Three fundamentals for the week: Toss up US election, BoE and Fed promise a roller coaster week

- The US presidential election is on a knife edge, implying high volatility and potentially unknown results for days.

- Bank of England officials are set to preside over a rate cut.

- The Fed will likely slash borrowing costs by 25 bps, regardless of the election.

Harris or Trump? The world is anxious to know the result of the November 5 vote – and may have to wait long hours for the outcome. Markets will also respond to the composition of Congress. The Bank of England (BoE) and the Federal Reserve (Fed) will enter the fray afterward.

Here is a preview of this week's dramatic events.

1) US presidential election on a knife edge

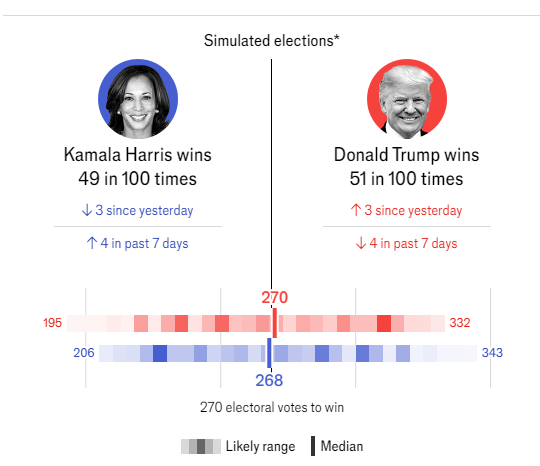

Tuesday, with results potentially coming early on Wednesday. Down to the wire – that is how various political analysts describe the vote. Former President Donald Trump seemed to have edged ahead until the latest round of polling showed Vice President Kamala Harris pulling ahead. All the potential advantages are within polls' margins of error.

US Election Forecast. Source: The Economist

For markets, the fresh response to an unwinding of the "Trump trade" is telling – a weaker US Dollar (USD) following more favorable numbers for Harris. The Republican candidate vowed to slap tariffs, which would boost inflation and cause interest rates to rise. A victory for the Democrats would serve as a continuation, allowing the Fed to continue cutting.

For Stocks and Gold, the picture is more complicated, and it depends on the control of Congress.

Here are four scenarios

1) Trump wins, split Congress: This outcome means tariffs, but no tax cuts. That is bullish for the US Dollar and bearish for Gold. Stocks would probably struggle.

2) Trump wins, GOP control of Congress: A Republican sweep means substantial tax cuts, which would outweigh tariffs. This is bullish for the US Dollar as rates would rise, while tax cuts would be bullish for Gold. Stocks love lower taxes and would also rise.

3) Harris wins, split Congress: This outcome continues the current situation and would be long-term neutral for all markets. In the short term, the US Dollar would fall, Gold would stabilize and eventually resume its uptrend, and Stocks would wobble but then stabilize.

4) Harris wins, Democratic sweep: Harris promised fresh spending on affordable housing. That means higher inflation and deficits, similar to a Republican sweep. That would be bullish for the US Dollar, Gold and specific stocks.

It is essential to note that the reactions also depend on what the winner says immediately after declaring victory.

Moreover, some investors have been on the sidelines, awaiting the outcome. A swift outcome would provide calm, supporting the long-term rise of Gold and Stocks, while weighing on the US Dollar. Such a calming force could temporarily contrast the long-term trends described above.

In general, the faster the outcome is known, the better for Stocks. If there is one thing investors hate, that's uncertainty.

2) BoE set to cut rates by an overwhelming majority

Thursday, 12:00 GMT. Inflation has been coming down in the UK, allowing officials at the "Old Lady" to loosen monetary policy further. BoE Governor Andrew Bailey will likely preside over a 25 basis point (bps) cut, setting rates at 4.75%.

Meeting Minutes from the Monetary Policy Committee (MPC) will likely show a vast majority of the nine members support lower borrowing costs. The cut is already priced into the Pound, but a signal that rates will fall in every meeting could weigh on it. A more cautious stance would help Sterling stabilize.

In addition to the decision, the BoE also releases its quarterly Monetary Policy Report (MPR). Given recent economic developments, a lower trajectory for inflation is expected. Any surprisingly upbeat forecast on inflation would trigger a strong Sterling.

Governor Bailey's press conferences tend to be gloomy, weighing on the Pound in the short term.

3) Fed to skirt politics, comments on inflation and employment are critical

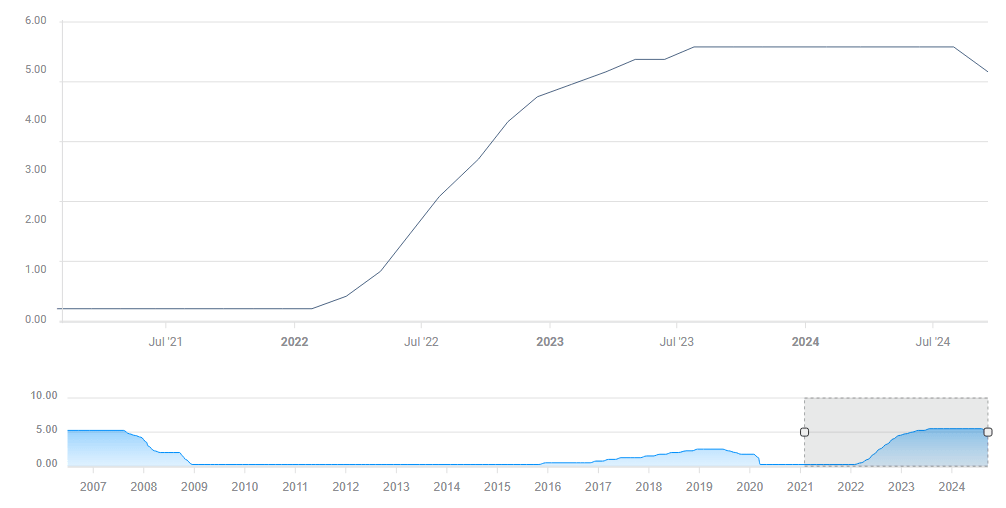

Thursday, 19:00 GMT, press conference at 19:30 GMT. First things first – the Federal Reserve is set to cut interest rates by 25 bps. That is what markets are pricing, and it is a balanced decision. The other options are a 50 bps cut, like in September, or a no-change.

Federal Funds Rate. Source: FXStreet.

Fed Chair Jerome Powell and his colleagues would also want to be seen as not taking sides in politics. By following through on expectations, they would show their independence.

Powell will also avoid any election-related questions, and reporters are set to focus on the next decision in December. The Fed Chair will surely repeat his stance of being data-dependent, but comments about recent developments may provide insights.

Nonfarm Payrolls were downbeat in October, but hurricanes heavily impacted the data. How does the Fed see it? An upbeat view on the labor market would boost the US Dollar and Stocks, hurting Gold. Worried comments would do the opposite.

While the jobs market is in the spotlight, the bank's opinion on the recent bump up in inflation is also of interest. Concern about inflation lifting its head would support the US Dollar and hurt Stocks and Gold. Dismissing the latest data as noise would do the opposite.

Final thoughts

A week like this one – in which the Fed is not the most important event – happens only once every four years. Volatility is set to be extreme. I recommend trading with care.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.