The US weakness, NFP and market trends

Today is the day of the release of the US employment data - an influential macroeconomic report that traditionally causes the maximum volatility of markets among all the world's data publications. In recent months, markets have been shifting their focus from employment data to attempts to determine the impact of US and Chinese trade conflict. Besides, the level of surprise in the data, i.e. deviations from expectations and the prevailing trend, was modest, giving no reason for fear or excitement.

Previous lull on employment report does not mean that the markets have lost interest in the NFP. Just the opposite. It may well turn out that the current release will attract more attention, if it sparks speculation around the further path of the economy and, as a consequence, monetary policy. This week's news makes us cautiously wait for the data on the increase in the number of employees in the US by the end of November.

The manufacturing ISM did not meet expectations, and the employment component in it showed an acceleration of the decline, which has been going on for four months. The service sector continues to expand, but it is the reversal in production trends that is considered a leading indicator of business activity.

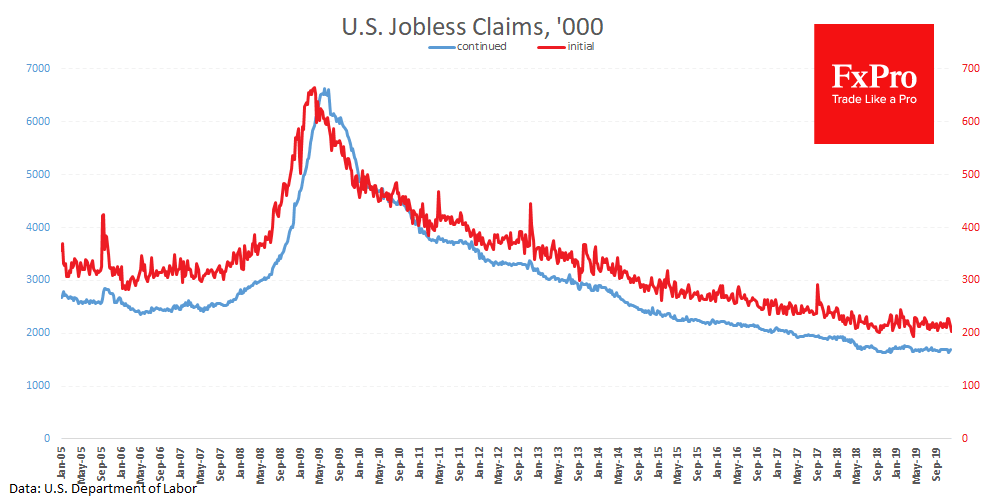

Another important indicator for the markets is the weekly employment rate in the US. The number of initial jobless claims has fallen to a minimum since April. But at the same time, the number of continuing jobless claims returned to growth. Markets are watching the reversal of this indicator, trying to assess the proximity of the recession. Judging only by these data, the economic cycle has already passed its peak, as the data show a trend for deterioration, despite the positive dynamics of stock markets and rates cut from the Federal Reserve.

Suddenly an unpleasant surprise was made by ADP estimates. According to this report, employment in the private sector in the US increased only by 67K, half the expectations. Even worse, this indicator somewhat dumped since May, when the 'trade truce' was over, and the US and China toughened their rhetoric.

On average, the markets predicted an increase in employment by 180K. If the figure is closer to the levels indicated by ADP, it may be a severe disappointment for the optimists.

Moderately weak employment indicators in the US can cause pressure on the dollar, as the market players will put new rate cuts in prices. In this case, EURUSD can continue to grow, rushing not only above the peaks of October by 1.1160, but threatening to break the downtrend of the last year and a half, potentially targeting 1.1400 in the coming weeks.

If we see frighteningly weak indicators, the financial markets may start a full-fledged exit from risky assets, and the dollar will be perceived as a safe-haven currency in the turbulent markets. Then EURUSD will see the prospect of decline towards 1.09.

Author

Team FxPro

FxPro

FxPro is a UK headquartered online broker providing contracts for difference (CFD) on foreign exchange, shares, futures and precious metals primarily to retail clients.