The Pound continues to decline, with little support from the Bank of England

The GBP/USD pair has slowed its decline, stabilising near 1.3391.

On the previous day, Bank of England Governor Andrew Bailey addressed key global economic challenges in a speech at Mansion House. He described the latest wave of trade tariffs as a systemic event capable of reshaping global trade dynamics. Bailey highlighted growing domestic imbalances in the US and weak domestic demand in China, urging both nations to clarify their strategies for addressing these issues.

However, Bailey clarified that not all trade imbalances are inherently problematic – many stem from productivity disparities between nations. Yet, he warned that widening macroeconomic and political divergences are increasing systemic fragility. Recent developments, he added, have exposed weaknesses in multilateral cooperation and a failure to tackle emerging challenges effectively.

The Governor also stressed the International Monetary Fund’s (IMF) role in mitigating global imbalances, calling for more proactive international institutions. He attributed distortions primarily to domestic economic policies, cautioning that without reform, global financial stability could be at risk.

While current imbalances remain manageable by historical standards, Bailey warned against complacency. A comprehensive reassessment of policy approaches is essential to ensure the stability and predictability of the financial system.

Technical analysis: GBP/USD

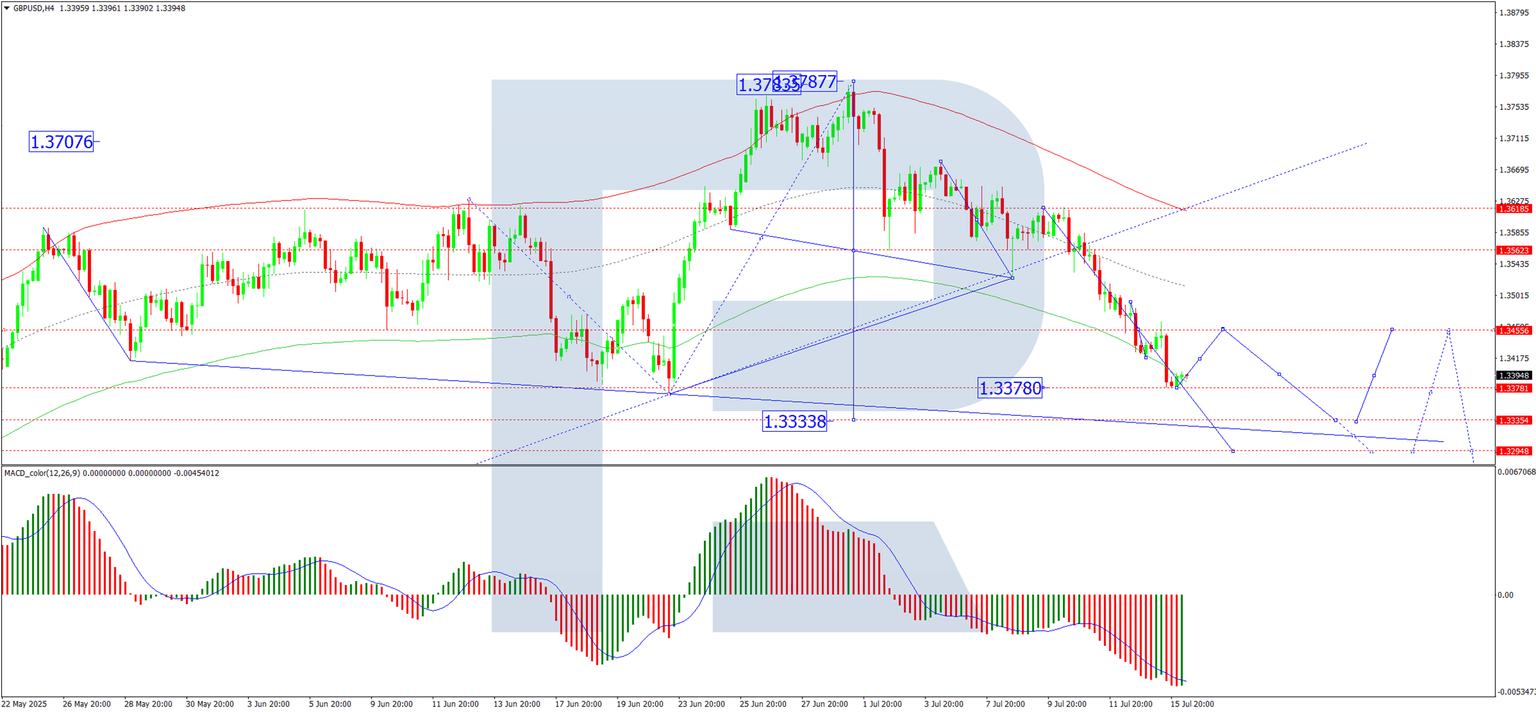

H4 Chart:

On the H4 chart, the GBP/USD pair has declined to the 1.3450 level, where a consolidation range has now formed. The pair has broken out to the downside, reaching 1.3378. Today, a short-term rebound to 1.3415 (as a retest from below) is possible. However, if resistance holds, the pair may resume its decline towards 1.3296. Upon completion of this downward wave, a potential bounce towards 1.3450 could follow. Technically, this scenario is confirmed by the MACD indicator, whose signal line is below zero and pointing firmly downward.

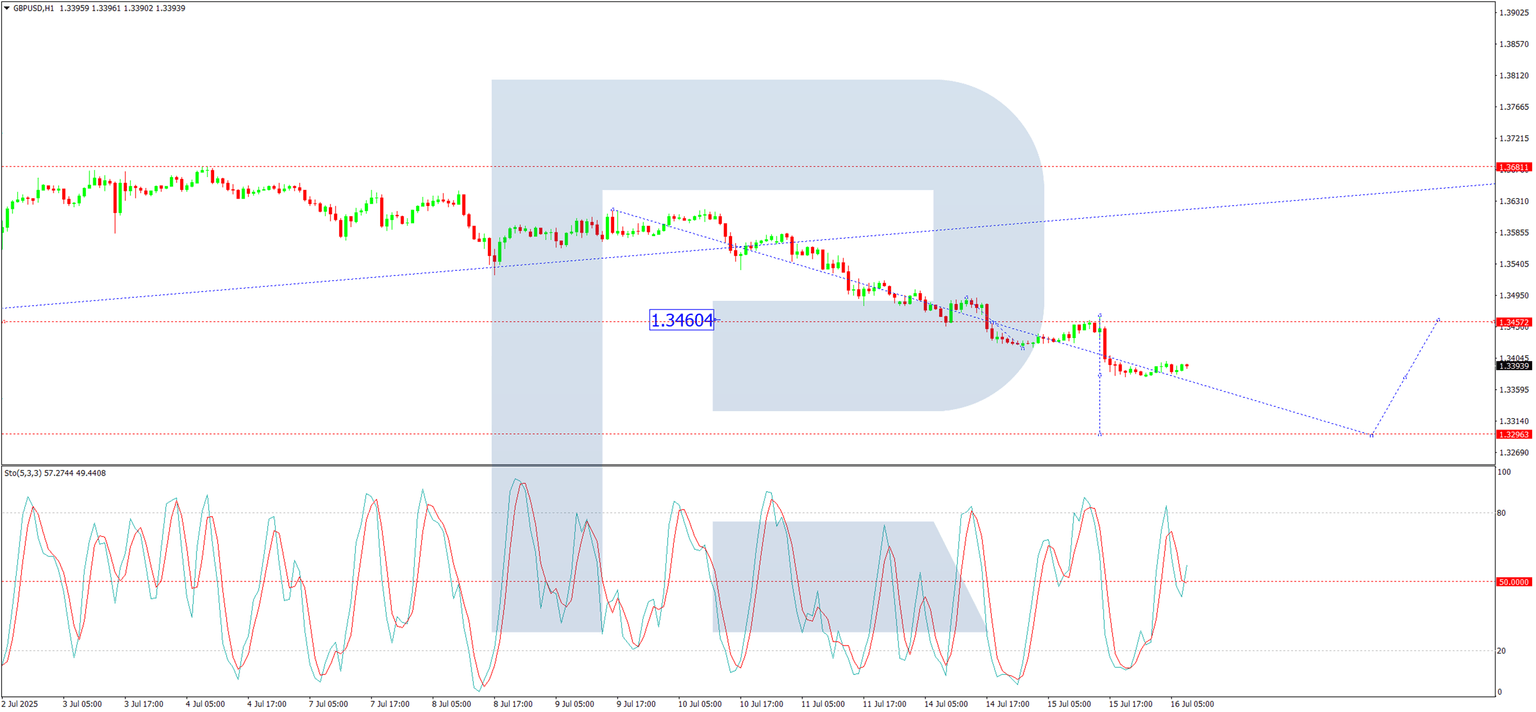

H1 Chart:

On the H1 chart, the GBP/USD pair is extending the third wave of its decline, with a local target at 1.3296. Once this level is reached, a correction towards 1.3460 could unfold. Technically, this scenario is supported by the Stochastic oscillator, with its signal line below 80 and trending sharply downwards towards 20.

Conclusion

Bearish momentum persists, with key support levels in focus. A short-term pullback remains possible, but the broader downtrend is likely to continue unless a significant shift in fundamentals occurs.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.