The Sahm Rule signal: On the blink or flashing red?

Summary

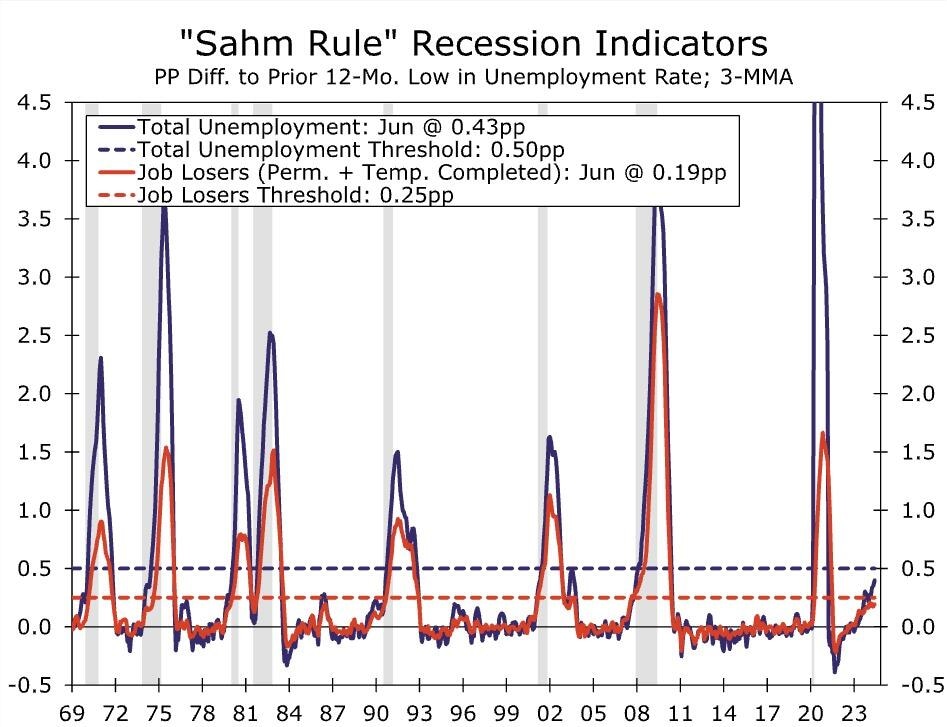

Rising unemployment over the past year has sent the clearest signal yet that the labor market is weakening. While the Sahm Rule indicator—which highlights the historical pattern that the unemployment rate has never risen 0.5 points above its prior 12-month low without a recession—has not crossed its recession threshold, the current rise would nonetheless be unique if a downturn in the labor market were to be avoided. Of course, this has been a unique labor market, with the pandemic initially delivering a massive shock to labor supply. Is the recovery in labor supply now interfering with the Sahm Rule signal?

At 0.43, the Sahm Rule indicator has already risen more than at the onset of any recession in the past 50 years. Yet entrants into the labor force, particularly re-entrants, have been an unprecedented driver of the increase. This should assuage some concern over the current rise as it comes in larger part for the “right” reason of more workers entering the jobs market, which ultimately makes it easier for businesses to grow.

Yet the increase in the unemployment rate for the “wrong” reasons is troubling in its own right. Looking at the rise in unemployment due to job loss on the same basis as the traditional Sahm Rule shows an increase similarly reminiscent of periods when the labor market was on the brink of a downturn.

Could this be the cycle where the Sahm Rule breaks? The larger lift from labor force entrants and more gradual ascent compared to the starting point of prior recessions raises the likelihood. That said, the negative feedback loop between rising unemployment and declining spending means that neither the current increase in the traditional Sahm Rule indicator nor the job loser version should be brushed aside. Recession thresholds crossed or not, the increase in both values shows an unequivocal deterioration in the labor market. With momentum in the jobs market difficult to shift, we see the risk of recession remaining unusually high at the moment.

Author

Wells Fargo Research Team

Wells Fargo