Today's forecasts for EUR/USD, GBP/USD, FTSE100, Dow Jones, Gold, and US oil

EUR/USD

The Euro went back and forth yesterday as volatility picked up but without having any clear direction, despite a better-than-expected US jobless claims report. However, technically it looks like the EURUSD pair is trying to recover with a sustained move above 1.2110 to trigger an acceleration to the upside with 1.2150 and 1.2170 as next resistance levels.

GBP/USD

The British Pound remains biased to the upside in the near term from a technical standpoint with rising support from the 50-period moving average keeping short-sellers in check. A break above 1.4050 to indicate the presence of buyers with 1.4150 as nearest upside target ahead of US Retail Sales due to be released later this afternoon.

FTSE 100

Today’s London session looks set to rebound following Wall Street’s impressive recovery yesterday, with FTSE futures back above the 200-period SMA overnight. However, a move above resistance at 7030 is needed to keep the strong bullish momentum ahead of US retail sales due later this afternoon.

DOW JONES

Better-than-expected US jobless claim figures delivered much needed support yesterday as the familiar “buy-the-dip” mentality pulled back the Dow Jones index from a technical collapse and back above the 34000 level. A sustained move above the 50-moving average today will trigger more buying with 34575 as nearest upside target. Alternatively, a move below the 200-period moving average would indicate the presence of sellers with 33800 as nearest support level, ahead of retail sales figures due later today.

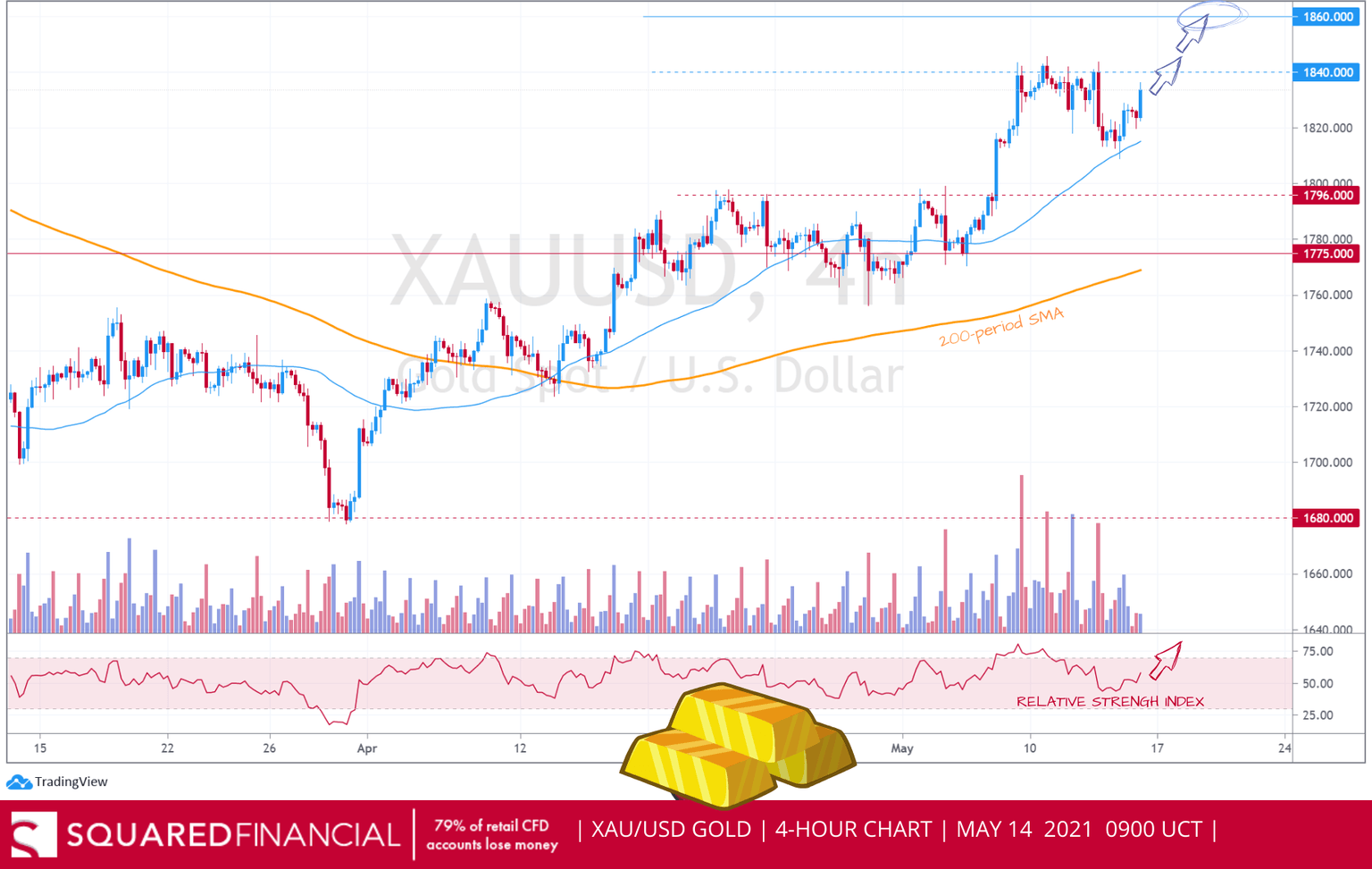

GOLD

Gold ended the session in the green, hitting our long resistance target at $1830, with inflation fears still lurking in the background and the latest PPI data surprising to the upside. All eyes today on US Retail Sales data for a gauge of economic recovery strength, with technical indicators favoring further continued upside momentum with $1840 and $1860 as next resistance targets in extension.

US OIL

Another round of restrictions in Singapore and Japan, an ongoing increase in cases in India, and a resurgence of the virus in China are weighing down on energy prices again, with WTI Crude shedding almost 3% in yesterday’s session. On another note, Colonial Pipeline now back online and adding to supply, with a move back to the resistance level at 64.35 looking favorable as the RSI points higher indicating strong upside momentum.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.