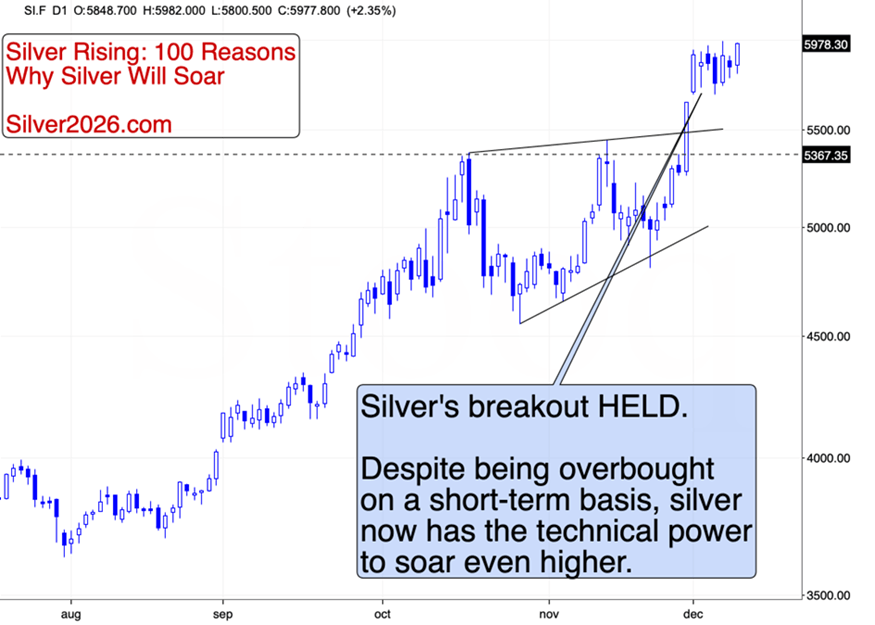

Silver’s strength here is truly exceptional. Dollar down or dollar up – the white metal not only broke to new highs, but is refusing to decline. Instead, it’s pushing further.

It looks ready to soar to new all-time highs any day or hour now (no wonder, silver has 100 reasons to do so).

Mining stocks, however, remain vulnerable. If the USD Index rallies – and it’s very much likely to do so – then miners could decline in a major way.

At this point, the theory about silver’s disconnection from the rest of the precious metals market remains intact.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any